Volkswagen CEO Mller Says Buybacks 'Possible,' In Theory

Volkswagen CEO Matthias Müller apologized again to dealers and customers for the ongoing diesel scandal in a statement to CNBC’s Phil LeBeau. When pressed, he also admitted that buybacks are possible.

The Dealer Who Swindled $6 Billion From General Motors

In the opening moments of the above scene from the flick “Fargo,” Oldsmobile dealership sales manager Jerry Lundegaard is working up some bogus paperwork to cover his tracks with General Motors Acceptance Corporation (GMAC). We can infer that he sold some floor-planned cars and did not pay back GMAC, which was the impetus for the movie’s storyline of his bumbling attempt to extort money from his father-in-law.

Jerry’s store may have been “out of trust” with GMAC on a few dozen 1987 Cutlasses, but that pales in comparison to the scheme concocted by New York car dealer John McNamara.

Between 1980 and 1991, McNamara convinced GMAC to advance him $6.2 billion to pay for 248,000 conversion vans that did not exist. It was one of the largest Ponzi schemes in history and ended up costing GMAC $436 million, equal to $725 million in today’s dollars.

We would like to show you a photo of McNamara but none are to be found. That may be because it is believed he went into the Witness Protection Program a few years after his conviction for fraud in 1992. Just picture Lundegaard with a really big brain.

McNamara’s brilliant swindle was deliciously simple. It was based on one undeniable truth he learned from his years of owning a Buick-Pontiac-GMC dealership on Long Island: General Motors and GMAC were too incompetent and too bureaucratic to figure out that they were being scammed.

Rental Van With Low-Pressure Tire Warning Rolls, Injuring Six Children; No Charges To Be Filed

When Maggie Dajani realized that the tire-pressure warning light was on in the van she’d rented to take six teenagers and their parents to a One Direction concert in El Paso, she took the van back to the rental company. A representative of the company, Star Limo, told her not to worry. She then continued to the concert. Shortly afterwards, the van blew two tires and rolled over. Several motorists helped drag the ten passengers out of the van, which was filling with smoke. The children went to the hospital with various injuries, and one of them reportedly received one hundred and fifty stitches as a result.

Now, the New Mexico Public Regulatory Commission has delivered a very, ahem, business-friendly verdict on the whole ordeal. Turns out that Star Limo is the beneficiary of a unique combination of regulatory conditions.

Editorial: BP's Settlement and a Pound of Flesh

Last week’s news of BP’s $18.7 billion settlement with federal and state governments brought to close the second act of one of the worst environmental tragedies of all time. There’s no promise that the third act won’t drag out for decades and ultimately end in heartbreak either.

BP’s structured settlement means the oil producer will pay roughly $1 billion each year over the next two decades to state and local governments impacted by the 3.9 million barrels of oil dumped into the Gulf of Mexico from the Deepwater Horizon oil rig. Of course, there’s no amount of money that could assuage the grief from families of the 11 workers killed in the spill.

But the settlement doesn’t address the hundreds of individual or class action lawsuits, or many of the claims made against BP by local business owners and people since the 2010 spill. Some of those civil cases are still in court, some on appeal, and many are years away from a meaningful conclusion.

Julie Hamp No. 10 in PR Week's "Power List", No. 1 in Badly Timed Awards

Resigned Toyota PR chief Julie Hamp was named to PR Week’s “Power List” two weeks after being busted for allegedly importing illegal prescription painkillers into Japan last month. Hamp allegedly received 57 pills of Oxycodone in a box labeled “necklaces” at Narita Airport in Tokyo.

The list, which ranks her No. 10, was released the same day Hamp resigned her position and included an editor’s note at the top explaining the awkward timing.

Citizen Honks At Cop For Speeding With Phone In Hand, Receives Ticket

“So you honked at me because you believed I was speeding…”

“Because you were driving recklessly and speeding now, it’s got wet roads and you were on your cell phone.”

