Americans Might Not Even Buy 1.4 Million Midsize Cars This Year; Market Share Down By Half Since Recession

Remember the midsize sedan death watch?

When TTAC introduced the series, Americans were still acquiring over 2 million midsize cars per year. That fact, the 2M+ aspect of the segment and the 1M+ nature of the top models, combined with the category’s 12-percent market share, caused many readers to doubt the possibility that any other intermediate sedans would ever bid farewell.

Others have, of course, fallen by the wayside. Joining the long-lost Mercury Milan, Pontiac G6, Saturn Aura, Suzuki Kizashi, Mitsubishi Galant, and Dodge Avenger in that great midsize parking lot in the sky are cars such as the Chrysler 200 and Ford Fusion. The Chevrolet Malibu is not long for this world.

Meanwhile, sales of the remaining midsize cars continue to tank. The notion that America’s midsize segment is a reliable provider of more than 2 million units per year is now cast by the wayside. Americans are likely to purchase and lease fewer than 1.4 million midsize cars in 2019. That’s 15-percent fewer midsize cars than Americans drove home in 2009 during the depths of the Great Recession.

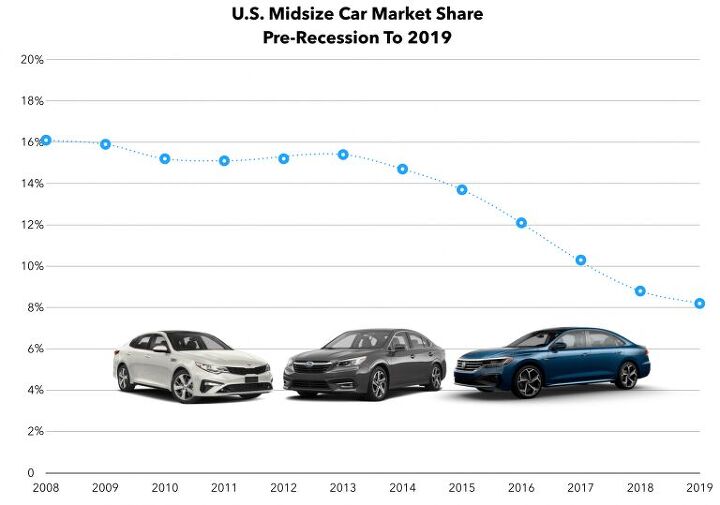

Leading up to that economic collapse, 16 percent of the U.S. automotive market’s volume was produced by midsize cars. That figure now stands at 8 percent.

In the last year alone, the midsize segment’s market share has fallen by more than half a percentage point. In a market that’s down less than 2 percent year-over-year, midsize volume is down nearly 7 percent through the first three-quarters of 2019.

It’s a drop caused by every member of the segment save for the departing Ford Fusion, where a dead cat bounce is causing an artificial spike at the end of the Fusion’s lifecycle.

Double-digit year-over-year percentage losses have been reported this year by vehicles such as the Hyundai Sonata and Subaru Legacy (down 16 percent), Mazda 6 (down 30 percent), and Volkswagen Passat (down 61 percent).

The class-leading trio (Toyota Camry, Honda Accord, Nissan Altima) are among the most recently redesigned. But while their market share in the segment is rising – from 56 percent in 2018 to 59 percent in 2019 — their sales are also in decline. The Camry, Accord, and Altima combined to lose 22,000 sales over the last nine months.

In the face of blustery headwinds, numerous midsize carmakers are forging ahead with distinct strategies. Volkswagen’s Americanized Passat has suffered consecutive annual sales declines ever since its arrival in 2012. Volkswagen’s path forward is a lightly refreshed example of an aging car.

At Subaru, where Legacy sales have never been strong, a brand new model is launching now despite the fact that other automakers have fled the scene while producing more sales in a quarter than the Legacy can in a year.

And at Hyundai, the Sonata is reverting to a bold styling strategy. It worked for the sixth-gen Sonata in 2011, but the seventh-gen Sonata in 2015 was an overly cautious and forgettable attempt. Sonata sales tumbled 55 percent between 2012 and 2018, so Hyundai went back to the drawing board. Is it too late for the Sonata to recover?

