GAO: Pension Plans Will Kill Detroit. Again.

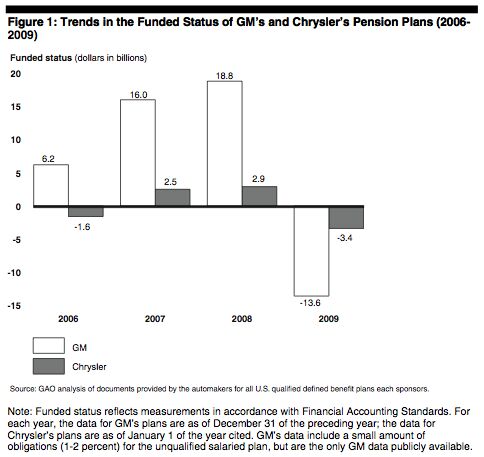

It would be impossible to blame Detroit’s decades-long decline on a single factor, but if one were to make a list, defined pension obligations to workers would be somewhere very near the top. Thanks in large part to the unionization of America’s auto industry, Detroit has groaned under the weight of crushing pension obligations since time immemorial. And, according to a new report by the Goveernment Accountability Office [ full report in PDF format available here], last year’s bailout of GM and Chrysler has not eliminated the existential threat that these obligations pose to the industry. In fact, the taxpayer’s “investment” in GM and Chrysler appears only to have exposed the public to even an greater risk of catastrophic pension plan failure.

The underlying problem is not even that GM and Chrysler continue to shoulder an unsustainable load of pension obligations, it’s that the bailout itself has created no guarantee that GM and Chrysler will become profitable enough to shoulder the obligations. As the report’s conclusion notes:

Treasury’s substantial investment and other assistance, as well as loans from the Canadian government and concessions from nearly every stakeholder, including the unions, have made it possible for Chrysler and GM to stabilize and survive years of declining market share and the deepest recession since the Great Depression. However, because of the ongoing challenges facing the auto industry—including the still recovering economy and weak demand for new vehicles—the ultimate impact that the assistance will have on the companies’ profitability and long-term viability remains uncertain. This, too, is the case for the companies’ pensions. The companies’ ability to make the large contributions that would be required based on current projections is mostly dependent on their profitability.

Though the Treasury’s auto team believes that both GM and Chrysler are able to achieve break-even performance in the short- to medium-term, they point out that such a performance will require a larger turnaround in the economy and demand for automobiles. What goes largely unsaid is that demand for GM and Chrysler-built vehicles in specific must recover before these companies are able to face their looming pension obligations, and that 2010 sales to date indicate that Chrysler is certainly behind the curve for achieving break-even volumes. Whether GM is approaching a break-even performance will become clear later today, when the firm reports its first post-bankruptcy, GAAP-approved earnings.

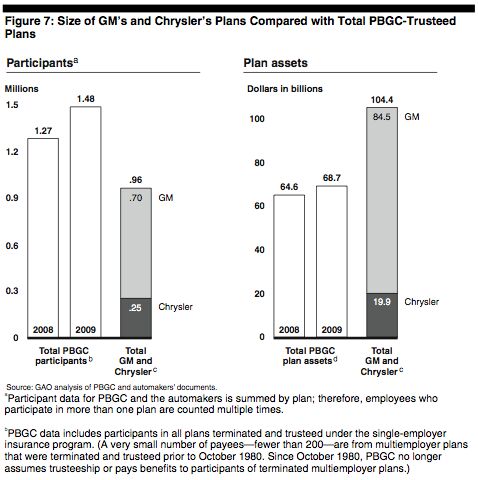

But had the auto bailout actually made progress on GM and Chrysler’s obligation load, this pressure for short-term results would be less pressing than it is. Unfortunately, because of the size of these obligations, a government bailout of Detroit’s pension obligations could have nearly doubled the rescue’s $81b pricetag. According to the GAO:

PBGC estimated its exposure for unfunded guaranteed benefits across the sector to be about $42 billion as of January 31, 2009, and the exposure for plan participants for unfunded nonguaranteed benefits to be about $35 billion.

