#buyouts

GM Offering Buyouts to Salaried U.S. Employees

General Motors is planning to spend an estimated $1.5 billion to buy out a meaningful portion of its salaried workforce in the hopes that the decision will help save the company $2 billion over the next couple of years. While it seems like a very expensive way to save money, CEO Mary Barra clearly feels as though now is the time to strike.

Buyout Begone: Ford Says You Can Never Own Leased EVs

Ford Motor Co. will be suspending end-of-lease buyout options for customers driving all-electric vehicles, provided they took possession of the model after June 15, 2022. Those who nabbed their Mach-E beforehand will still have the option of purchasing the automobile once their lease ends. However, there are some states that won’t be abiding by the updated rules until the end of the year, not that it matters when customers are almost guaranteed to have to wait at least that long on a reserved vehicle.

Cadillac Expects to Lose One-Third of All U.S. Dealerships This Year

Cadillac is expected to have lost one-third of its U.S. dealerships this year — going from nearly 900 physical locations at the start of 2021 to an estimated 560 by year’s end.

But there’s allegedly no need to worry about the brand because this is part of a planned electric offensive. Last year, Cadillac asked dealers to spend the capital necessary to install charging stations, update their service centers, and retrain staff to better tackle EVs or take a buyout before the automaker’s first battery-driven car (the Lyric crossover) hits the market early in 2022. It would seem that a meaningful portion of the whole decided to bow out, which Cadillac seems totally fine with.

Ford to Cut 1,400 Salaried Positions in U.S. Through Buyout Initiative

Barely a full day after news broke that Ford was on the cusp of announcing layoffs, Ford announced those layoffs. On Wednesday, the automaker informed employees that it needs to eliminate 1,400 salaried jobs as part of its $11-billion restructuring program. The good news is that these cuts will be handled through retirement buyouts that won’t leave the departing workforce empty handed. The automaker’s internal memo also stated that the buyouts would be voluntary.

The Blue Oval previously said it expects a full-year loss in 2020 thanks to the pandemic, with a pre-tax profit of anywhere between $500 million and $1.5 billion in the third quarter.

Getting Into the Game: Amazon Purchases AV Startup Zoox for an Undisclosed Sum

Always eager to slash delivery costs — especially if the government opts to stop subsidizing the company via the U.S. Postal Service — Amazon has been getting chummy with EV startups. It’s also begun exploring new business opportunities in regard to food delivery and ride hailing, resulting in sizable investments into both sectors.

On Friday, Amazon announced it will acquire California-based Zoox to help it further those goals. Coming off a staffing reduction of about 10 percent to contend with the pandemic, the company is currently focused on delivering an symmetrical, self-driving, zero-emissions vehicle that can compete on the currently nonexistent robo-taxi market. While the world’s 13th largest company (by revenue) seems like it would make good use of the property to advance its autonomous delivery program, corporate messaging seems to indicate Amazon is more interested in Zoox’s expertise in people moving.

'Do or Die': Nissan Buying Out U.S. Employees As Cost-cutting Spree Continues

In an effort to reduce expenses and lower its headcount, an embattled Nissan is offering buyouts to its U.S. employees.

It’s rumored that Nissan plans to eliminate thousands of white-collar jobs and shutter several global factories as part of its effort to improve the company balance sheet. Going into 2020 weak and not expecting to make any money, the automaker is turning its focus to restructuring for at least the next 24 months.

“To adapt to current business needs and improve efficiencies, Nissan will offer voluntary separation packages to eligible U.S.-based employees,” the company said in a statement.

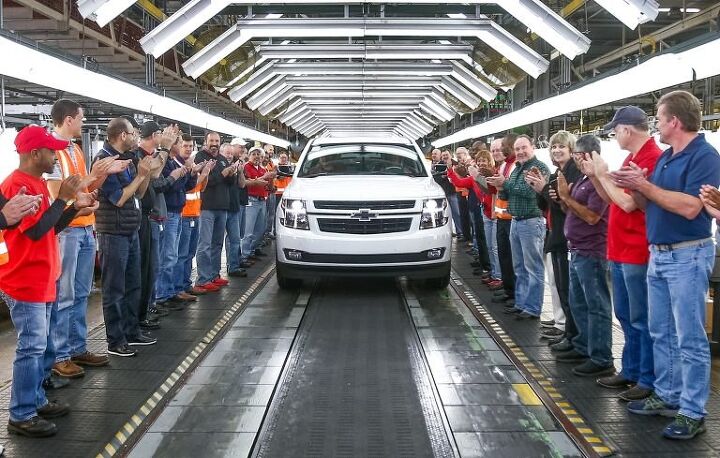

GM Offers Buyout to 18,000 Salaried Employees

Wednesday morning, General Motors announced third-quarter 2018 earnings “reflecting profitability in all core operating segments.” Operating profits were at $2.5 billion, with North American profit margins hovering around 10.2 percent thanks to healthy truck sales. All in all, things were looking pretty good.

Then GM announced a plan to extend buyouts to salaried employees in the region with 12 or more years experience in order to cut costs. Roughly 18,000 salaried employees are said to be eligible for voluntary severance packages. The reason? General Motors says it wants to do this while the company is still healthy, which sounds like a pretty strong hint that bad times are ahead.

BMW Buying Out Brilliance Automotive in China, Adding Capacity for U.S.

Now that China has relaxed its joint-ownership mandates, BMW has announced that it will procure a majority stake in its venture with Brilliance Automotive. The German firm will be the first foreign automaker to have majority control of its business in the region.

