Reduced Ethanol Blender's Credit Headed For Senate Vote

It seems that yesterday’s optimism about a possible end to the ethanol “Blender’s Credit” may have been somewhat premature, as Senate Budget Committee chair Max Baucus has now proposed extending the 45 cents per gallon tax credit at the lower rate of 36 cents per gallon. The ethanol industry has expressed disappointment, but says it will accept the proposal. Which, given the fact that the Blender’s Credit is opposed by groups as diverse as Friends Of The Earth and FreedomWorks, seems like the reasonable step. And because the 36 cent per gallon extension is only good for a year, even if it is approved, this battle will rage on.

Japan Trades Wastewater For Oil

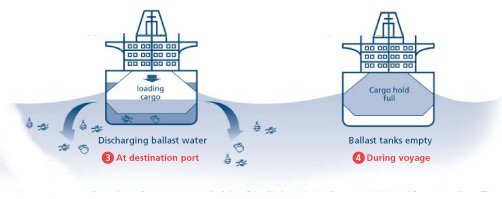

Oil and water supposedly don’t mix. Like a lot of conventional wisdom, this one is totally bogus. Without water, we wouldn’t have any oil. What do you think is in a supertanker when it goes back empty to Saudi Arabia or Prudhoe Bay? Water. It’s needed for ballast. Without it, the tanker would just pop out of the — water. About 60 million barrels of ballast water is shipped around the globe and is thrown away each day. Now, the Japanese have a better idea: They want to ship waste-water to oil-producing countries in the Middle East, and exchange it for crude oil. Say what?

The Truth About EVs: They Will Be Nuclear Powered

“I want to make nuclear power generation ‘visible’ through electric vehicles,” says Takafumi Anegawa, a former nuclear engineer who works for Tokyo Electric Power Co. He thinks that “electric cars are the best tool to help people understand the importance of nuclear power,” reports The Nikkei [sub].

Peugeot Goes Dddde Extra Kilometre

The U.S. has its hypermiling. Europe has its hyperkilometreing. In a European orderly fashion, of course. Germany has its Sprit-Spar-Meisterschaft, formerly sponsored and dominated by Volkswagen, now sponsored and dominated by Toyota. France has the Peugeot Eco Cup.

This is a competition in which different Peugeot (surprise, surprise) models are driven by everyday drivers to see if they can meet or beat official fuel consumption figures. The cars were driven 1000km on French and Swiss roads in wintery conditions (that must have been a picturesque drive). The results of the 2010 Peugeot Eco Cup are in (via The Auto Channel).

Travel Advisory: Avoid Europe

You don’t want to be traveling in or to Europe these days. In Germany, Lufthansa’s pilots went on strike this morning, grounding 3200 planes. “The largest strike in the history of German aviation” ( Die Welt) paralyzed German air traffic, and caused jams on the ground as travelers switched from planes to trains and automobiles.

Meanwhile next door in France, a nation is running out of gas. Workers at the six refineries owned by the country’s biggest oil group, Total, have been striking for more than a month. The work stoppage threatens to spread “to the two French oil refineries owned by US group Exxon Mobil, where strikes are planned for Tuesday,” reports the BBC.

Hong Kong Battles Strange Ghosts In A Bottle

While the world is trying to come to grips with pedal-gate, tiny Hong Kong is attempting an exorcism of its own gremlins: 18,000 (mostly Toyota Crown) taxis and 2,000 minibuses are propelled by LPG, liquefied petroleum gas. The gas is lugged around in a large tank housed in the trunk of the taxis, much to the chagrin of suitcase-schlepping tourists. The real problem is: The LPG mobiles are breaking down in wholesale fashion, China Daily reports. Hundreds a month.

The Hong Kong government set up a special task force to investigate. Nobody is blaming Toyota – this time.

Is A Gas Tax Hike Coming?

