6 Views

Chart Of The Day: Gas Prices, Trucks And Automobiles

by

Derek Kreindler

(IC: employee)

Published: November 28th, 2014

Share

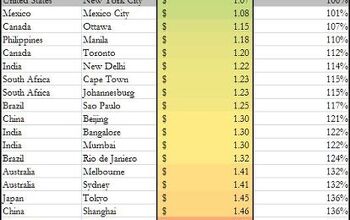

Courtesy of our own Tim Cain. The fain green line represents gas prices, starting from the peak price of crude oil in 2014. Elsewhere, we see market share figures for passenger cars, SUVs/CUVs and pickup trucks. We’ll be keeping an eye on this as the months roll on. Crude oil dipped below $70 a barrel today – truly a black Friday for world oil markets. Let’s see how consumers respond in terms of new vehicle choices.

Derek Kreindler

More by Derek Kreindler

Published November 28th, 2014 10:49 AM

Comments

Join the conversation

First, pump prices have to go down. Then the vehicle buying public has to decide they will stay down for at least a few years. Last, the motor vehicle buyer has to have occasion to make a purchase. What you get out of all this is a lead-lag relationship that is only beginning to emerge. The first phase has already mostly happened. We are in the middle of the second phase (wha' happen? - 'fracking' dude). The third phase will play itself out like it has always done in the past. The value of motor vehicle inventories will adjust. 'Gas guzzler' good - econobox bad.

I do think Derek purposely chose the data the way he did, with a limited window of time and a limited number of variables that affect vehicle sales. I do think those cheap and extended loans play a role. As does economic activity and the average age of the US vehicle fleet. If people are trading in older pickups for newer pickups that have better FE is this bad? I think at least a 10-15 year period with the data I laid out above will give you far better information for trending and the ability to produce a better assessment. Fuel prices do play a role. How much? I'd say a smaller part than many think.

The product mix data is important, but whether or not people are making good decisions in the macro sense would probably be best represented by the UMTRI fuel efficiency data. Fleet fuel economy took an unexpected plunge in September before consumers could react to falling prices, and it didn't budge in October. November numbers will be interesting. Also will be interesting to see what happens to VMT as fuel prices ease.

I would expect consumers to select the type of vehicle that meets their perceived need while opting for the more powerful engine choice when fuel is less expensive. Turbo engines allow manufacturers to sell more power while passing the CAFE test. As long as consumers understand how the EPA test differs from reality, I'm ok with this gaming of the system.