Editorial: Tax - Don't Subsidize - Electric Cars

All power is not created equal.

That’s one of many takeaways from a comprehensive study by the National Bureau of Economic Research, one of the nation’s prominent think tanks.

The paper focused on the relative impact of green-energy cars, concluding that an electric car in New Jersey doesn’t have the same environmental impact as an electric car in California.

The initial reaction has been largely surface-deep: electric cars on the East Coast and in the South are powered by “dirty energy” and aren’t as clean as their gas-powered counterparts. That much is a quasi-fair assessment — the source for the electric cars’ power should be considered when it comes to ultimately determining their environmental impacts.

The study, however, is a larger look at the federal subsidies offered on electric cars.

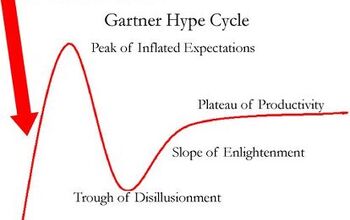

The second factor answers itself: a one-size-fits-all approach rarely works — and in terms of the electric car subsidy, it doesn’t work at all anymore.

It’s clear that well-heeled buyers — who may not actually need a tax perk anyway — are adopting expensive electric cars at a higher clip than middle-class Americans. In the first quarter of 2015, Tesla’s Model S outsold the Nissan Leaf despite costing nearly $40,000 more. In addition to the pricier pick, proportionately more electric-car buyers were from regions of the U.S. with higher subsidies than other parts of the country.

It’s hard to imagine how luxury car buyers deserve the same tax breaks as car buyers shopping in ranges half that of their counterparts, but it’s even harder to imagine how buyers in markets with comparatively “dirtier power” deserve clean federal tax rebates at all. As the report exhaustively details, the externalities of states’ electric-vehicle incentives weren’t considered before states began offering them. According to the report, 91 percent of pollution from electric cars is exported to states other than where the car is driven.

It’s clear there are innumerable factors when considering the efficacy of economic incentives for the “public good.” Markets often don’t respond quickly or with conscience when it comes to public initiatives. Electric vehicle purchases in the United States are clearly lukewarm now after gas prices have dropped considerably over the last 5 years. It’s equally clear that the future of transportation of a growing population needs to be powered by something other than a finite resource that requires breaking the earth, extracting ancient raw materials, refining them, and shipping them halfway across the world to be sold for less than milk in many markets. Relying on that incredibly destructive process for a lasting consistent energy resource makes little sense.

And still, gasoline is an incredibly potent and efficient fuel. A kilogram of gasoline has more potential energy than coal, methanol, ethanol, fat, gunpowder, TNT or even dynamite. Our reliance on gasoline is not without reason: it’s incredibly useful as an energy source.

But just like gasoline has in the past, electric energy requires progressive taxes and consideration to improve the infrastructure it relies on, instead of a one-size-fits-all approach. California recently adopted a tiered system for its incentives based on buyer income. That’s a good first step, but it should also be expanded. The United States should consider a tiered tax on some electric cars based on income and use.

It’s clear the gas tax is outdated and ineffective at maintaining America’s roads and bridges. A tax on electric cars should not be considered as some kind of replacement, supplement or even complement to a woefully outdated gas tax that needs comprehensive reform.

But the gas-guzzler tax, a penalty that creates very little revenue and even less discouragement from buying inefficient cars, is an interesting first step. The tiered system levies a tax that gets progressively larger as the car gets thirstier. Even the 16-cylinder, quad-turbo Bugatti Veyron, which swallows more gas than any other production car on the road, didn’t qualify for the steepest penalty. In 2012, the sin tax generated only $73.5 million in revenue — a fiscal drop in the bucket for the government.

Any tax revenue based on the electric car’s initial price could help fund infrastructure improvements to the power grid and offset environmental impacts felt beyond than where the vehicle is purchased. Just like municipal and state taxes vary by region and services, an electric car tax wouldn’t need to be a unilateral levy.

Like the gas-guzzler tax, a tax on electric cars isn’t meant to raise money — it’s meant to be a consideration: how much help is a tax break on a luxury car?

The appeal of electric cars and clean energy would still remain, and a graduated tax on cars based on MSRP could still persuade middle-of-the-road buyers to consider potentially cleaner electric cars when they head to dealer lots. But needlessly subsidizing wealthier buyers purchasing environmentally neutral — or marginally helpful — electric cars doesn’t serve a larger goal of cleaner transportation. The United States wouldn’t be the first country to revisit its electric-car incentives.

The power of public perception is very often greater than reality. In that respect, all power is clearly not equally created.

More by Aaron Cole

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Analoggrotto Finally, some real entertainment: the Communists versus the MAGAs. FIGHT!

- Kjhkjlhkjhkljh kljhjkhjklhkjh *IF* i was buying a kia.. (better than a dodge from personal experience) .. it would be this Google > xoavzFHyIQYShould lead to a 2025 Ioniq 5 N pre-REVIEW by Jason Cammisa

- Analoggrotto Does anyone seriously listen to this?

- Thomas Same here....but keep in mind that EVs are already much more efficient than ICE vehicles. They need to catch up in all the other areas you mentioned.

- Analoggrotto It's great to see TTAC kicking up the best for their #1 corporate sponsor. Keep up the good work guys.

Comments

Join the conversation

Recent listener, 2nd time caller. I started reading this site in an attempt to learn something about cars before the upcoming retirement of my DD (a term I never would have used few weeks ago). Having to sift through the polemic to glean useful insight is actual very unpleasant. Sorry. And no, you don't know my political stance. I didn't think it was all that relevant to reading about cars. When you participate in a forum for a while, sometimes you forget that people who don't write anything are still reading what you're saying. As someone who prefers to lurk --and should, b/c I definitely know nothing about cars-- reading all that above is why I usually skip the comments. It was more than one person, and I don't think banning is the answer, but I just want to learn something, not have my day crapped on. Sorry, that rhetoric was sh**ty to read. I know people believe those things, but I just come here for the auto knowledge. And not only did I not vote for Obama, he wasn't even on the ballots here.

This article misses one important point. The primary motivation for purchasing an electric car is to reduce CO2 emissions. The study here is entirely excluding CO2 and focusing on air pollutants such as particulates and oxides of nitrogen. Things that, yes, dirty coal-fired plants create in abundance. Electric or alt-fuel car subsidies and gasoline/diesel taxes will necessarily change in the coming years as electric/alt-fuel cars take more and more market share and autonomous tech puts the whole concept of private car ownership into question for many people.