Affluenza Redux: Rich Guy Gets Slap On The Wrist For Drunken High Speed Chase

Seattle’s TV stations are reporting that a wealthy businessman who led police on a high speed chase through the city of Olympia in his Ferrari F360 has been sentenced to just one year of work release. According to the reports, Shaun Goodman pleaded guilty to felony police evasion and DUI for the December 29 incident that saw his terrified passenger leap from the moving car when he slowed at an intersection and ended only after he crashed into a parked car and then careened into the side of a house.

A Moment Of Reflection

Two weeks ago we had a horrific accident here in Buffalo. It was the end result of a street race that saw a 47 year old man trapped in the wreckage of his car and burned alive.

QOTD: How Do You Use Your Horn?

Yesterday, someone had the audacity to honk at me. It wasn’t one of those cheerful little toots that a person might use to get someone’s attention when waving them into traffic, but a full-on ten second blast – the kind that you should only use when you are behind the controls of a freight train that is bearing down upon someone in the tracks. The offender? Some octogenarian in a Buick. My crime? A not so near-miss that occurred while I was making a left turn across traffic from a side street into a center turn lane.

Japanese Tourists Spark Chase, Get Spiked

The Japan Times is reporting that a car driven by Japanese tourists had to be stopped with a spike strip after its driver failed to stop despite the fact she was being pursued by at least three patrol cars.

Strict Enforcement of NY's Parking Laws Affects Official Vehicles

Photo courtesy of wikipedia.org

The New York Times reported Sunday on how strict enforcement of parking violations in Manhattan is causing problems for government agencies as they are forced to reclaim official vehicles that have been towed. In most cities, official vehicles are kept immune from the effects of parking enforcement by dashboard placards that allow government officials to park in red zones or without feeding the meter while they are on the job.

Testing The Limits Of Civil Obedience: An Experiment

Yesterday, while folks in the Southeast were getting hammered with their second severe winter storm in two weeks, the skies over Buffalo were wonderfully bright and sunny. Of course, when you count the wind chill factor, the temperature barely climbed into the double digits but as a result of the sun and a whole lot of road salt, the highways here were mostly bare and dry. That means my evening commute was a breeze. I hit Route 33 and ran my little CUV up to just over the 55 mph limit and sailed right out of town. Things were going great, but then, unexpectedly, traffic began to slow.

I shifted left into a place I really don’t run that much these days and wicked the speed up to a smidge over 60 in order to keep up the pace. I found myself fourth or fifth back in a line of cars that was whizzing up the fast lane overtaking car after car and, as a student of the road, I began to wonder just what the hell was holding all these people up. I found the reason at the head of the line, a Buffalo City Police cruiser running right at the limit and, like all the good people of the Earth who don’t want a senseless speeding ticket, I found myself easing off the gas. But as I noted his lack of response to all of the cars ahead of me that were simply accelerating away into the wide open space the officer had created, I decided that for whatever reason he simply wasn’t interested in writing tickets and so I continued on, barely adjusting my pace.

EU Secretly Planning To Add Police-Controlled Kill Switch To All Cars By 2020

The British Newspaper The Telegraph is reporting that, if senior European law enforcement officials have their way, all cars entering the European market may soon be fitted with a remote shutdown device that would allow police officers to electronically deactivate any vehicle at the touch of a button.

Taking A Ride With The Iowa State Patrol

We sourced this article as a direct response to reader suggestions that we present another view of highway enforcement personnel — JB

Last year I watched as someone I loved went off-track – and came dangerously close to the wall – right in front of where I stood under an umbrella as the rain poured down. He was a passenger in the car, a volunteer instructor for the weekend. The wife of the car’s driver, standing next to me, said with a look of shock on her face, “I don’t know how you do this.”

“The same way I live every day with a brother as a state trooper,” I replied. “I don’t think about it. I can’t think about it.”

Little Car Lost: When Thieves Come Calling

The joke was that the little Honda was so old and undesirable that it would take a ten dollar bill on the dash and the key in the ignition to attract a thief. With 300K miles on the clock, the little car was old and tired, but my sister Lee and her husband Dave aren’t the kind of people who replace their cars very often. The Chevy Chevette they bought new in 1981 lasted ten long years under their care so the little Civic, purchased used in 1991 from one of my father’s workmates, was on target to last forever. Other cars came and went in the driveways of the other houses up and down the street, but in their driveway the Civic endured, a fixture of solidity and reliability in an ever changing world. And then one day, it was gone.

