America's Midsize Pickup Truck Sales Growth Is Suddenly Slowing - Oh, Ranger, Where Art Thou?

Nearly two and a half years since General Motors increased the number of offerings in the midsize pickup truck sector by two-thirds, and nine months since Honda revitalized its unique Ridgeline offering, we’re once again in need of new midsize pickup truck nameplates.

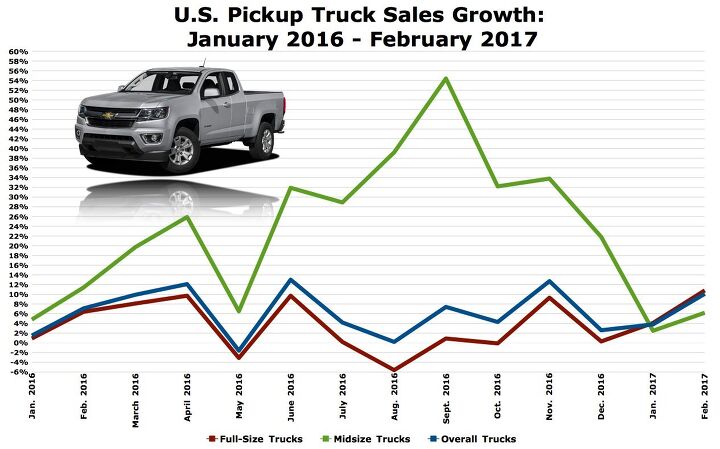

America’s pickup truck category began 2017 with a bang, growing by more than 7 percent and easily outpacing an industry that declined by more than 1 percent in the first one-sixth of 2017.

Yet virtually all of that growth — fully 90 percent — was fuelled not by midsize pickups but by the stalwarts: full-size trucks.

Fortunately, midsize pickup truck sales growth continues, albeit at a far slower rate than we’ve become accustomed to seeing, despite a modest slowdown in Toyota Tacoma volume (Toyota is increasing Tacoma production to help meet demand) and a sharp downturn in Nissan Frontier sales.

GM’s twins — the midsize category’s second-ranked Chevrolet Colorado and the truck market’s lowest-volume pickup, GMC’s Canyon — combined for an 8-percent uptick over the course of January and February.

But with the Honda Ridgeline excluded from the equation, as it wasn’t on sale at this stage of 2016 and is undeniably distinct in mission, America’s midsize pickup truck sales have fallen 6 percent so far this year.

That’s a stunning turnaround for a group of vehicles that produced 61 percent of the overall truck market’s growth in 2017.

Full-size pickups certainly have the strength of character, and the ability to be deeply incentivized, to keep midsize pickup trucks cowering in the corner.

A broader range of capability and competitive fuel economy are just two of numerous easily identified reasons that point to full-size trucks’ 85-percent market share. Moreover, full-size pickup trucks were less costly this February than last: KBB says the average full-size pickup truck transaction price last month was down 2 percent compared with February 2016. Average midsize pickup truck transaction prices continue to rise, however, climbing 2 percent in February 2017, year-over-year.

These factors have been and will continue to be in place. Full-size pickup trucks will, just as they always have, tow and haul more while also capably handle greater passenger loads. Full-size pickup trucks will continue to be priced in such a way as to pressure midsize pickup trucks.

Yet there’s another factor. Midsize pickup truck demand continues to be reigned in by a dearth of available midsize pickup trucks.

2009 this is not. There were still 11 small and midsize pickup trucks on sale in America eight years ago: the current quintet plus contenders from Suzuki, Mitsubishi, Mazda, Isuzu, Dodge, and Ford.

The Equator, Raider, B-Series, i-Series, Dakota, and Ranger disappeared; the Chevrolet Colorado and GMC Canyon eventually did, too. And in the lead-up to the launch of the current Colorado and Canyon, midsize pickup truck sales were falling even as the market surged and overall pickup truck demand increased. Through the first two-thirds of 2014, small/midsize pickup truck sales were down 4 percent.

But rather than diminishing the Toyota Tacoma’s success or limiting the Nissan Frontier’s appeal, the arrival of a new Chevrolet Colorado and GMC Canyon occurred in concert with record Toyota Tacoma volume in 2015 and 2016 and a 15-year high Nissan Frontier result in 2016.

There’s nothing that says the category can’t reclaim rapid growth in 2017. We’ve only seen two consecutive months of a severe slowdown in growth, and those two months form the weakest portion of the calendar for auto sales.

For the midsize truck category to once again be truly empowered as it was over the last 12-24 months, however, new product will once again be necessary. The next Ford Ranger is roughly two years away.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 28-Cars-Later I'm getting a Knight Rider vibe... or is it more Knightboat?

- 28-Cars-Later "the person would likely be involved in taking the Corvette to the next level with full electrification."Chevrolet sold 37,224 C8s in 2023 starting at $65,895 in North America (no word on other regions) while Porsche sold 40,629 Taycans worldwide starting at $99,400. I imagine per unit Porsche/VAG profit at $100K+ but was far as R&D payback and other sunk costs I cannot say. I remember reading the new C8 platform was designed for hybrids (or something to that effect) so I expect Chevrolet to experiment with different model types but I don't expect Corvette to become the Taycan. If that is the expectation, I think it will ride off into the sunset because GM is that incompetent/impotent. Additional: In ten years outside of wrecks I expect a majority of C8s to still be running and economically roadworthy, I do not expect that of Taycans.

- Tassos Jong-iL Not all martyrs see divinity, but at least you tried.

- ChristianWimmer My girlfriend has a BMW i3S. She has no garage. Her car parks on the street in front of her apartment throughout the year. The closest charging station in her neighborhood is about 1 kilometer away. She has no EV-charging at work.When her charge is low and she’s on the way home, she will visit that closest 1 km away charger (which can charge two cars) , park her car there (if it’s not occupied) and then she has two hours time to charge her car before she is by law required to move. After hooking up her car to the charger, she has to walk that 1 km home and go back in 2 hours. It’s not practical for sure and she does find it annoying.Her daily trip to work is about 8 km. The 225 km range of her BMW i3S will last her for a week or two and that’s fine for her. I would never be able to handle this “stress”. I prefer pulling up to a gas station, spend barely 2 minutes filling up my small 53 liter fuel tank, pay for the gas and then manage almost 720 km range in my 25-35% thermal efficient internal combustion engine vehicle.

- Tassos Jong-iL Here in North Korea we are lucky to have any tires.

Comments

Join the conversation

I drive a four banger small truck. Primarily because they are fairly reliable and obscenely easy to work on. Not really sure where that puts me, but I could never really see me in a full size truck. I just prefer smaller-ish vehicles.

Mitsubishi has the most to gain by joining in and selling a pickup truck in USA and Canada. Triton/L200 is smaller than the Tacoma, Colorado, Frontier and Ridgeline. It is very rugged and dependable design. Keep it simple and sell it for less than all the competitors. Mitsu requires a minimal sales volume to deliver a return on investment and then profit. If they partnered with FCA perhaps assembly of complete knockdown kits could be completed at an FCA North American plant in return for a version to be sold as Ram or FIAT. FIAT already sells a Fullback branded version of Triton in some markets.