Ironically, pre-bailout restructuring and attrition efforts by GM and Chrysler have actually worsened their pension obligation pictures. Though cutting workers and slimming down overcapacity was necessary for GM and Chrysler to even have a shot at medium- to long-term profitability, the fact that the bailout babies made these cuts at a time when it was starved for cash meant that they actually raided their pension funds for cash buyouts to workers.

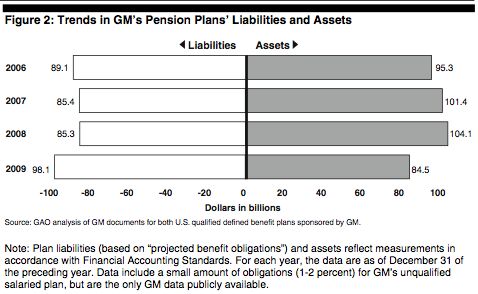

GM began its downsizing even before its TARP-related restructuring efforts reduced the number of its North American brands from eight to four. According to a GM news release, approximately 66,000 U.S. hourly workers left the company under a special attrition program between 2006 and 2009. Often the lump-sum payments and buyouts offered by these programs were paid from company assets, but when these benefits are paid from pension assets, there can be an impact on the plan’s financial status. GM noted that the attrition programs implemented between 2006 and 2009 contributed to an increase of estimated plan obligations during this period and—along with other factors, such as discount rate changes— played a role in the recent increase in GM’s pension liabilities

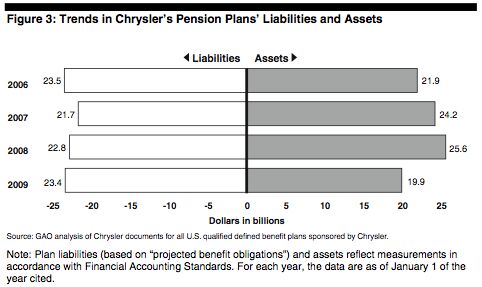

Similarly, Chrysler’s downsizing efforts also predate TARP… Due in part to these programs, over the past few years, Chrysler’s pension liabilities have fluctuated while plan assets have been declining. For example, Chrysler’s UAW plan reported a $900 million increase in liabilities from 2007 to 2008, and the plan’s 2008 valuation report noted that the cost of special termination benefits during 2008 were nearly $390 million. Total liabilities for the Chrysler Pension Plan increased by a smaller margin overall from 2007 to 2008, but the plan’s 2008 valuation report noted that nearly $195 million in additional costs were being recorded due to special early retirements, added service costs, and curtailment loss.

In addition, GM’s jiggery-pokery with Delphi’s pension obligations (first spinning its own obligations off into its once-captive supplier, then re-assuming some last summer when Delphi struggled to emerge from bankruptcy) have added $2.1b to The General’s pension deficit. In visual terms, the impact of these “slimming” efforts looks something like this:

In both cases, it doesn’t take a financial genius to understand the scope of the problem. For an even simpler understanding of Detroit’s pension problem, we must look to GM and Chrysler’s estimates of future contributions required to maintain minimum funding levels for its pension plans, as required under law. Both bailed-out automakers are currently above minimum levels, however starting in 2013, large contributions are expected to be needed.

As of October 1, 2008, GM had about $36 billion of credit balance in its hourly plan and about $10 billion in its salaried plan. However, once these credit balances are exhausted, GM projects that the contributions needed to meet its defined benefit plan funding requirements will total about $12.3 billion for the years 2013 and 2014, and additional contributions may be required thereafter. In its 2008 year-end report, GM noted that due to significant declines in financial markets and deterioration in the value of its plans’ assets, as well as the coverage of additional retirees, including Delphi employees, it may need to make significant contributions to its U.S. plans in 2013 and beyond.

That’s $5.9b in 2013, and $6.4b in 2014, a significant cost to be incurred in such a short time, given GM’s current inability to earn a profit. Chrysler, meanwhile faces smaller payments over the short term, of $400m in 2010 and $40m in 2012, but payments to maintain minimum funding levels will increase to $930m in 2013 and $1.25b in 2014.

