#ally

No Fixed Abode: Putting Out a Contract on That Honda

I’ve always been suspicious of the word “ally.”

As a child, reading John Toland and William Shirer when most of my classmates were still sounding out words one syllable at a time, I didn’t much care for the Allies. Instead, I rather approved of the Axis powers — minus that treacherous Stalin, mind you. Save your disapproval. The rest of America must have secretly felt the same way or else we wouldn’t have surrendered our vehicle-manufacturing capabilities to Germany and Japan. Indeed, I think that President Bush made a mistake talking about the “Axis Of Evil.” First off, that sounds like a really bad-ass metal band. Second, it implies that the countries involved might eventually create reissues of the Messerschmitt Me262 Sturmvogel, which would be enough to sway any man with functioning testicles to their cause.

But “Ally” is also a euphemism for GMAC, the company that sucked up $17 billion worth of taxpayer money so it could offer 0-percent financing on Chinese-made Buick Envision SUVs. And since the nice people at Ally learned precisely nothing from that bailout, the same way your neighbor’s kid Chadwick learned precisely the wrong lesson from his parents’ decision to replace his 2014 Mercedes-Benz SLK 250 with a 2016 Mercedes-Benz SL 550 after Chadwick tripped out on Ecstasy and barrel-rolled said SLK into a kindergarten schoolyard, Ally busies itself offering all sorts of additional financial “products” via direct mail to all sorts of people.

I’m one of those people.

Ally wants to cover my 2014 Accord V6 ( did you know I had one?) with a special service contract. Who’s the bigger fool here: Ally, for offering me a contract, or me, for considering it?

GM Financial Double Crosses Their Ally

Following in the footsteps of Spanish bank Santander, GM Financial announced that it would enter the prime lending market in 2014.

97 Months And Running

8 years to pay off a car? A report by the Wall Street Journal claims that in Q4 of 2012, the average car loan stretched out to 65 months, or just over 5 years. Loan terms were being stretched out over increasingly longer terms too, with credit firm Experian reporting that nearly 1 in 5 car loans had terms between 73 and 84 months long, with some stretching for as long as 97 months.

How A New Generation Of Sub-Prime Auto Financing Could Cause Another Catastrophe

March was the 5th straight month of a SAAR above 15 million vehicles. Industry analysts have explained the strength of the market in a number of ways. The need to replace older vehicles is one (new car sales were hit hard during the recession as consumers held on to their vehicles for longer. This also caused used car prices to skyrocket, something TTAC has been documenting), while others have cited increasing fleet demand, and the desire to replace vehicles damaged in Hurricane Sandy.

But one factor that is just starting to get attention outside of TTAC is sub-prime financing. Sub-prime lending, which involves giving high-interest loans to customers with poor credit scores, is driving the SAAR in a big way, by letting buyers with poor credit purchase new cars. In turn, the sub-prime bubble is being driven by Wall Street, whose clients cannot get enough of financial instruments backed by sub-prime auto loans.

The Artist Formerly Known As GMAC Comes Back To Mami - Partially

Bailed-out GM agreed to pay about $4.2 billion for the European and Latin American operations of likewise bailed-out Ally Financial, formerly known as GMAC.

Bailed-Out GM Wants To Help Bailed-Out Ally With Some Of Its Bail-Out Money. Investors Not Amused

Bailed-out GM might sink $2 to $4 billion into likewise bailed-out Ally Financial to buy some of the lender’s international operations. Ally “ironically wants to use the proceeds to help repay its own federal bailout aid,” says Reuters. That plan does not sit too well with some observers. Says the wire: “Analysts and investors disagree on whether that would be the best use of cash, with some preferring a stock buyback or dividend payment.”

Guess Who Owned Ally Financial's ResCap? You Did

Minutes after Ally Financial, the bs-artist formerly known as GMAC, took its Residential Capital bankrupt, David Shepardson tweeted to his followers that all is fine:

“GM owns 9.9% of Ally Financial Inc, while @USTreasuryDept owns 74 percent”

GM's Floorplan Banker Could Take Mortgage Arm Bankrupt

There is new trouble brewing in an important part of GM’s business: Ally, the former GMAC. Nearly 75 percent of the credit that GM dealers in the United States use to finance their inventories is from Ally, says a Reuters report. The report also says that Residential Capital (ResCap) – Ally’s mortgage servicing and lending unit – is again on the verge of being put into bankruptcy.

GM's AmeriCredit Deal: Awaiting Approval

Now that GM’s acquisition of the subprime lender AmeriCredit has had 24 hours to sink in, howls of protest are starting to surface. The charge is being led by Senator Chuck Grassley, who has requested a review of the deal from the SIGTARP, saying

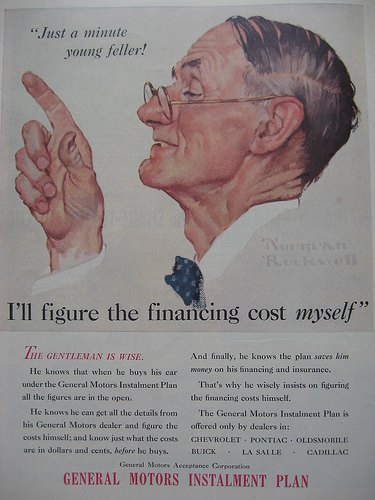

If GM has $3.5 billion in cash to buy a financial institution, it seems like it should have paid back taxpayers first. After GM’s experience with GMAC, which left GM seeking a taxpayer bailout, you have to think the company and, in turn, the taxpayers would be better off if GM focused on making cars that people want to buy and stayed clear of repeating its effort to make high-risk car loans.

And though Grassley’s criticism could be read as mere partisan gamesmanship from a leader of “the party of no,” there are a number of very good reasons for opposing the deal.

GM Captive Finance Push Explained: The General Wants More Subprime Business

When we first heard that GM was eying a return to in-house financing, our first reaction was to worry that

the potential for falling back into old bad habits can’t be ignored.

Clearly our concern wasn’t wasted, as the AP [via Google] reports that The General’s major motivation for considering re-creating a captive lender is to chase subprime business its current major lender won’t touch. And considering that that lender is GM’s bailed-out former captive finance lender GMAC (now Ally Financial), which was badly burned by subprime mortgages, it’s not surprising that GM is frustrated by GMAC’s tentative approach. But should The General charge into the low-standard lending sectors where Ally fears to tread?

GM And Chrysler Racing Towards Captive Finance?

News that GM is considering a number of options for a return to captive finance, has lit a fire under Chrysler CEO Sergio Marchionne, who tells the Detroit News that

One of the things that we do not wish under any circumstance is to have an uncompetitive relationship vis-À-vis GM

That would certainly be the case if GM bought up its recently-bailed-out former captive finance arm, GMAC (now known as Ally Financial). Chrysler relies on GMAC for leasing and loans just as much as GM does at the moment, so an Ally buyout would create major long-term problems. But even if GM created a new finance arm, Chrysler doesn’t seem to think that it will be able to survive without forming its own in-house finance department. Which would then compete with GM and Ally, to say nothing of the industry’s other finance competitors. But is the rush to captive finance going to be good for anyone?

Recent Comments