Chrysler's Financial Plan: Leveraged Assumptions

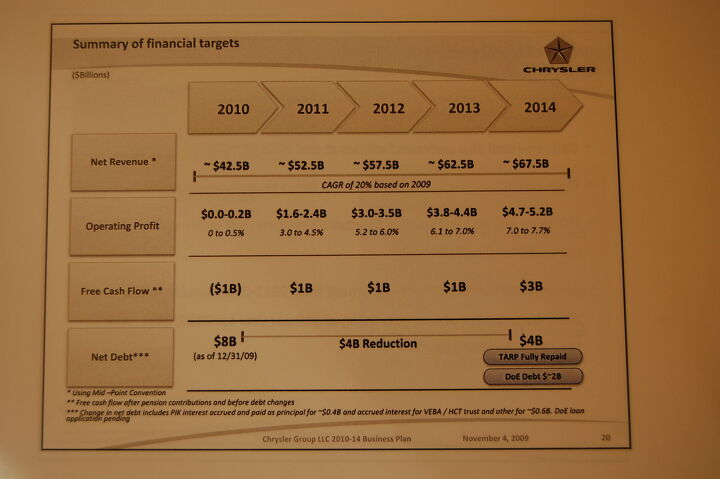

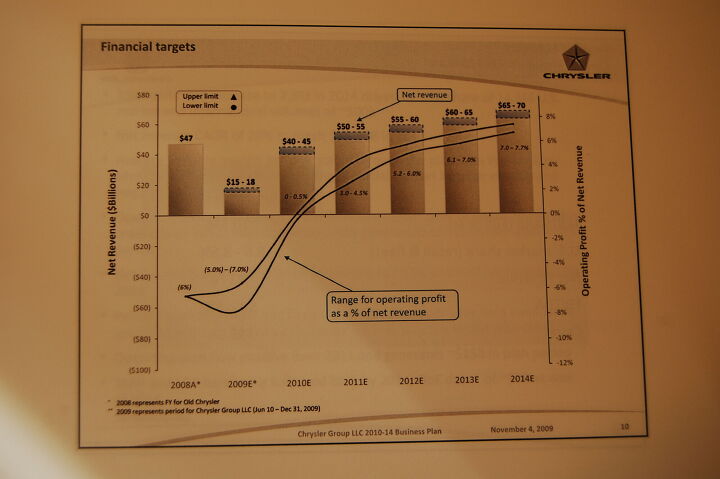

Chrysler’s financial plan is where the rubber hits the road for Sergio Marchionne’s turnaround. It starts with a break-even projection for 2010 on net revenue of about $42.5b, which is more than double the projections for 2009 of $17b net revenue. As the previous sales projection chart and product plan analysis indicates, a short-term turnaround of this magnitude seems highly unlikely. Unfortunately, because Chrysler plans to spend $23b on R&D and other capital expenditures (capex) between 2010 and 2013 without injecting any fresh capital, this sales turnaround absolutely has to happen in order for the rest of the plan to move forward. Though this plan is said to be stress-tested for a zero-SAAR growth by 2011 scenario, there’s no indication that these projections consider the possibility that Chrysler’s market share won’t grow. In this weak-market/strong share growth scenario, Chrysler believes that despite a $7b drop in revenue, $.4b operating profit could be rescued through cost interventions. But it’s not specified where those cost interventions would come, leading to the inevitable assumption that product development (the crucial factor in any market share growth) would be drastically reduced. It’s worth noting again that Fiat does not plan on contributing any new capital to Chrysler.

More analysis on Chrysler’s financial plans are coming, but in the meantime, check out the complete presentation ( PDF).

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts I hope they make it. The R1 series are a genuinely innovative, appealing product, and the smaller ones look that way too from the early information.

- MaintenanceCosts Me commenting on this topic would be exactly as well-informed as many of our overcaffeinated BEV comments, so I'll just sit here and watch.

- SCE to AUX This year is indeed key for them, but it's worth mentioning that Rivian is actually meeting its sales and production forecasts.

- Kjhkjlhkjhkljh kljhjkhjklhkjh a consideration should be tread gap and depth. had wildpeaks on 17 inch rims .. but they only had 14 mm depth and tread gap measured on truck was not enough to put my pinky into. they would gum up unless you spun the libing F$$k out of them. My new Miky's have 19mm depth and i can put my entire index finger in the tread gap and the cut outs are stupid huge. so far the Miky baja boss ATs are handing sand and mud snow here in oregon on trails way better than the WPs and dont require me to redline it to keep moving forward and have never gummed up yet

- Kjhkjlhkjhkljh kljhjkhjklhkjh Market saturation .. nothing more

Comments

Join the conversation

@ amcurrie; I was thinking the same thing but that's why I normalize on a "per unit" basis. If they ignore the revenue pre-bankruptcy, then they'd also shed the claim of shipments pre-bankruptcy. So dividing total revenue by the # of units should somewhat limit the impact of the bankruptcy as regards to comparing numbers from one year to another year. Yes, there are still some differences. For example, vehicles shipped in the latter half of a year tend to have better net revenue per unit since they are the newer model year vehicles with less incentives. If you dig a bit deeper, Chrysler's expected 2010E revenue per vehicle of $25K is pretty high. On Page 1 of Ford's 2008 Annual Report they put their operating highlights: Ford's 2008 Revenues = $129.2B and 5.532M units shipped worldwide. That's a per-unit average of $23,355. So Chrysler has a $2,000 per unit advantage in pricing/incentives of the average vehicle versus the Blue-Oval average vehicle? Yes, Chrysler has a higher mix towards large vehicles, but the difference isn't that extreme. Couple this with foreign markets having higher revenues than NAFTA (especially with a weak US Dollar), and Chrysler doesn't have high penetration into foreign markets. There really are some aggressive assumptions coming from Auburn Hills once you start digging and thinking. $2,000 on Chrysler's expected 1.65M units isn't chump change. I wonder how the cost advantage stacks up.

Exactly whom will they be taking market share from with their fine new products? It's not like Toyota, Ford or Hyundai will roll over for them.