Cops Nab Electric Leaf Owner Before He Can Ride Free On Your Nickel

The owner of a Nissan Leaf was arrested in Georgia last week for stealing 5 cents worth of electricity after he plugged his car into the exterior outlet at a local middle school while his son was playing tennis.

What's Wrong With This Picture? Police Parking Illegally

Can you spot the reason for that “No Standing” sign?

This is a photograph taken recently at the Cadillac Place building, on West Grand Blvd just west of Woodward in Detroit. It used to be called the General Motors Building before GM decamped to the RenCen. To make sure that much office space (when it was built, the GM Bldg was the second largest in the world) wouldn’t go vacant in Detroit’s economically viable midtown area, the State of Michigan moved many of its Detroit area office workers into the renamed building. Some of those state employees work for the Michigan State Police, which has offices for their Detroit detachment on the Milwaukee Ave. side of the building. It’s not a full scale police post, there’s no public lobby, but it’s where state police hang out in Detroit when they aren’t busy protecting and serving the public, not to mention rescuing injured peregrine falcons.

Balls Of Fire, Then And Now

Chrysler’s recent decision to snub a recent NHTSA recall request is big news. I need not restate the facts of the story, if you are a “car guy” and haven’t heard the sordid details, or noticed the dramatic photos of burned out Jeep Grand Cherokees and Liberties posted all over the internet in the past few days, you must live under a rock. With 2.7 million vehicles involved the costs of conducting such a recall would be staggering but, ultimately, inaction may cost the company even more money if consumers lose confidence in the brand.

Vengeful Scam On Legit Repo Man or Crooked Repo Man Selling Stolen Car? You Decide!

The world of towed-away cars can be a harsh one, as our very own Steven Lang often points out. Today I heard the latest in a long series of tales from the often-penumbral world of towing and repossessions, a Craigslist ad that purports to be selling a mistakenly-repoed Crown Vic. A phony ad meant to drag a clean business and its owner into a world of pain— an all-too-common occurrence in the maddening world of Craigslist cars-for-sale listings— or something that will soon have the constabulary asking a lot of pointed questions in a certain Maryland tow yard’s office?

"Distracted Driving" Joins The Ranks Of Primary Offenses In Virginia

In a move that will undoubtedly create a flood of profitable tickets save uncounted lives, Virginia has made “distracted driving” a primary offense and raised the fines to the proverbial ceiling.

Police Error Is A Primary Offense Now

In November 2010, the officer was tailing a truck around midnight. He ran a registration check on the vehicle, which listed the truck as red. But this truck was blue… The officer then realized his mistake, but continued with the stop to provide an explanation. He noticed an odor of alcohol, conducted a field sobriety test, and arrested the driver.

In the state of Wisconsin, that’s now good enough.

Night Flight Of The Silver Ghost. An On Request Future Writer Story

Some claimed yesterday that David Hester’s views of a government-issued Panther are more desired than his discussion of D.I.Y. engine mods. You ask for it, you get it today. How’s that for service? Also, be judicious with your comments about his prose. David may be a rookie writer, but he’s a seasoned cop, and he knows where to find you. In any case, I’ve seen a few police reports in the past, and Dave’s way with words definitely beats them all.

My cellphone begins to bleat a mere three hours after my head hit the pillow. I shake the cobwebs from my head and listen to an excitable 3rd shift sergeant inform me of a criminal act requiring the immediate attention of the Special Victims Section detective, yes, pronto, never mind the pre-dawn hours. Quick shave. Quick shower. Quick peck on the cheek of my sleeping wife. Then out into the cold for the forty minute drive from my home into the sleeping city.

Kill Switch Thwarts Denver Civic Thieves Once Again, Junkyard Parts To the Rescue

I love my beater 1992 Honda Civic, and living near downtown Denver is great, but the combination of fifth-gen Civic and urban living means that thieves are going to try to steal my street-parked car on a depressingly regular basis. Would-be thieves tore up my steering column less than a year ago, and they did it again a couple of weeks back. Both times, my homebrewed kill-switch system kept the bad guys from starting the car. Both times, I got the car back on the road with cheap junkyard parts.

