#international

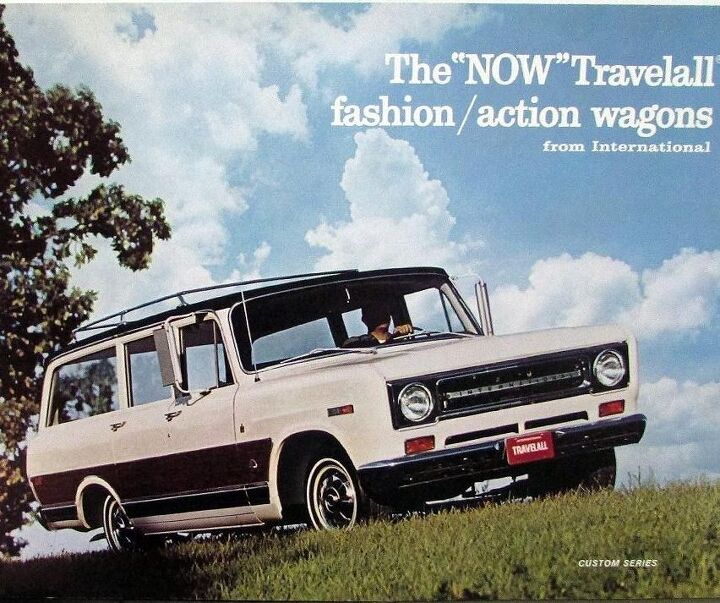

Rare Rides: The 1971 International Harvester Travelall, Adversary to Suburban

Today’s Rare Ride hails from the alternative to the Detroit Three: International Harvester. The company catered mostly to a farm-truck audience and was never a full-line manufacturer, but made some inroads with the family utility buyer with its Travelall.

Rare Rides: The 1970 International Harvester 1200 D, a Pristine Pickup

Today’s Rare Ride marks the first time the series has featured a vehicle from the defunct International Harvester brand. Though the luxury-lined Monteverdi Safari was International-adjacent, today’s truck represents the agricultural, working heritage of IH.

Rare Rides: An International Truck Experience With the 2008 MXT

The Rare Rides series doesn’t often venture into Tough Trucks land, but when it does, it goes all the way. Before you is the International MXT, a practical pickup from the semi truck people.

Rare Rides: A 1971 Jeepster Commando of the Hurst Variety

Long before the Wrangler and Cherokee became Jeep’s household names, and even before the Jeep brand existed as we know it today, the company known as Kaiser Jeep produced the Jeepster Commando. And for a few special examples, Hurst made some of its own modifications.

Let’s have a look at a special proto-Cherokee:

Piston Slap: When RON Met PON…Mon!!!

Brian writes:

Hola! First off, love the site, long time listener, first time caller. I recently had the amazing opportunity to act as chauffeur for my good Chilean friend Diego’s road trip through Patagonia. He had access to a little four banger 1998 Daihatsu Feroza (Rocky in the US) but did not know how to drive. So I gladly I wrestled this thing around Southern South America in a circuit of just over 3000 Kilometers that took us south on Chile’s famous Carretera Austral (dirt roads cutting through the Andes) and back north through Argentina’s Route 40 (very similar to route 66 in the US).

GM CFO Young Named VP for International Operations

For all the criticism that’s been leveled at GM’s finance operation, the firm’s most recent CFOs have yet to pay much of a career price. Previous CFO Fritz Henderson was promoted to the CEO’s spot by the presidential auto task force, and Automotive News [sub] reports that current CFO Ray Young has just been named VP for International Operations. Young’s departure from GM’s finance unit has been something of a foregone conclusion since GM exited bankruptcy, with reports of his imminent departure in the Detroit papers of record going undenied, and a recent acknowledgment that a search was on for his successor. In light of GM CEO Ed Whitacre’s ongoing game of executive whack-a-mole, it was tempting to believe that Young was on his way out, but apparently GM CFOs are pre-sprayed with teflon.

One Percent Of GM China Worth $85m

Fresh details on GM’s Asian wranglings are coming in, and it seems that SAIC paid The General a mere $85m for the one percent needed to control the joint venture. GM’s Nick Reilly tells the New York Times:

the 51 percent stake would give S.A.I.C. the right to approve the venture’s budget, future plans and senior management. But the venture has a cooperative spirit in which S.A.I.C. has already been able to do so… S.A.I.C. wanted to have a majority stake to consolidate the venture in its financial reporting

Which is about as credible as the conclusion that the Shanghai and India deals are going to provide GM International with a meaningful amount of cash with which to rescue its European and Korean divisions. As it turns out, the Indian deal isn’t going to translate into free cash for GM. GM and SAIC will set up a joint Hong Kong-based investment company, which GM will give its Indian operations and SAIC will fund with $300-$530m, bringing its overall value to $650m.

Recent Comments