Editorial: General Motors Death Watch 219: Rrrrrrescue Pack!

Editorial: General Motors Death Watch 218: Disconnect and Die

Editorial: General Motors Death Watch 214: Whose Car Company is This Anyway?

Editorial: Bailout Watch, German Edition, Drei: Opel, Heim Ins Reich?

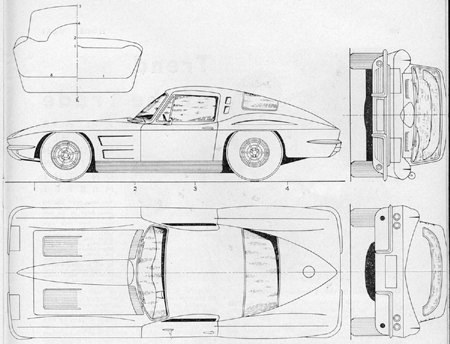

Editorial: General Motors Death Watch 213: Blueprint for a Taxpayer-Funded GM C11

Editorial: General Motors Death Watch 212: An Open Letter to President-Elect Barack Obama

Dear President-elect Obama,

Upon taking office, you will immediately face some tough decisions about the future of the government’s role in “saving” Ford, GM and Chrysler. As you know, the Detroit-based automotive industry has already bent the ears of your political colleagues, particularly Speaker Pelosi and Senate Majority leader Reid. These Democratic leaders in Congress seek membership approval to provide taxpayer dollars to prevent these automakers from impending collapse. While we respect the efforts of Congressional leadership, and we share their desire to enhance and protect America’s industrial base and employment therein, we ask that you spare a moment to listen to the opinions of people who do not share their belief that massive federal funding will achieve these goals. First, our qualifications.

We have been involved with the American automobile industry for decades. We are factory workers, designers, engineers, managers, mechanics, dealers, part suppliers, enthusiasts, journalists, and consumers. Together, we represent the combined voices of the “front lines” of our industry. We are loyal to our country’s economic self-interest and seek but one outcome: an American auto industry that builds vehicles admired and desired by the American public.

Over the last three decades, for reasons too numerous to elaborate, the majority of Americans (especially passenger car buyers) have switched their loyalties to foreign-owned brands. You will hear various explanations for this failure from the men in charge of Detroit: unfair foreign trade, currency manipulation, fuel economy regulations, health care costs, union collective bargaining agreements, the current credit crisis and more. We urge you to discard these explanations and only look at sales trends for the past three decades. Again, for whatever reasons, American consumers mostly abandoned Detroit.

By the same token, American automakers abandoned their customers, by failing to invest its profits in flexible assembly techniques, new powertrains and platforms, and better design. By failing to spread their investments in a range of vehicles to meet consumer needs, or fully embrace the fuel efficient future that Congress has dictated. To rectify this situation, urgent action is required. But you, as president-elect, must face this crisis with a clear understanding of the limitations you face.

First, accept the fact that jobs will be lost no matter what you do. The American automobile industry has too many products, brands, bureaucrats and dealers relative to the size of its market share. Until it can recapture– or at least maintain– market share, it will continue to contract. As any process of recovery will be slow and arduous, Ford, GM and Chrysler will have to shed thousands more jobs. With or without federal aid, this “downsizing” should continue, and sometimes with less than gracious outcomes.

Second, admit that Chrysler has no future. Actually, it had no future when Daimler sold it to Cerberus. Worse, Cerberus never had any intentions to invest the capital necessary to make a go of it. It has no future products in the pipeline today, and hence is undeserving of rescue. To best protect Chrysler’s past and present employees’ pensions and interests, Chrysler must be allowed to fail and be liquidated. At least some jobs will be saved as the company’s best assets get sold to other automakers, and proceeds will be returned to the debtor’s estate for apportionment among its stakeholders.

Third, understand that GM and Ford needs bespoke funding solutions. Your administration would be well advised to create a menu of funding options, each with different levels of security interest and control assumed by the federal government. Ford and GM’s executive management and their Boards will have the option to choose among a variety of solutions to resurrect their companies’ fortunes. If an initial solution does not work, any return to menu will incur significant costs and dilution. A “one size” solution to the problems of both automakers is not wise and simply doesn’t work.

For example, the cash needs of GM vastly outweigh those of Ford. GM does need a massive financial restructuring, Ford doesn’t. Taking a few billion here and there at GM won’t restore profitability at the company, it just prolongs the agony. Any analyst will tell you that GM needs perhaps $25 to $50b as part of a proper restructuring that includes a major “cramdown” on all stakeholders (including the United Auto Workers’ health care association). This “last resort” menu option then gives the taxpayers a significant interest in the company in return for the cash, with a small piece left for the creditors. And as its largest stockholder of sorts, the Feds get to call most of the shots at GM.

At Ford, the company has done most of the work necessary to restructure itself to long-term profitability in the near future – when auto sales come back to trend if not sooner. The amount of government assistance needed to ride through the crisis is considerably less than what’s required at GM. As a result, Ford will take a different menu option. Less money taken with less risk to taxpayers means less government influence and equity dilution for existing stockholders.

Fourth, the current management team at GM must be replaced, even if GM selects the lowest funding level option off the menu we prescribe. While we do not believe that government should involve itself in the highest levels of American enterprise, if it does, it should do so whilst protecting the financial interests of the American taxpayer. Any funds to GM must come with a wholesale revamping of this company’s Board of Directors and its senior management team.

Fifth, do not fall into the political trap of demands made by the UAW as deserving of a bail-out of their VEBA plan, regardless of what happens to each of the Detroit Three. The UAW itself is a business, with its own motivations for profit (for its members) and metrics of success. Its fortunes must rise and fall with its respective employers and not be treated as an independent party at the political bargaining table for government funding. If you grant a payout to the UAW, you set a future course for enterprise in this country that has long term negative consequences by insuring employment stability. Russia abandoned that principle two decades ago, and for good reason.

We wish you all the best for your future and that of our country.

Recent Comments