More and More Consumers Paying Big Bucks For Smaller Trucks

U.S. sales of midsize pickup trucks jumped 54 percent in September 2016 to nearly 40,000 units.

While massive year-over-year increases in pickup truck sales can often be attributed to commensurate increases in incentives, as seen with the Ram P/U’s victory over the Chevrolet Silverado in September, midsize pickup truck buyers are willing to pay big bucks.

Average transaction prices in the Toyota Tacoma-controlled midsize pickup truck segment last month, according to Kelley Blue Book, rose 6 percent compared with September 2015. That was by far the biggest increase for any segment in average transaction prices.

These are hardly the sub-$20,000 antiquated Ford Rangers of 2010.

On average, consumers were buying $32,350 midsize pickup trucks in September 2016.

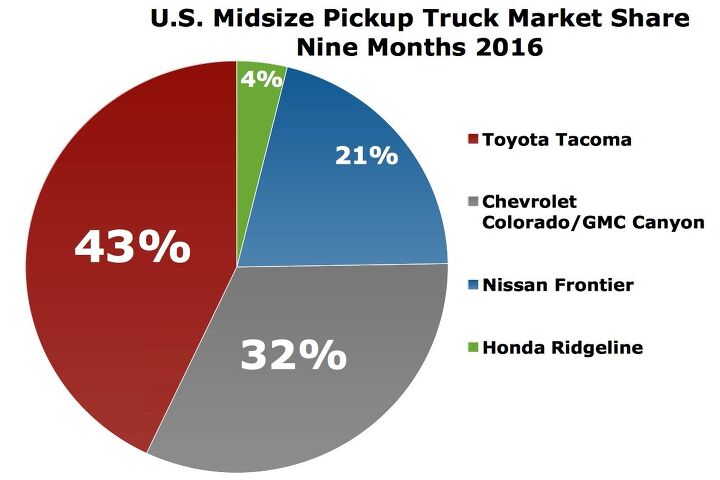

Led by the surging Toyota Tacoma, every member of the five-truck category posted noteworthy year-over-year sales improvements, including the Honda Ridgeline’s astounding 165,800-percent uptick.*

As full-size pickup sales grew just 1 percent in September, a modest 1,784-unit year-over-year improvement, four automakers produced 14,076 additional midsize pickup sales.

The 39,969-unit September result marked the eighth consecutive month in which Americans registered more than 30,000 midsize pickups.

After claiming just 12 percent of the overall pickup truck market in September 2015 — and only 14 percent in calendar year 2015 — midsize pickup truck market share soared to 17.3 percent in September 2016; 16.8 percent so far this year.

Only in August, when midsize pickup truck share jumped to 17.9 percent, has the sub-segment garnered a greater chunk of the overall pickup truck market this year.

The sudden rise in midsize pickup share is all the more impressive when one considers the dearth of available nameplates. True, a decade ago, during peak Ridgeline, small/midsize pickup truck share was a loftier 21 percent. But a bundle of niche players, such as the Mitsubishi Raider, Mazda B-Series, and Isuzu i-Series, were at that time joined by the five nameplates that still exist and high-volume competitors from Dodge and Ford.

Dodge was consistently selling substantially more than 100,000 Dakotas per year prior to 2006’s harsh decline.

Ford Motor Company, which had grown accustomed to selling 300,000 Rangers per year, was entering a phase in which the nameplate wouldn’t crack the 100,000-sales mark. But the Ranger, like the Dakota, remained a major player in the small/midsize pickup truck market in 2006.

After letting the Ranger go — not in the sense of allowing it to run free, but in the manner of not getting a shower and changing out of pajama bottoms in the morning — Ford determined that remaining Ranger customers were purely interested in a cheap vehicle. “It was often times only a purchase because it was an expensive Ford product, not as a pickup,” a Ford spokesperson said in 2010.

“We’re investing in F-Series because the small truck segment has steadily shrunk from almost 8 percent of total industry sales in 1994 to 1.9 percent of industry sales in 2012,” Ford’s Jackie DiMarco told Reddit in 2013, failing to point out that the automaker’s own neglect of the segment played a role in the segment’s decline.

But the game in which a new Ford Ranger would play is conducted on a whole ‘nuther field. Although CAFE requirements pose a challenge for midsize trucks, Automotive News reported last year, the F-150’s move upmarket has opened a gap in Ford’s lineup for a less costly product.

“We think we could sell a compact truck that’s more like the size of the old Ranger, that gets six or eight more miles per gallon than a full-size truck, is $5,000 or $6,000 less, and that we could build in the U.S. to avoid the tariff on imported trucks,” Ford’s Doug Scott told Automotive News last year.

To what degree that strategy has changed, with the average light-duty full-size ATP up to around $38,000 and the midsize truck market quickly transforming, will be made known after Ford reveals its real plans for the Wayne, Michigan, factory.

Whether Ford can engineer a Ranger that much more efficient than the F-150 remains to be seen. But current evidence suggests Ford doesn’t need to worry too much about bringing the Ranger to market with affordability as its main selling point. Midsize truck buyers do not want a full-size truck, and the next Ford Ranger to land in North America won’t be a full-size truck.

That fact alone should be more than enough for Ford to find tens of thousands of paying customers.

* The Ridgeline wasn’t on sale at this time last year, during the hiatus between the first and second-generation Honda pickups.

[Images: Toyota, Honda, TTAC]

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 1995 SC I wish they'd give us a non turbo version of this motor in a more basic package. Inline Sixes in trucks = Good. Turbos that give me gobs of power that I don't need, extra complexity and swill fuel = Bad.What I need is an LV1 (4.3 LT based V6) in a Colorado.

- 1995 SC I wish them the best. Based on the cluster that is Ford Motor Company at the moment and past efforts by others at this I am not optimistic. I wish they would focus on straigtening out the Myriad of issues with their core products first.

- El Kevarino There are already cheap EV's available. They're called "used cars". You can get a lightly used Kia Niro EV, which is a perfectly functional hatchback with lots of features, 230mi of range, and real buttons for around $20k. It won't solve the charging infrastructure problem, but if you can charge at home or work it can get you from A to B with a very low cost per mile.

- Kjhkjlhkjhkljh kljhjkhjklhkjh haaaaaaaaaaahahahahahahahaha

- Kjhkjlhkjhkljh kljhjkhjklhkjh *Why would anyone buy this* when the 2025 RamCharger is right around the corner, *faster* with vastly *better mpg* and stupid amounts of torque using a proven engine layout and motivation drive in use since 1920.

Comments

Join the conversation

Just spent 13,000 for a 2002 Tacoma 4X4 - not sure how much longer I can wait for a new small truck. I don't want a midsize - I want a small truck. I know we are told we don't want small trucks any more - so why are 14 year old toyotas still fetching 66% of their original MSRP?

@Robert Ryan--Yes, and so is the ute. What the US considers a pickup for the most part is classified as a light truck. I have a 99 S-10 that I use as a truck for hauling things but then I use it as a personal vehicle and not for business. I do not consider a midsize pickup any less of a pickup as any other pickup even though it might not have the same hauling and towing capacity. I use my pickups for truck like things as well as for commuter duties--to me its like a Swiss Army knife which can perform a multitude of tasks.