IIHS Study Loves Red Light Cameras, Says Americans Do Too

The controversy over red light cameras, once relegated to websites like TTAC, thenewspaper.com, motorists.org and highwayrobbery.net, is hitting the mainstream media thanks to a new study by the IIHS [ PDF here]. The study used the following methodology:

Telephone surveys were conducted with 3,111 drivers in 14 large cities (population greater than 200,000) with long-standing red light camera programs and 300 drivers in Houston, using random samples of landline and cellphone numbers. For analyses combining responses from the 14 cities, cases were weighted to reflect each city’s share of the total population for the 14 cities.

And what did they find?

Among drivers in the 14 cities with red light camera programs, two-thirds favor the use of cameras for red light enforcement, and 42 percent strongly favor it. The chief reasons for opposing cameras were the perceptions that cameras make mistakes and that the motivation for installing them is revenue, not safety. Forty-one percent of drivers favor using cameras to enforce right-turn-on-red violations. Nearly 9 in 10 drivers were aware of the camera enforcement programs in their cities, and 59 percent of these drivers believe the cameras have made intersections safer. Almost half know someone who received a red light camera citation and 17 percent had received at least one ticket themselves. When compared with drivers in the 14 cities with camera programs, the percentage of drivers in Houston who strongly favored enforcement was about the same (45 percent), but strong opposition was higher in Houston than in the other cities (28 percent versus 18 percent).

Sounds like those red light cameras are pretty great after all, doesn’t it? That’s certainly the IIHS’s takeaway…

Tyre Shredder!

I saw some great right-hand-drive machinery on the streets of St. Ann’s Parish, Jamaica, during my visit last week, but sometimes it’s the little details that really let you know you’re rolling in a strange foreign land.

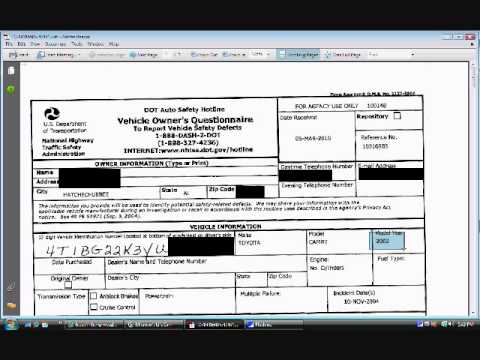

89 Dead In The NHTSA Complaint Database? It's A Sham

This week, NHTSA came out and said that after a recount of their complaints database, they found 89 dead bodies in their computers, allegedly killed by evil runaway Toyotas. The MSM ate it up. If it bleeds, it leads. Even if it smells. In this article, we will show you the secrets of the incredible killing machine at NHTSA.

Editorial: Speeding Wants to Be Free

Hammer Time: How to Cheat on the Cash-for Clunkers Program, Part One

Editorial: Unsafe at Any Speed?

Editorial: Maximum Street Speed Explained

Editorial: How to Stop Illegal Street Racing Without Really Trying

Editorial: Georgia Cities Ignoring Extended Yellow Law

Busted! Redflex's Redlight Camera Semi-Snuff Film

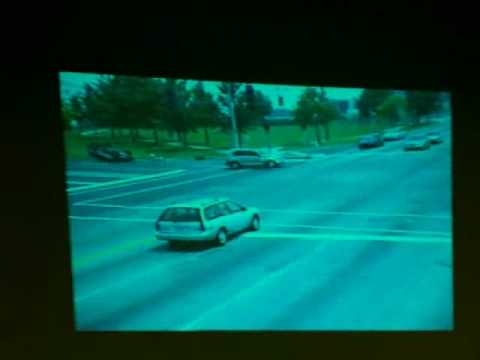

Redflex is the Australian company that runs many if not most of America’s red-light camera programs. Although I’m not a city resident, I attended two Redflex Q&A sessions in Canton, OH over the past two nights. About twenty people attended the first meeting. Around sixty showed up at the final of four meetings—once people caught wind of what was at stake. All of the meetings included city council members, city safety director Thomas Nesbitt and Hizzoner the Mayor, William Healy. Redflex’s Executive Vice President Aaron Rosenberg began the first meeting with the video above. The clip was shown without warning. Hello and boom: a graphic and violent accident of the type Redflex’s cameras are supposed to prevent. No emotional blackmail there, then.

