Between the Lines: Jalopnik's Ray Wert on GM – Chrysler Merger

Last night, the New York Times “broke” the story that General Motors and Chrysler/Cerberus were discussing a merger. The report lacked only one crucial component: facts. As RF reported in his initial blog on the subject, the story unravels by paragraph two. We learn that the entire story is based on “two people close to the process.” While anonymous attribution is common new industry practice, a story without independent corroboration is a nothing more than rumor— especially when it defies common sense. General Motors’ assertion that they routinely talk to other manufacturers about collaborative efforts doesn’t count. But it does reveal the truth of the matter.

In fact, the GM – Chrysler/Cerberus meetings are an open secret. As The General’s spinmeister intimated, GM regularly engages in tech sharing discussions with a wide range of carmakers. Given Chrysler’s yet-to-be-realized tie-up with Nissan, its decision to provide re-badged minivans for VW and ongoing attempts to create a Chinese hook-up, GM is a logical “partner” for Chrysler ongoing campaign to outsource product development. And cut costs.

GM and ChryCo could be discussing rebadged Malibus. Or a Chrysler badged Cobalt. With materials costs soaring, the two ailing American automakers might be examining the possibility of sharing resources. Or looking for economies of scale re: suppliers. And, lest we forget, General Motors owns 49 percent of endangered auto and mortgage lender GMAC; Chrysler’s masters hold the other 51 percent. If GM and Chrysler are NOT talking to each other about GMAC’s future, there’s something seriously wrong (more wrong?) with both companies’ executive management.

It’s no wonder Times scribes Vlasic and Sorkin backpedal on their GM – Chrysler merger story. They tell us that their two sources estimate chances of a merger are “50-50.” There could be “significant roadblocks,” not including the fact that sewing two losing companies together merely makes a bigger losing company. But the real argumentative implosion comes buried in the story: “neither side has yet to dig into each others’ private financial books and records.” How serious can the merger talks be if the lawyers and accountants haven’t even begun diligence? Answer: they can’t.

Clearly, the providers of “all the news that’s fit to print” didn’t give the merger story a fitness test. In fact, this is a classic example of what GM shill Rush Limbaugh calls “drive by media.”

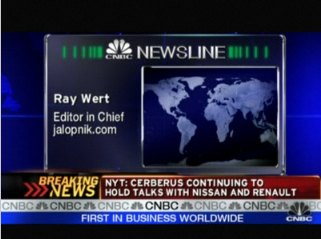

The 24 hour news cycle (of which this writer, typing after midnight, is a member) was quick to pick up the story and discuss all the implications. The CNBC network, “the recognized world leader in business news,” called in the big guns for comment: Ray Wert of Jalopnik. While we understand the mainstream media’s ongoing fascination with the “new hotness” of blogs, Wert screwed the pooch on this one.

Wert claimed that GM and Chrysler “have two different lineups that actually are very complementary.” This is just wrong. GM and Chrysler have nearly identical lineups, with some niche-product distinctions. Recognizing this, Wert contradicted himself in his next comment. “They’re both looking to sell a lot of large trucks and large SUVS, and it makes sense for them to manufacture them on the same platform.”

The CNBC hosts ask Wert about the financial issues in a merger. His vaguely dishes “My assumption is that Cerberus has probably bit off a lot more than they can chew, and with credit kind of crunching in right now it makes a lot of sense for them to try to jettison a company that isn’t providing something that isn’t to their core business plan.” Except that’s not what anyone is talking about. The story from The New York Times: Cerberus would end up with an enormous stake in the hypothetical GM-Chrysler firm.

CNBC concludes by asking Wert about potential issues with a merged GM-Chrysler and organized labor. “I think it’ll be easier for them to get some economies of scale on UAW talks. It’ll be easier to work out one deal as opposed to two deals.” Efficiency in labor talks is a secondary goal (talking for less time, paying fewer labor lawyers). The actual issue is concessions. There is no quantitative academic evidence to suggest that it would be easier for a gargantuan company to negotiate with the UAW and CAW than two very, very large companies. In fact, odds are good the negotiations would be even stiffer.

CNBC failed in its background research. They should have read the editorial Wert published the same day: “GM Will Go Bankrupt: Why That May Actually Be Good For The General.” Considering Wert’s previously held belief that GM would benefit from Chapter 11 filling, why did he suddenly decided that a GM-Chrysler merger be well-advised? Something to do with publicity perhaps?

All of this discussion blatantly ignores the glaring issue: a GM-Chrysler merger would be a disaster. And that’s the truth.

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Zipper69 "At least Lincoln finally learned to do a better job of not appearing to have raided the Ford parts bin"But they differentiate by being bland and unadventurous and lacking a clear brand image.

- Zipper69 "The worry is that vehicles could collect and share Americans' data with the Chinese government"Presumably, via your cellphone connection? Does the average Joe in the gig economy really have "data" that will change the balance of power?

- Zipper69 Honda seem to have a comprehensive range of sedans that sell well.

- Oberkanone How long do I have to stay in this job before I get a golden parachute?I'd lower the price of the V-Series models. Improve the quality of interiors across the entire line. I'd add a sedan larger then CT5. I'd require a financial review of Celestiq. If it's not a profit center it's gone. Styling updates in the vision of the XLR to existing models. 2+2 sports coupe woutd be added. Performance in the class of AMG GT and Porsche 911 at a price just under $100k. EV models would NOT be subsidized by ICE revenue.

- NJRide Let Cadillac be Cadillac, but in the context of 2024. As a new XT5 owner (the Emerald Green got me to buy an old design) I would have happy preferred a Lyriq hybrid. Some who really like the Lyriq's package but don't want an EV will buy another model. Most will go elsewhere. I love the V6 and good but easy to use infotainment. But I know my next car will probably be more electrified w more tech.I don't think anyone is confusing my car for a Blazer but i agree the XT6 is too derivative. Frankly the Enclave looks more prestigious. The Escalade still has got it, though I would love to see the ESV make a comeback. I still think GM missed the boat by not making a Colorado based mini-Blazer and Escalade. I don't get the 2 sedans. I feel a slightly larger and more distinctly Cadillac sedan would sell better. They also need to advertise beyond the Lyriq. I don't feel other luxury players are exactly hitting it out of the park right now so a strengthened Cadillac could regain share.

Comments

Join the conversation

Advantages of tie-up: 1) Buick, Hummer, Dodge, Chrysler, Saturn, etc get dumped into "new" Chrysler, which then files Ch.7. 2) GM gets Chrysler's $11B + double Fed bailout which is close to $15B 3) Board & mgmt get huge bonuses 4) What UAW? Current contract burned & buried. Tons saved. Disadvantages: 1) Everyone else is screwed. Dealers, workers, suppliers, etc. 2) GM fire sale prices + Chrysler quality issues = less market share than they had seperately.

So nobody thinks the low gas prices will bring some of the big vehicle consumers back to the dealers soon? Do you think the cheap gas won't last? Do you think the credit crunch just means that there aren't enough people who can afford or will afford a new vehicle?