#credit

Hide Your Kicks, Hide Your Wife: Nissan's Credit Branch in Hot Water Over Illegal Repossessions

Nissan’s credit arm landed in some big trouble this week. It turned out that there are literally some rules around repossessing a car from a consumer. Apparently Nissan Motor Acceptance Corp. didn’t read those rules, and now they’ll have to pony up.

Report: Nissan Hunting for Credit to Backstop the Whole Shebang

As assembly plants turned out the lights across North America in late March, automakers were quick to call upon new credit lines to ensure fiscal stability in the coming months. No one’s really sure by just how much the coronavirus pandemic will hamper sales and profits.

While Nissan, cash-strapped as it is (and facing a new crisis after tackling too many in recent times), has already furloughed its U.S. workforce, that doesn’t seem to be enough to satisfy company bean counters. The automaker is reportedly on the hunt for available cash.

Junk Food: Ford's Debt Rating Downgraded by Moody's

It should surprise no one that the fortunes of a car company aren’t solely tied to the quality or relevance of the vehicles they produce. Much also hinges on Wall Street’s confidence in the place and, as of now, the money mavens don’t seem to have much conviction in Ford at all.

Moody’s, the investor services company which rates fixed-income debt securities, has downgraded Ford’s credit to junk status. They kicked it out of Baa3 and into Ba1 territory, which is the first rung of junk, a term which simply translates into non-investment speculative grade debt. This preceding phrase causes your author’s mind to spin even more than it does after studying assembly instructions for an IKEA Vittsjö shelving unit.

Heading to Ponderosa? Don't Forget Your Nissan Card

If supermarkets, gasoline retailers and a slew of other automakers can offer branded credit cards, why not Nissan?

The Japanese automaker most closely associated with the word “value” is throwing a perk at its customer base, rolling out a consumer credit card program to turn those fuel and meal purchases into real Nissan cents.

The Nissan Visa card, offered through Synchrony Financial, allows dedicated brand loyalists (with good credit) to collect points towards a new or pre-owned Nissan vehicle, or servicing. While some owners might entertain thoughts of gassing and eating their way into a new Armada, the card’s other features are probably a bigger draw. The fine print, however, might prove less tempting.

The Industry Might Be Facing Disaster, But at Least Used Car Prices Are Down

The auto industry has really turned a corner over the last decade, but this year has been underlined by an unsettling lack of interest in new vehicles — potentially hinting at the return of a industry-wide crisis. The good news is that abnormally high used car prices are sinking like a stone. The flip-side of that coin, however, means that we could be approaching darker days as more consumers shy away from the new vehicle market.

Most carmakers spent last year enjoying record sales but seemed keenly aware that the market was about to plateau. However, 2017 sales have stagnated more than predicted, with rising interest rates and deflated prices seen on second-hand automobiles. It all looks very pre-recessionish and some analysts are beginning to make fearful noises.

News Round-up: Faraday 'Storyteller' Jumps to Kia, The War in the Air(waves), and 'Brexit' Vote Tomorrow

A company that still has yet to build its “game-changing” car will need to find another “storyteller.”

That, the UK will finally have an answer to The Clash, and Cadillac has a dogfight with Silicon Valley … after the break.

Car Loans Get Longer, Credit Scores Get Lower, and We're More Reliant on Automakers for Money and Cars Now

In news that will shock precisely no one, the current car blitz is partially fueled by longer loan rates, higher monthly payments and an increasing prevalence to finance our new cars from the automaker themselves — when we’re not renting it from them in the first place.

Experian released Wednesday its data on third-quarter sales and financing and found, on average, that borrowers’ credit scores were at the lowest level since before 2008. According to the credit agency, car buyers had an average credit score of 710 when they financed their car — which happens in 86.6 percent of car transactions, an all-time high.

Buyers opted for longer loans too. According to the data, new car loans longer than six years increased to 27.5 percent for the third quarter, up 17.1 percent from the same period last year. Loans between five and six years accounted for 44 percent of new vehicle financing.

Will Volkswagen Hock Its Roundel for $21.5 Billion in Loans?

On Friday, Barclays Plc announced it estimates the near-term costs of Volkswagen’s seemingly ever expanding emissions scandal will be about $27 billion USD (25 billion Euros).

Volkswagen’s automotive group had $29.6 billion in net liquidity at the the end of the third fiscal quarter of this year. About $10.8 billion is allocated to protect the company’s credit ratings. That leaves about $19 billion in cash for the company to work with.

There are fines that will be paid in a number of countries, along with goodwill gestures to owners of affected VW vehicles and incentives needed to sell cars from a tainted brand. Then there will the cost of litigation and any judgments or settlements that come out of those lawsuits.

