Elio Motors Stock Soars in Over-The-Counter Trading

(Caveat: I know nothing at all about stocks, bonds or other financial instruments.)

After automotive startup Elio Motors raised approximately $17 million dollars in a Reg-A+ stock offering the company crowdsourced from small investors via StartEngine, it said its shares would be listed on the OTCQX exchange to provide those investors with liquidity.

It’s probably too early to call Elio another Tesla (whose own market capitalization probably exceeds its actual value), and I don’t know how many of those investors are going to sell their stock so soon. But, if they did, they would have more than doubled their money in less than two weeks as of Monday’s close.

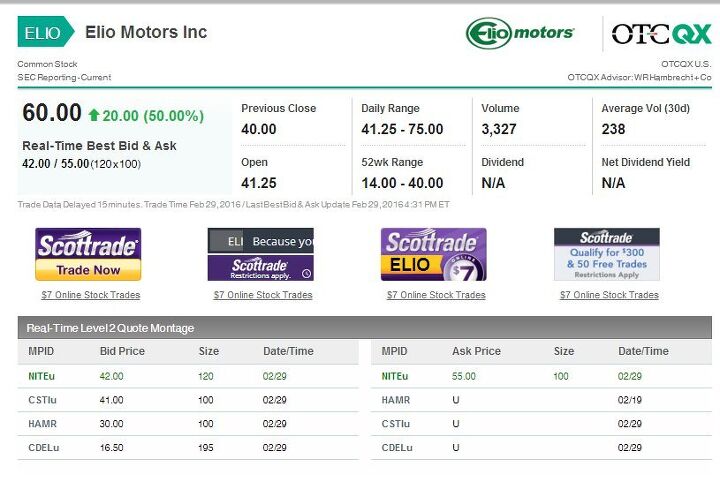

Elio stock started trading on February 19, 2016, with an initial value of $15/share set by WR Hambrecht & Co., Elio Motors’ securities advisor. As of February 29, it was trading between $41.25 and $75.00 a share.

Volume is still light — a bit more than 3,300 shares were traded yesterday, with the average transaction involving less than 240 shares. Still, the news has to buoy those Elio fans who have gone all in and invested in the company in addition to having put down money to reserve an Elio trike, should it ever come to production.

Elio is using the money raised in the stock offering to build a series of validation prototypes. It still needs to raise about $200 million to start production and has been putting most of its eggs in the basket of its application for a loan from the U.S. Department of Energy’s Advanced Technology Vehicles Manufacturing (ATVM) program.

As mentioned above, I don’t know much about securities, but it seems to me that if its publicly traded Reg-A+ stock is attractive enough to investors that it’s significantly increasing in value, the other shares held by the company and its original investors should also be increasing in value as well. If that’s the case, selling off some of that stock might be an alternative way of raising capital versus hoping for an ATVM loan.

As Elio has pushed back its proposed start of production, some early enthusiasts have become disenchanted. There’s been some hearty back and forth between the lapsed converts and those who are still true believers in Paul Elio’s dream. With Elio Motors’ stock seemingly taking off, the true believers are crowing. We’ll see if they’re singing the same tune at the end of this year when Elio hopes production will start.

[Image Source: OTCMARKETS.COM]

Ronnie Schreiber edits Cars In Depth, the original 3D car site.

More by Ronnie Schreiber

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy 9 miles a day for 20 years. You didn't drive it, why should I? 😉

- Brian Uchida Laguna Seca, corkscrew, (drying track off in rental car prior to Superbike test session), at speed - turn 9 big Willow Springs racing a motorcycle,- at greater speed (but riding shotgun) - The Carrousel at Sears Point in a 1981 PA9 Osella 2 litre FIA racer with Eddie Lawson at the wheel! (apologies for not being brief!)

- Mister It wasn't helped any by the horrible fuel economy for what it was... something like 22mpg city, iirc.

- Lorenzo I shop for all-season tires that have good wet and dry pavement grip and use them year-round. Nothing works on black ice, and I stopped driving in snow long ago - I'll wait until the streets and highways are plowed, when all-seasons are good enough. After all, I don't live in Canada or deep in the snow zone.

- FormerFF I’m in Atlanta. The summers go on in April and come off in October. I have a Cayman that stays on summer tires year round and gets driven on winter days when the temperature gets above 45 F and it’s dry, which is usually at least once a week.

Comments

Join the conversation

This suffers from the 'Bitcoin Problem' - if you don't have enough volume to buffer the market rate, then the market rate is irrelevant. It's great that one guy paid $50 for something, but if no one else is willing to, the price isn't very durable.

"I don’t know how many of those investors are going to sell their stock so soon. But, if they did, they would have more than doubled their money..." By the sounds of things, if more than a dozen of them did, the stock value would collapse and everybody else would be SOL. The volumes here just aren't high enough to draw any sort of conclusions about the business.