Worst of all, this entire mess is playing out against the backdrop of a larger crisis in the US government’s pension guarantee system. As of last September, the Pension Benefit Guarantee Corporation had an accumulated deficit of a staggering $22b, largely due to the assumption of of pension obligations in the manufacturing section. Nearly half of that deficit has been accumulated since September 2008, and another $14b of unfunded obligations currently hang in the balance from auto supplier firms alone. Furthermore,

Each year, PBGC assesses its exposure to losses from underfunded pension plans sponsored by financially weak companies… At the end of fiscal year 2009, PBGC estimated that its exposure from reasonably possible terminations was approximately $168 billion, up from $47 billion a year earlier.63 A significant part of this increase was due to the dramatic increase in exposure related to manufacturing, which PBGC attributed primarily to changes in the auto industry

In short, if GM or Chrysler fail to make their minimum payments, and default on their obligations, an already-staggering PBGC could collapse into complete insolvency.

This intense pressure on the PBGC combined with continued weakness in the auto sector puts worker benefits (particularly for high earners and those nearing retirement) into jeopardy, without a functioning federal safety net. As suppliers continue to fail, these obligations and risks will continue to mount, all of which will hurt GM and Chrysler’s chances at a successful IPO, and force the treasury to balance the government’s pension guarantee problems against the financial health of the two automakers it hopes to shortly cash out of. That, according to the report, is a recipe for “tensions” and “conflict” for everyone involved in the auto bailout. The GAO concludes:

The federal government and its institutions, the automakers, and the unions have all made a concerted effort to ensure that GM and Chrysler do not fail. But, should the automakers not return to profitability, interests may no longer be aligned. Treasury officials said that they will consider all commercial options for disposing of Treasury’s equity, including liquidation; this would likely mean terminating the companies’ pension plans, and allocating remaining company assets. In such circumstances, it would be difficult for Treasury to make any decisions that would trade off the value of its investment against the expense of the pension funds, potentially exposing the government either to loss of its TARP investment or to significant worsening of PBGC’s financial condition. This is not a choice the government wants to face, but this risk and its attendant challenges remain real.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 1995 SC I will say that year 29 has been a little spendy on my car (Motor Mounts, Injectors and a Supercharger Service since it had to come off for the injectors, ABS Pump and the tool to cycle the valves to bleed the system, Front Calipers, rear pinion seal, transmission service with a new pan that has a drain, a gaggle of capacitors to fix the ride control module and a replacement amplifier for the stereo. Still needs an exhaust manifold gasket. The front end got serviced in year 28. On the plus side blank cassettes are increasingly easy to find so I have a solid collection of 90 minute playlists.

- MaintenanceCosts My own experiences with, well, maintenance costs:Chevy Bolt, ownership from new to 4.5 years, ~$400*Toyota Highlander Hybrid, ownership from 3.5 to 8 years, ~$2400BMW 335i Convertible, ownership from 11.5 to 13 years, ~$1200Acura Legend, ownership from 20 to 29 years, ~$11,500***Includes a new 12V battery and a set of wiper blades. In fairness, bigger bills for coolant and tire replacement are coming in year 5.**Includes replacement of all rubber parts, rebuild of entire suspension and steering system, and conversion of car to OEM 16" wheel set, among other things

- Jeff Tesla should not be allowed to call its system Full Self-Driving. Very dangerous and misleading.

- Slavuta America, the evil totalitarian police state

- Steve Biro I have news for everybody: I don't blame any of you for worrying about the "gummint" monitoring you... but you should be far more concerned about private industry doing the same thing.

Comments

Join the conversation

no, I haven't been offered the CEO position, nor would I be interested. yes, GM could sell another million units in North America...if they would listen to someone who knows how to do it. they certainly do not.

I finally got around the reading the article. GM and Chrysler both have large assets in play that can make money and contribute to the plan. Since we are still pretty low on the economic recovery of the market, the assets will increase in value over time. Hopefully in 3 years we are in much better position today. If the assets increase, GM and Chrysler may owe significantly less or nothing.