Bark's Bites: How Do New Car Dealers Make Money?

If I’ve seen it once in the comments on this site, I’ve seen it a hundred times.

Never once in the history of the Internet has anyone, anywhere admitted that they paid more than invoice for a new car.

Everybody gets the best deal possible. We all “ stick it to the man.” However, despite the well-known and understood tendencies of most people to lie on forums, in comments, or even when writing about their own business practices on the Internet, this might be one of the few times when the braggadocio matches reality.

The truth is that virtually everyone gets a “good deal” on a new car.

The invoice price now seems to be the starting place of negotiations on commonplace cars. And yet, franchise owners all across these great United States (and Canada, I presume) are raking the money in, hand over fist.

Many of the questions you’ve all been so kind to send into the Ask Bark mailbox lately have been regarding crazy leases, manufacturer incentives, and other such deals that seem too good to be true. How can anybody be making a nickel on these $69 a month Cruze leases? What gives?

Relax. Uncle Bark is here to pull back the curtain and show you how the dealer is more than happy to have you sign on the dotted line for that once-in-a-lifetime deal.

For years now, OEMs have been slowly but surely reducing the amount of profit on invoice statements, to the point where something like a Ford Fiesta ST offers less than $700 difference between sticker and invoice; lower trims have even less. A decade ago, it wasn’t uncommon for a dealer to average around $1,500–1,800 on the front end (the actual profit made on the sale of the car before any finance, insurance, or warranty products are involved). Now? The majority of domestic cars don’t have that much profit built into the sticker.

Not that anybody pays sticker. Invoice pricing is hardly a secret, available to the public on any number of third-party sites, along with actual transaction data for your zip code. It’s beautifully simple to find out what the dealer paid for your dream car, as well as what others in your area forked out recently for the same car you’re eyeballing. If you don’t personally enjoy the haggling process at a dealer, there are even lead generating companies that will happily do the negotiating for you, provided that you’re okay with them selling your data to the highest bidder.

So in this age of information, how do dealers still manage to squeak out any money? Simple: That profit that the OEMs have been taking out of the invoice? They’re giving it back to the dealer in a variety of different ways, either via manufacturer rebates or any number of incentive programs that reward specific behavior an OEM is looking for from its franchisees.

One reader recently wrote to me with the following question: “Why do auto manufacturers like GM put so much cash on the hood? Obviously it helps move the cars, but to me the optics of a lower MSRP would be a lot better.”

Well, that would make more sense to us — the end user — but remember the golden rule of the car business: the OEM’s customer is the dealer, not the buyer. So that cash on the hood, in the form of a factory-to-customer rebate, just ends up being a down payment that is paid directly to the dealer. Sure, you could request it as a check made out to you, but nobody ever does. Most consumers view a rebate as a reduction of the sticker price, when it’s actually nothing of the sort. Rebates are only relevant after the final sale price is negotiated — then the rebate is applied. That’s an easy way for a dealer to hold on to a grand or two with an ill-informed customer.

But what about the dealer who’s willing to sell at invoice minus rebates? Well, that’s likely a dealer who’s trying to hit a OEM sales target.

Depending on the OEM, these are either paid out monthly or quarterly and, depending on the volume of the store, they can be extremely large dollar amounts. And it’s not just the sales numbers that matter. In order to qualify for the highest possible payouts, dealers also need to hit any number of moving targets — including, but not limited to, responding to internet leads within a predetermined time frame, making recommended facilities improvements, having dealership employees complete required online product and sales training, and, most importantly, good customer satisfaction index scores. You know that survey you get a couple of weeks after your purchase of a new car? If you circle anything less than a “10,” you’re likely costing that dealership money. CSI scores are incredibly important to every dealer on the planet. But if a dealer hits all the goals set by the OEM, it’s more than enough money to make up for eating a grand of dealer contribution here or there on a lease.

Speaking of those ridiculous leases that seem to be pervasive at domestic stores early in 2016 — Malibus for $149? Edges for $166? — dealers love them! It’s the easiest way to get another checkmark on the wall of the sales tower, and it ensures you’ll be back again in 24 months so that dealer can get another crack at selling you a new car. The dealers aren’t assuming any of the risks associated with flooding the market with cheap and easy leases with inflated residuals. Let GM Financial worry about that (which is another subject for another time). It’s party time in the break room!