Ray LaHood seems to think so. He tells the Dallas-Fort Worth Star-Telegram:

The problem we have is, Congress wants to pass a very robust transportation bill in the neighborhood of $400 billion or $500 billion, and we know the highway trust fund is just deficient in its ability to fund those kinds of projects. The highway trust fund was substantial at one time but now with people driving less, and driving more fuel-efficient cars, it has become deficient. To index the federal fuel tax, that’s something Congress is going to have to decide. As we get into the reauthorization bill, the debate will be how we fund all the things we want to do. You can raise a lot of money with tolling. Another means of funding can be the infrastructural bank. You can sell bonds and set aside money for big projects, multibillion-dollar projects. Another way is (charging a fee to motorists for) vehicle miles traveled. The idea of indexing the taxes that are collected at the gas pump is something I believe Congress will debate. When the gas tax was raised in 1992 or 1993, in the Clinton administration, there was a big debate whether it should be indexed. At that time, they thought there’d be a sufficient amount of money collected. Now we know that isn’t the case. That is one way to keep up with the decline in driving, and more fuel-efficient cars.

E85 Boondoggle of the Day: Water, Water, Everywhere

Two recent developments have tarnished whatever green reputation ethanol has left. First, the news that corn-derived ethanol requires up to three times more water to produce than previously thought has cast a spotlight on the industry, especially in the dry west and southwest. A new study published by the American Chemical Society reports that previous estimates of water used to produce ethanol are inaccurate. The article’s abstract:

Won't Anyone Buy Some Oil?

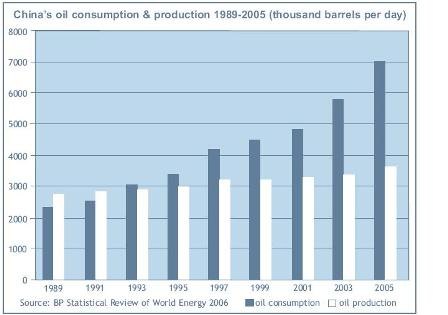

OPEC’s threatened 2 million barrel/day output cut has done nothing to halt oil’s collapse. The AP reports that Wednesday’s futures market dipped below $40/barrel for the first time since 2004. Markets are spooked by the realization that even mighty China is in a world of growth hurt at the same time as an unprecedented continued fall in US demand. US “demand for gasoline over the four weeks ended Dec. 12 was 2.7 percent lower than a year earlier.” “‘There’s just so much oil in inventory out there right now,’ said Michael Lynch, president of Strategic Energy & Economic Research. ‘Nobody wants to buy this stuff.'”

OPEC Slashes Production; Crude Continues to Tumble

Wild Ass Rumour of the Day: ExxonMobil to Buy GM and Become an Integrated Producer/Consumer

Wal-Mart Ripe For The Pickens?

NYT: Drill, Baby, Drill

From a crowd-pleasing chant at the Republican National Convention to op-eds at the New York Times, the refrain “Drill, Baby, Drill” is looming large in the American psyche. In the Gray Lady’s pages, Robert Hahn of the American Enterprise Institute and Peter Passel of the Milkin Institute (motto: Milkin’ The Issues) investigate the idea of penetrating mother Earth for more of that sweet, sweet dino juice. Opponents of drilling offshore and oil extraction in the Arctic National Wildlife Preserve (ANWR) argue that the benefits would be marginal. Hahn and Passel don’t necessarily disagree. They reckon 7b barrels could be pulled from ANWR, with another 11b available offshore, Hahn and Passel estimate the U.S. could thusly increase output by six percent, resulting in a 1.3 percent drop in worldwide prices. Meh. But the two argue that at $100/barrel, that oil would be worth nearly $2t not including the benefits of reduced pump prices for consumers. Development costs including environmental clean-ups would cost only $400b, making drilling an “economic no-brainer.” Hahn and Passel estimate the “non-use value” of ANWR at “only” $11b. The authors could “imagine a political bargain in which several hundred billion dollars went into a fund with a charter to preserve wilderness in the United States, or climate-stabilizing rainforests in Africa and Latin America.” In short, to protect the environment we must defile the environment. In reality, drlling is one of those idealism vs. pragmatism issues where win-win is a no-no. As long as the “Drill, Baby, Drill” refrain is still echoing out of St Paul, this kind of compromise is a long way off.

Recent Comments