Even On Valentine's Day Ford Won't Commit to the New Fiesta in America

It’s been nearly three months since Ford introduced the seventh-generation Fiesta B-segment hatchback. We’ve still not received any U.S.-market specifics for the 2018 Ford Fiesta.

At the time, you may recall TTAC’s Steph Willems saying, “Because this was a Ford of Europe event, we’re still waiting on U.S.-specific details.”

But December and January and half of February flew by, and Ford’s U.S. PR corps still has no information to provide regarding the new subcompact. In fact, on Valentine’s Day, the day for committing to a loved one, we asked Ford to confirm the new Fiesta for the United States.

Ford declined to do so.

Is the new Ford Fiesta DOA?

It was not out of the ordinary to see Ford’s unwillingness to comment on the Fiesta’s U.S. specs at the seventh-gen Fiesta’s reveal last November. Even at North American events for North American-specific vehicles, it’s not unusual for automakers to simply unveil a car and say little about it. Comments from Ford to CarScoops in early December — “We were talking about the new Fiesta for Europe and MEA yesterday. We’ll have more to say about other markets at a later date.” — also weren’t entirely out of the ordinary, either.

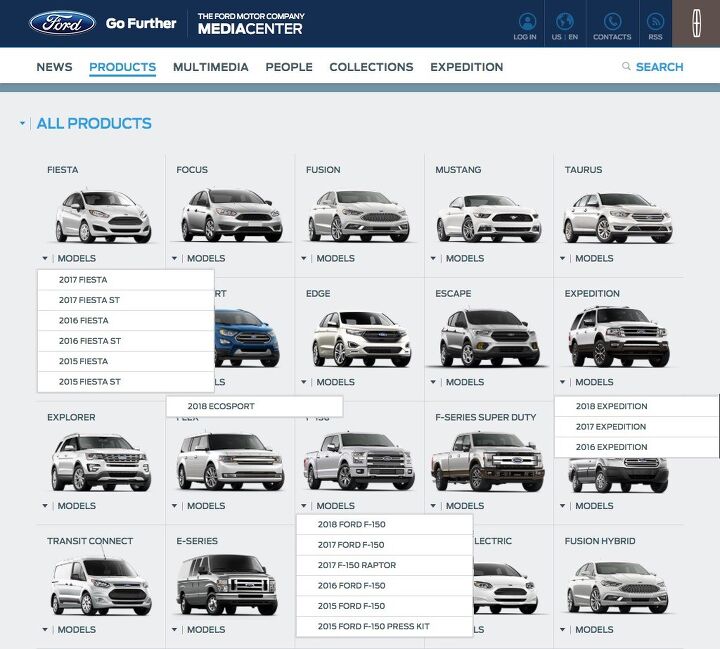

But our suspicions grew when, on two occasions since the Fiesta’s debut, Ford’s media site delved into the kind of details for other products that Ford still hasn’t shared for the Fiesta.

Ford debuted the revamped 2018 F-150 in January and the all-new 2018 Expedition in February. Along with details for those two 2018 models, Ford’s U.S. media site also has details for the 2018 Ford EcoSport.

Pair these suspicions with persistent declines in U.S. Fiesta demand (sales in 2016 were down 31 percent from the 2013 peak) and a gradual shying away from subcompacts in general, the Fiesta’s grip on the U.S. market appears tenuous.

Mazda essentially replaced its subcompact, the Mazda 2, with a subcompact crossover, the CX-3. Could that be Ford’s intention with the EcoSport?

Prompted by TTAC to reveal Ford’s U.S. timeline for the new Fiesta, Ford’s Karl Henkel said last year’s Fiesta introduction was for Europe, the Middle East, and Africa.

“Customer demand for small vehicles continues to grow globally, and Fiesta is an important part of our portfolio,” Henkel told TTAC last week. “We’ll have more to say about other markets at a later date.”

That sounds familiar.

Forget the timeline then. Yesterday, we asked Ford to simply confirm that the new, seventh-generation Fiesta will make its way to the U.S. market.

Ford declined to do so, telling TTAC once again that, “We’ll have more to say about other markets at a later date.”

Could the Fiesta make its way to the United States solely in crossover-themed Fiesta Active guise?

Could Ford believe that fewer than 50,000 annual sales in a historically low-profit category simply aren’t enough to justify the effort when the Indian-built EcoSport can pick up some of the slack?

Or, with the new Fiesta likely to be imported from Thailand and not Mexico (if, in fact, it is imported) could Ford simply be delaying a decision until the automaker has a firmer grasp on the non-TPP regulatory environment?

The current Fiesta, down 24 percent in a category that slid just 3 percent in 2016, is certainly not the only Ford car to have suffered a sharp decline in U.S. sales last year. Focus volume was down 17 percent to a seven-year low as compact cars fell just 5 percent. (January 2017 Focus volume fell to a six-year January low.) As midsize car sales slid 11 percent, the Ford Fusion likewise tumbled 11 percent to a four-year low. Compared with its 2013 peak, Ford C-Max volume was 44-percent lower, down to 19,834 units and a four-year low. The Mustang and Taurus? They declined in 2016, as well.

Despite those downturns, the Ford Motor Company’s overall U.S. sales picture in 2016 was flat compared with 2015. Lincoln sales grew 10 percent, Ford’s SUVs rose 4 percent, and Ford van sales jumped 9 percent.

Ford F-Series pickup sales rose 5 percent to an 11-year high of 820,799 units; 126,753 more sales than all Ford and Lincoln cars combined.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jrhurren Worked in Detroit 18 years, live 20 minutes away. Ren Cen is a gem, but a very terrible design inside. I’m surprised GM stuck it out as long as they did there.

- Carson D I thought that this was going to be a comparison of BFGoodrich's different truck tires.

- Tassos Jong-iL North Korea is saving pokemon cards and amibos to buy GM in 10 years, we hope.

- Formula m Same as Ford, withholding billions in development because they want to rearrange the furniture.

- EV-Guy I would care more about the Detroit downtown core. Who else would possibly be able to occupy this space? GM bought this complex - correct? If they can't fill it, how do they find tenants that can? Is the plan to just tear it down and sell to developers?

Comments

Join the conversation

I tried to lease a Fiesta ST the same time Bark got his, with the good lease deals available. The local Ford dealer tried to f*** me over basically, oh everyone wants these, a hot car, we can't give that deal. Ya, really, then why is it in May of 2015 you still have 2014 models sitting on the lot? No wonder they are still there. Anyway the fever for a fun manual shifting small car was dead and I opted for nothing.

So much for the one world by Ford touted. No it will always be different cars in different countries