Being first will not come cheaply, however. It will cost BMW $4.2 billion to assume control with a majority stake of 75 percent of the business — albeit as part of a larger deal. All the manufacturer has to do is come up with the funds and wait until 2022, when rules limiting foreign ownership for all Chinese auto ventures are officially lifted.

Amid Lawsuit, SEC Investigation, Musk Says Tesla's Private Funding Will Come From Saudi Arabia

Last week, Tesla CEO Elon Musk announced his intention to take the automaker private. But speculation quickly arose that the claim was just a clever ploy to drive up the company’s share price and burn short sellers, a group Musk seems to have a particular disdain for. This resulted in a shareholder complaint, filed Friday as a securities-fraud class action in federal court in San Francisco, alleging he lied to manipulate shareholder prices.

However, the Securities and Exchange Commission was already investigating the matter at the time of the lawsuit’s filing. While the bulk of the initial investigation involved asking Musk if he was lying, it’s presumably advanced in scope and complexity since then. The lynchpin to the whole issue is whether Tesla actually secured the billions in funding necessary to go private. Even though the CEO said the money is real, he did not specify who would provide it.

That changed on Monday morning, when Musk pointed to oil-rich Saudi Arabia. But it’s not as simple as it sounds.

Take the Cash, Hit the Bricks: Nearly 2,500 Korean Workers Opt for GM's Voluntary Redundancy Package

Union officials have stated that roughly 2,500 workers from General Motors’ South Korean unit have applied for a redundancy package offered as part of the automaker’s comprehensive restructuring of the region. The number represents around 15 percent of total GM staff in the area and should make negotiations with one of the most inflexible workers’ unions on the planet that much easier.

Still, what General Motors plans to do with its remaining South Korean factories is unknown, but it has already announced one closure. This has left many wondering if the automaker will abandon production in the country entirely. Fortunately, the Korean workforce has not responded with violence. In fact, many appear to see the writing on the wall, opting to take a buyout rather than cause a fuss during the restructuring.

J.D. Power Bought by XIO Group; Deal Appears to Have High Initial Quality

J.D. Power and Associates is planning to put more of your possessions under the microscope, now that they’ve taken on new ownership in a deal worth $1.1 billion.

Best known for its vehicle quality ratings, J.D. Power, a unit of McGraw Hill Financial Inc., was snapped up yesterday by London-based XIO Group, according to Reuters (via Automotive News).

The investment firm muscled out a competing private equity firm to land the cash deal, which is expected to close in the third quarter of this year. XIO Group has a strong footprint in China, where it is linked to many high-powered investors.

With Liabilities Looming, GM And UAW Agree To Pension Buyouts. But What About The Workers?

One of the legacy costs that GM was not able to reduce in the bailout was pension costs, a whopping $128b obligation as of the end of 2010. And though the plan is “only” underfunded by $10.8b at the end of June according to GM, Kenneth Hackel, president of CT Capital LLC (and author of two textbooks on valuing securities) recently told Bloomberg

The financial risk because of [GM’s pension liability] is higher than people understand. The cold reality is if you used a conservative discount rate and you wanted to close out the plans, you would have to raise about $35 billion.

With GM’s market cap sagging into the low-$30b range (currently around $34b), the risk of pension liabilities growing larger than GM’s market capitalization is very real. And as lower interest rates and a weak stock market reduce pension fund returns, the obligations grow, in turn putting pressure on GM’s stock price. And it’s not like nobody saw this coming: a GAO report released in April 2010 issued dire warnings about the state of GM and Chrysler’s pension obligations. Now, according to the ace reporters at Reuters, GM and the UAW have hashed out a buyout deal giving workers the option of being bought out of their pensions. Which has us dying to know: what’s a UAW pension worth in cash?

GM To UAW: Take This Job And Keep It

When the music finally stopped at Old GM, the UAW’s VEBA fund was left holding a lot of IOUs. On those merits, the union’s benefit trust was given about 17.5 percent of the equity in the bailed-out and re-organized New GM. UAW leadership has always maintained that having its membership’s benefits staked on the company’s financial performance would not change its mission, and that VEBA’s representative on GM’s board, Steve Girsky, would operate free from union influence. And one hopes he would, considering he’s being paid well to advise CEO Ed Whitacre. But the tension between GM’s IPO sprint and the UAW’s non-VEBA interests never goes away, and the Wall Street Journal [sub] is reporting that the latest spat is over the old hobbyhorse of buyouts.

Ford Brings Back Buyouts, Visteon Dumps Pensions on Public

It’s been a while since we’ve heard the word “buyout” echoing out of Detroit, as 2008 marked the year in which auto industry employees finally started to be fired like everyone else: without a hefty severance kiss-off. Ford, on the other hand, did not get a shot at free house-cleaning in bankruptcy court, so it’s bringing back buyouts. According to Market Watch, the Blue Oval is offering blue-collar employees a $50,000 lump sum payment and a $25,000 voucher for a new vehicle or another $20,000 lump sum, as well as six months of health insurance coverage. There’s even an extra $40k for workers of “a certain age.” But this being Detroit, employee benefits are either feast or famine. While Ford’s workers are being offered cash for their jobs, the former Ford parts division Visteon announced today that it is seeking to dump pensions for 21,000 retirees in bankruptcy, following Delphi into yet another stealthy yet popular form of indirect automaker bailout.

Recent Comments