Rosenberg claimed the accident happened in Dayton, OH (it’s also featured on the company’s website). According to Rosenberg, the Chrysler PT Cruiser blows through the red in the curb lane doing 33 in a 35. This after the light had been red for 28.4 seconds.

As I slowly overcame the high-school-drivers’-ed-style shock of seeing a quick clip of carnage, I became increasingly angry and appalled. Why is it OK for a company selling safety equipment to use such blatant shock tactics to rally taxpayers to their for-profit cause? With aspiring teen drivers, you can understand the value of “tough love.” But while good profits may come from scare tactics, good governance does not.

Whose meeting is this anyway? By allowing Redflex to start the evening in this cynical, manipulative manner, Canton was revealing the truth: the fix was in. And then I started to dissect the accident. . . .

We were shown the brief clip of footage. Nothing more. No information on the cross-street speed limit. The Subaru was going plenty fast, but who knows if he was speeding?

The hapless pedestrian was strolling along across the street AFTER the cross-street light had changed to green. Doesn’t at least a small part of the blame rest on his decision to cross that street against signage? Cities and towns put up those Walk/Don’t Walk signals for a reason.

Also, did the pedestrian have a reasonable amount of time to cross?

I remember an article about an elderly woman getting ticketed for blocking traffic in a crosswalk. A TV crew investigated and found that a group of high school students couldn’t make it across the intersection before the light turned green at a dead run.

Furthermore, what exactly did Redflex’s camera do to prevent this accident? Ipso facto, nothing. Supposedly, Redflex’s systems reduce this kind of T-bone crash rate. But there’s no independent data on this for one simple reason: it’s not true.

In fact, red-light cameras are notorious for causing rear end collisions. While a spectacular crash like the one shown is particularly horrific, a large[r] number of rear-end collisions would lead to a large[r] numbers of whiplash cases. It’s a chronic injury that can literally ruin lives.

Last but not least, even if no T-boning accident had occurred, it looks like the SUV could have struck and maybe even killed the pedestrian.

To know the truth about this “instructive” incident, I would like to see the actual accident report and hear an analysis from a safety expert whose salary doesn’t depend on a red-light camera contract.

As those of you familiar with my screen name (SexCpotatoes) might imagine, I gave the city’s suits and the Redflex EVP a hard time, asking plenty of pointed questions. When pressed about Houston and Denver’s increased accident rate after red-light camera installation, Rosenberg responded “That was not our company.”

I asked city traffic engineer Dan Moeglin why his department hadn’t implemented any other safety measures: number boards that count down to red, synchronizing more traffic lights through town, or extending the yellow times. “I have all the traffic info about yellow light timing and such right here, I can go over them with you if you want, but these numbers give even me a headache.”

He also said that “yellow light duration is set by a formula taking into account speed limit, and width of the roadway.”

I briefly touched on the lawsuit against Redflex regarding the radar equipment they’d imported and distributed in violation of federal law. “That was an issue with a sticker not being properly placed or affixed,” Rosenberg demurred.

So a company devoted to catching motorists who must follow the letter of the law down to the last tenth of a second justifies breaking the law, perjuring themselves and falsifying certification documents as a clerical error. Nice.

I’m starting a petition to get the red-light camera issue placed on the ballot for the next general election. I leave it up to you, TTAC’s Best and Brightest, to decide whether using this crash footage to sell camera systems to greedy cities is morally reprehensible. Meanwhile, if you want to know why Canton is even entertaining this idea, I suggest you ignore the video and, as always, follow the money.