For the Passat, 2019 is on track to be the worst year since 2012. Legacy sales are projected to fall to a new low (since before Outback/Legacy sales were isolated.) The Sonata’s drop will cause sales to fall below 100,000 units for the first time since 2003; it’ll be the first 5-digit Kia Optima sales year since 2011. Chevrolet Malibu sales are tracking toward a 16-year low. If Mazda’s 30-percent Mazda6 decline continues in Q4, 2019 will be the nameplate’s worst year ever.

And what about that top-tier trio? Revamped for 2020 with new powertrains and available all-wheel drive, the Nissan Altima is on pace for an 18-year U.S. sales low. If not for a disastrous, tsunami-inflicted 2011, the Honda Accord’s 276,000-unit 2019 tack would point the highly regarded Honda in the direction of early 80s output. In 13 of the last 20 years, Toyota has reported more than 400,000 U.S. Camry sales — Toyota is on pace for fewer than 340,000 in 2019. In the last two decades, only 2010 and 2011 stand out as lower-output years.

It’s disappointing individual results that explain how a segment could see its market share fall by half in a decade. The good news for lovers of the midsize category? The rate at which the segment is shedding market share has slowed noticeably. In 2015, the segment lost a full percentage point of share, and within two years another 2.4 points were gone. Between 2017 and 2018, midsize market share collapsed from 10.3 percent to 8.6 percent, a 17-percent decrease. 2019’s slide from is modest by comparison.

Yet, and this will come as no surprise, we still expect to see America’s midsize car category slip below 8 percent in 2020.

Timothy Cain is a contributing analyst at The Truth About Cars and Driving.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

[Images: Toyota, Honda]

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 28-Cars-Later Why RHO? Were Gamma and Epsilon already taken?

- 28-Cars-Later "The VF 8 has struggled to break ground in the increasingly crowded EV market, as spotty reviews have highlighted deficiencies with its tech, ride quality, and driver assistance features. That said, the price isn’t terrible by current EV standards, starting at $47,200 with leases at $429 monthly." In a not so surprising turn of events, VinFast US has already gone bankrupt.

- 28-Cars-Later "Farley expressed his belief that Ford would figure things out in the next few years."Ford death watch starts now.

- JMII My wife's next car will be an EV. As long as it costs under $42k that is totally within our budget. The average cost of a new ICE car is... (checks interwebs) = $47k. So EVs are already in the "affordable" range for today's new car buyers.We already have two other ICE vehicles one of which has a 6.2l V8 with a manual. This way we can have our cake and eat it too. If your a one vehicle household I can see why an EV, no matter the cost, may not work in that situation. But if you have two vehicles one can easily be an EV.My brother has an EV (Tesla Model Y) along with two ICE Porsche's (one is a dedicated track car) and his high school age daughters share an EV (Bolt). I fully assume his daughters will never drive an ICE vehicle. Just like they have never watched anything but HiDef TV, never used a land-line, nor been without an iPad. To them the concept of an ICE power vehicle is complete ridiculous - you mean you have to STOP driving to put some gas in and then PAY for it!!! Why? the car should already charged and the cost is covered by just paying the monthly electric bill.So the way I see it the EV problem will solve itself, once all the boomers die off. Myself as part of Gen X / MTV Generation will have drive a mix of EV and ICE.

- 28-Cars-Later [Model year is 2010] "and mileage is 144,000"Why not ask $25,000? Oh too cheap, how about $50,000?Wait... the circus is missing one clown, please report to wardrobe. 2010 AUDI A3 AWD 4D HATCHBACK PREMIUM PLUS

Comments

Join the conversation

I frequently drive my mom and aunt around and they have some mobility issues. Mom's hip is degrading and she's already had a knee replacement. I had a Mazda6 which was great, but with the hip and joint issues for my frequent passengers it got to be a challenge. I ended up getting a CX-5 which had everything I wanted, save a manual. The mileage penalty isn't too terrible and will likely improve as the vehicle breaks in.

@mikey--Good choice one of the best cars GM has made in recent years along with the LaCrosse. That is one reason I bought my neighbors low mileage 2012 LaCrosse Premium (45k miles) for 11k a one owner pampered car. I rented an Impala LTZ a few years ago and loved it to the point where I didn't want to return it. A lot of car for the money especially a used low mileage one. I also ordered WeatherTech laser cut mats front and back. I am 67.