GM Lost $4.3b In The Second Half Of 2009

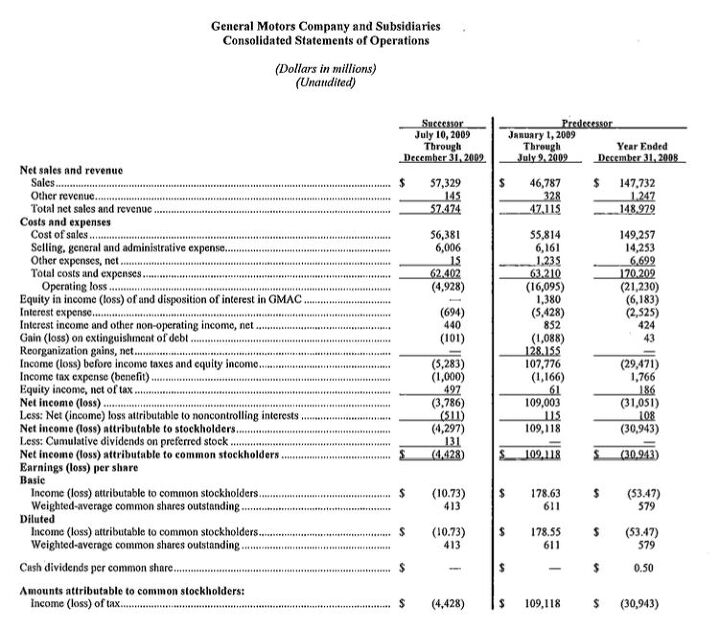

GM has announced its “fresh-start” post-bankruptcy accounting results, and between July and December of last year, the bailed-out automaker lost $4.3b [press release here, full numbers here, in PDF format]. The loss comes despite $57.5b in global revenue, and $1b in “net cash provided by operating activities.” According to GM’s release:

The $4.3 billion net loss includes the pre-tax impact of a $2.6 billion settlement loss related to the UAW retiree medical plan and a $1.3 billion foreign currency re-measurement loss.

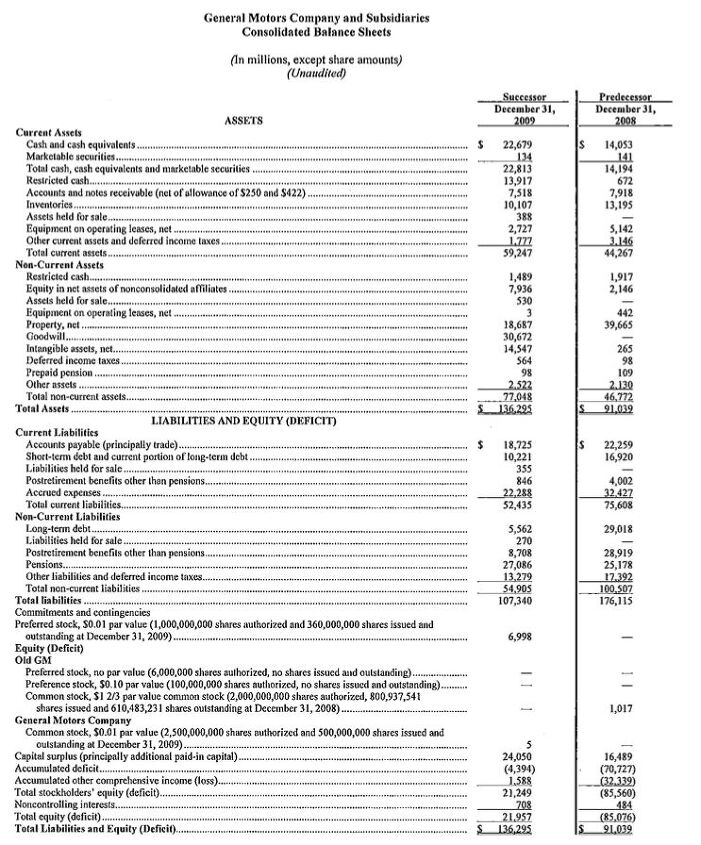

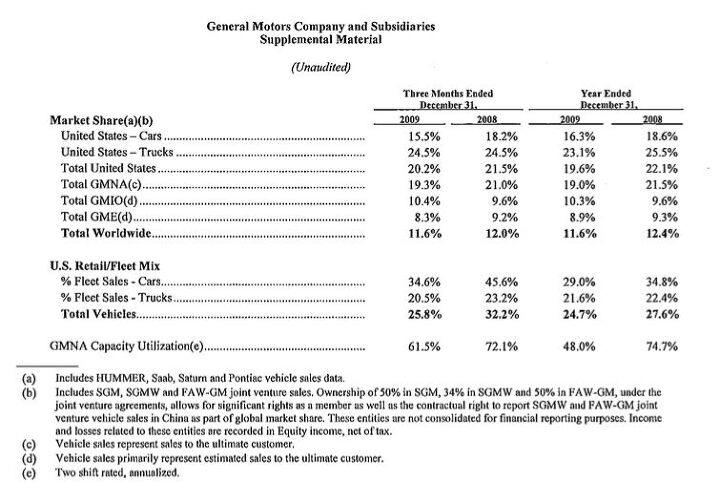

Of course, you have to dig into the numbers to find the bad news, like the $56.4b in “cost of sales,” or the $700m interest cost, or the 48 percent North American capacity utilization in 2009, or the 16.3 percent US car market share. Which is why we’ve included the consolidated statement of operations, consolidated balance sheets and more, for your no-download-necessary perusal, after the jump.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy TG likes price reductions.

- ToolGuy I could go for a Mustang with a Subaru powertrain. (Maybe some additional ground clearance.)

- ToolGuy Does Tim Healey care about TTAC? 😉

- ToolGuy I am slashing my food budget by 1%.

- ToolGuy TG grows skeptical about his government protecting him from bad decisions.

Comments

Join the conversation

While I continue, during casual conversations, and the opportunity allows it, inform others of my 2004 decision to assist the "home team" by buying a Ft. Wayne-made Chevy truck and how several dealers AND corporate GMC spat upon me by refusing to even make a honest attempt at diagnosing several of the defects that negatively affected the truck and that added several thousand dollars of indirect cost to the total "cost of ownership" during the warranty period (lost time/wages, car rentals, etc)

they still have to invest in the business - so a run rate of $2b per year cash from operating and forecast cap ex of $6b (cap ex was $7.5b in '07 & '08) results negative free cash flow. But yeah, "favorable managed working capital of $4.3 billion primarily driven by the effect of increased sales and production on accounts payable and the timing of certain supplier payments" = no cash burn from operations...