Houston Prof. Manipulated Study to Make Red Light Cameras Appear Safer

The Truth About the Nissan GT-R and the Nrburgring Lap Record

I agree with TTAC reviewer Stephan Wilkinson : the new Nissan GT-R is the old Honda NSX. Once people actually start driving Nissan’s “everyday supercar”– as opposed to simply jumping on the hype bandwagon and bench racing numbers supplied by Nissan– they’ll appreciate the parallel. Although I'm still looking forward to my first hands-on experience with the GT-R, the reality of the car’s true nature and importance in automotive history is right under the fan-boys’ noses.

The GT-R allegedly 'outperforms' thoroughbred supercars at a fraction of the price. Yes, but what price? The sticker price, or the in-your-garage price? Considering the hype surrounding the car and the limited production numbers, it will be years before a single new $70k GT-R will be sold for under $100k. At the moment, comparing the Nissan to say, a Corvette Z06, obfuscates the truth. But what the [Green] Hell…

No small part of the current GT-R lovefest can be attributed to the car’s 7:38 Nürburgring lap time. As TTAC has pointed out, there are real questions about the Green Hellmobile’s qualifications for the title “second fastest production car around the ‘Ring.” The GT-R's suspension was modified from the current Japanese production model, supposedly to reflect the American and European spec. Supposedly. Will anyone get a chance to compare the fabled ‘Ring runner and a final production car? I doubt it.

Meanwhile, the YouTube video of the Nissan’s “historic run” clearly shows that the GT-R had a flying start. All other manufacturers testing at the ‘Ring use standing starts for published lap times. The video also proves that the car's lap time was not measured at the exact same location (start and stop). Take these two factors into account, and the 7:40 claim seems highly dubious.

The icing on the cake: GT-R chief engineer Kazutoshi Mizuno’s subsequent admission from that "We used cut slick tyres." If that doesn’t cancel their claim, nothing does.

In fact, a regular Corvette Z06 would probably beat the GT-R on the Nürburgring. When Road & Track tested the GT-R against the Z06 on a track much smaller than the ‘Ring, they concluded that the GT-R was fast in the corners, but they didn't shed a whole lot of light on how the GT-R performed on the straights. Although the ‘Ring has an enormous amount of corners, it also has some of the longest straight-aways in the world.

In Road & Track’s technical comparo, the GT-R was just as fast to 60mph as the Z06 (despite being less powerful). What many have over-looked is the trap speed at the end of the 1/4 mile. The Z06 is about seven mph faster than the GT-R. When you look at the graph that accompanies these numbers, the GT-R’s AWD system gave it a clear advantage– but only at the start. Applied to the Green Hell, the Z06 would outpace the GT-R on the straights.

The Z06’s fastest recorded lap time at the Nürburgring is 7:42.9 This lap was driven in 2005 by Jan Magnussen in 'muggy' conditions. Last year, Chevy revised the suspension on all Corvette models including the Z06. In theory, the new suspension and better weather conditions should be enough for a Z06 to equal or even better the Nissan GT-R's true time of +7:40. When you consider that the Z06 can achieve this time with a GM-standard standing start and production tires, it seems obvious that the GT-R is no match for the Z06 around the ring.

But what does it all mean? Well, not much actually. Every racetrack is different and some cars are suited to some tracks while others are not. The GT-R is suited to smaller tracks like the one R&T used, and the Z06 is suited to longer and faster ones like the ‘Ring.

So why did I bother ranting about this? Nissan has chosen to flaunt its Nürburgring lap times to show the world that their new, high-tech Nissan GT-R is the new bang-for-the-buck Alpha. But it’s not true. The cheaper Corvette Z06 is still the worlds best [unmodified] performance car bargain. What’s more, if the GT-R cannot handle a stock Z06, then how will it fare against the upcoming ZR1? Never mind the 'almighty' spec V model.

Given the GT-R’s looks and oft-reported lack of driving feel, there’s only one reason anyone would buy the uber-Nissan: to own the fastest thing on the road. In the corners, maybe. If you were committed enough to drive at 10/10ths (never mind how “easy” it is), you could probably blow-off a 911 or similar. Down the straights (the great American pastime), there are faster and cheaper choices– and that’s without exploring relatively inexpensive modifications.

In short, the GT-R is an awesome achievement, but Wilkinson’s right: it’s not all that.

Recent Comments