About the same time as Barclays’ announcement, Automotive News and Bloomberg reported Volkswagen AG will be meeting in Wolfsburg this week with representatives of about a dozen banks to secure as much as $21.5 billion in loans by the end of this year. Those meetings aim to shore up the company’s financing and show the credit markets that VW has enough liquid assets to cover emissions-related costs.

Sub-prime Borrowers May Get Bounced Out of the Club Next Year

Next year may not be as kind to new car buyers with bad credit.

If you’ve been paying attention to the market recently, it’s been an up-and-down ride for the past few days. Market volatility is just one of the indicators that the Federal Reserve may be considering a hike to the federal funds rate (probably not this year, though), which would impact borrowing rates in a record-setting year for the auto-loan business.

“It has the potential to impact auto loans, any rate increase certainly can,” said Melinda Zabritski, senior director for Automotive Finance for Experian. “The rate depends on so many other factors in the market … (A rate increase is) at some point, likely. But there’s not a strong chance that it will go up this year.”

Rates for loans have largely stayed the same since 2008, when interest rates were lowered to spur lending after the recession. Many of the low-rates today haven’t changed and automakers such as Subaru have offered interest-free loans on some of their cars.

Auto Loans Top $1T; Sub-prime Loans Grow 10 Percent Over 2014

Credit-reporting agency Equifax says that as of June 2015 more than $1 trillion has been loaned or leased in the United States. The total dollar amount is 10.5 percent higher than last year.

The average loan amount is $20,800, which is a 3.65 percent increase over last year, and the average sub-prime loan is $18,200. Sub-prime loans comprised 23.5 percent of newly originated auto loans.

More than 9 million new loans were made up to April 2015, which is a 5.8-percent increase over last year. Overall, more than 73.7 million cars are financed through loans in the U.S.

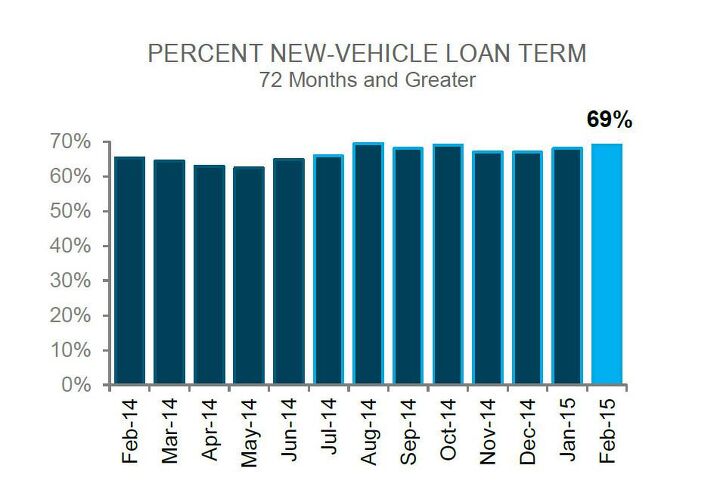

Chart Of The Day: 8 Years A Slave, Redux

Faced with less disposable income, higher taxes and more expensive vehicles (in most cases), loan terms in the Canadian market has gradually shifted to one where bi-weekly and even weekly payments have become the advertised norm, with 72, 84 and 96 month loans appearing as a fixture of the new and used vehicle marketplace. And with household debt levels reaching record heights in Canada, the chart above should be deeply concerning.

Repossessions, Delinquencies Up As Oustanding Auto Loan Balances Hit All-Time High

The latest Q2 2014 data from Experian was released this week, and key metrics like repossessions, loan delinquencies and outstanding balances have all seen increases.

No Credit Score? Show Your Cable Bill, Get Approved

New technology is allowing buyers with no credit score – due to a lack of credit history or a personal bankruptcy – to get vehicle financing via examination of documents like the payment history of their cable or cell phone bill.

"All Is Fine In Sub-Prime Land," Says Someone With A Vested Interest In Its Success

The Detroit Free Press paints a pretty clear picture of the automotive lending landscape: auto loan terms are rising, with 1 in 5 loans now lasting longer than 6 years. At the same time, the average credit score for those taking out loans is dropping. Ominous signs for a car market that’s running on the hype of a perpetually increasing SAAR, right? Well, not according to some.

97 Months And Running

8 years to pay off a car? A report by the Wall Street Journal claims that in Q4 of 2012, the average car loan stretched out to 65 months, or just over 5 years. Loan terms were being stretched out over increasingly longer terms too, with credit firm Experian reporting that nearly 1 in 5 car loans had terms between 73 and 84 months long, with some stretching for as long as 97 months.

Recent Comments