Sergio Marchionne Is Alarmed By FCA's Sudden Canadian Downturn, And Rightly So

With Jeep as the fastest-growing auto brand in the country and Ram pickup truck sales soaring to record levels, Fiat Chrysler Automobiles was Canada’s top-selling automobile manufacturer in calendar year 2015.

It was the first year in the company’s 90-year history that FCA (or DaimlerChrysler, or Chrysler Group, or whatever it was known as) outsold all other manufacturers.

Yet in claiming the top-selling mantle, FCA’s Canadian market share decreased marginally, falling from 15.6 percent in 2014 to 15.4 percent in the automaker’s highest-volume year to date.

Fast forward nine months and FCA boss Sergio Marchionne finds the company’s Canadian situation, “alarming,” according to Automotive News Canada. How bad is it? And how did the tide turn so quickly?

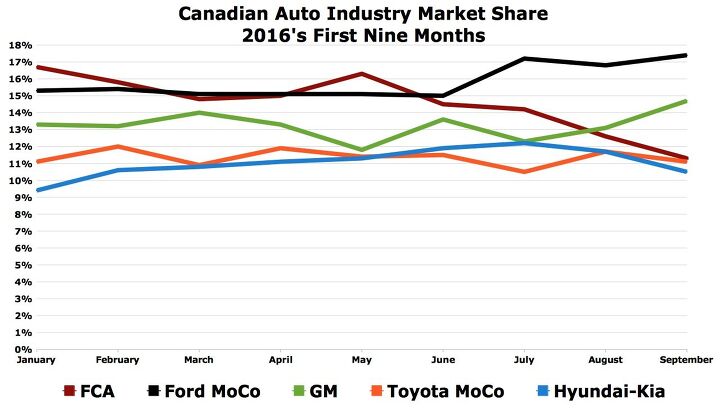

MARKET SHARE

The Canadian market is most definitely slowing. But it’s not like the industry ran into a brick wall.

Across the industry, including FCA, sales fell 2 percent in Q3. Subtract FCA from the equation and Canadian auto sales actually increased 1 percent in Q3, adding nearly 5000 sales in large part thanks to all-time record Ford F-Series sales.

FCA produced one-quarter of its volume via fleet sales during the five-year period stretching from 2011 to 2015 and made a practice out of advertising $7,000 or more in Grand Caravan discounts.

But producing that volume — and earning a profit at the same time — is becoming more difficult for FCA because of a Canadian dollar that’s much weaker now than it was five years ago. Essentially at par with the U.S. dollar as recently as April 2013, one Canadian dollar now buys only USD $0.75.

Selling cars in Canada, however, is another matter.

In 2013, FCA was selling, for example, a CAD $40,000 pickup truck in 2013 that was worth roughly $40,000 U.S. dollars.

Today, that CAD $40,000 sale equals only USD $30,000.

FCA is obviously less willing to make that deal, resulting in lower incentives and higher prices that drive buyers to rival showrooms.

BLUE OVAL

Back at FCA, the automaker trailed Ford Canada by a 20,372-unit margin heading into the fourth quarter. General Motors Canada unexpectedly managed to outsell FCA’s Canadian division in August and September, as well.

Canada is disproportionately important to Fiat Chrysler’s North American operations. The Canadian auto industry generates 9.6 percent of North America’s total auto sales volume. FCA produces 11.0 percent of its North American volume in Canada.

[Images: FCA, TTAC]

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts E34 535i may be, for my money, the most desirable BMW ever built. (It's either it or the E34 M5.) Skeptical of these mods but they might be worth undoing.

- Arthur Dailey What a load of cow patties from fat cat politicians, swilling at the trough of their rich backers. Business is all for `free markets` when it benefits them. But are very quick to hold their hands out for government tax credits, tax breaks or government contracts. And business executives are unwilling to limit their power over their workers. Business executives are trained to `divide and conquer` by pitting workers against each other for raises or promotions. As for the fat cat politicians what about legislating a living wage, so workers don't have to worry about holding down multiple jobs or begging for raises? And what about actually criminally charging those who hire people who are not legally illegible to work? Remember that it is business interests who regularly lobby for greater immigration. If you are a good and fair employer, your workers will never feel the need to speak to a union. And if you are not a good employer, then hopefully 'you get the union that you deserve'.

- 28-Cars-Later Finally, something possibly maybe worth buying.

- EBFlex The simple fact is very small and cheap ICE vehicles have a range thats longer than all EVs. That is the bar that needs met. And EVs cannot meet that.Of course range matters. But that's one element of many that make EVs completely ineffective at replacing ICE vehicles.

- Wolfwagen I like the exterior mods short of the satellite dish. Put a normal interior in it and they could have sold it as some sci-fi movie trim

Comments

Join the conversation

Consumer Reports coming back to haunt FCA?

Much of this is due to truck allocation going to the U.S., and maxed out production not being able to fill Canadian demand. When it comes down to where to put the sale, it'll go to the more valuable dollar.