Of course, let’s not forget that “invoice” doesn’t really mean “invoice.” With only a few exceptions (mostly imports), dealers keep an additional 2- to 3-percent “holdback” on every car they sell. Holdback isn’t shown anywhere on any invoice; it’s built into the invoice price. While some dealers will try to tell you that holdback covers the cost of floorplanning their cars (a floorplan is basically a giant loan that dealers use to finance the cost of their lot inventory), in actually, it actually allows the dealer to borrow a little bit more money because it’s an invisible addition to the invoice that artificially inflates the value of a car.

Then there’s the virtual gold mine that is the Finance and Insurance office. Several times in the last 10 years, I’ve had dealers become magically amenable to my purchase terms when I agreed to allow them to match my bank’s financing offer. If they can’t make any money on the front end, they can still make money on the loan itself, as well as on gap insurance and extended warranties. This can easily add up to as much or more money than the dealer would expect to make on the sale of the car — anywhere from $1,000–2,000.

Unfortunately, many of these additional dollars that the dealer principal gets are rarely shared with the front-line salesperson. Even though a dealership might end up making $3,000-4,000 on a new car deal when it’s all said and done, if the front end gross is minimal, then your hard-working salesman/woman might not see anything above a $100 mini-commission. Just another way that the rich get richer and the poor stay poor.

When it’s all said and done, maybe you did or maybe you didn’t get such a great deal on that that new car. The minute you walked out the door, the sales managers could have been high-fiving each other as they put another checkmark on the glass, moving the store that much closer to the OEM target. As long as you’re happy enough to give them a great CSI survey, in the end, what difference does it make?

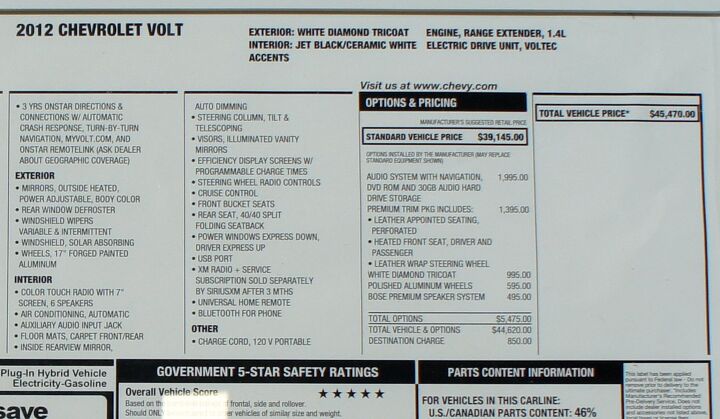

[Image source: Top, Bobby Mascio/YouTube; Monroney Sticker, Mariordo (Mario R. Durán Ortiz) [ CC BY-SA 3.0], via Wikimedia Commons]

More by Mark "Bark M." Baruth

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Varezhka Maybe the volume was not big enough to really matter anyways, but losing a “passenger car” for a mostly “light truck” line-up should help Subaru with their CAFE numbers too.

- Varezhka For this category my car of choice would be the CX-50. But between the two cars listed I’d select the RAV4 over CR-V. I’ve always preferred NA over small turbos and for hybrids THS’ longer history shows in its refinement.

- AZFelix I would suggest a variation on the 'fcuk, marry, kill' game using 'track, buy, lease' with three similar automotive selections.

- Formula m For the gas versions I like the Honda CRV. Haven’t driven the hybrids yet.

- SCE to AUX All that lift makes for an easy rollover of your $70k truck.

Comments

Join the conversation

I bought my car used, but I bought it from a new car dealer, and it was 2 years old, so the sale process was somewhat similar (just no incentives). I feel like I got a good deal on it. My sale price ($15k) was less than any comparable asking prices in the state, including Carmax (all of which were over $16k). It was also less than the original for sale price for the car a few weeks prior ($18k), as well as the then current asking price ($15k). I made the offer and they accepted. Either I overpaid (possible, but I don't feel like it given the other pricing data), or I think I had two things going in my favor mentioned by Bark here - I was upfront about wanting an extended service plan and was open to dealer financing as long as they could match my credit union. I also think it helped being a local buyer with an ESP, as they would be my dealer of choice for servicing the car, so they were setting up a stead stream of (warranty reimbursed) revenue for the service department for years.

"Unfortunately, many of these additional dollars that the dealer principal gets are rarely shared with the front-line salesperson" The Dealer Principal, huh? Can't wait to meet that guy! :)