September 2014 Sales: Even Uglier For Volkswagen USA

Following 17 consecutive months in which year-over-year volume at the Volkswagen brand declined in the United States, sales fell 19% in September 2014.

These September results ended a third quarter in which VW USA sales fell 15% and a nine-month period in which sales were down 14%.

Volkswagen is therefore among disappointing and disappointed company. In terms of September sales alone, Volkswagen’s U.S. volume fell to a four-year low: down 19% year-over-year, down 28% compared with September 2012, down 4% compared with September 2011.

Two years ago, in September 2012, the Volkswagen brand owned 3.1% of the U.S. market. Fast forward to last month, and the brand’s market share had fallen by a full percentage point to just 2.1%.

At the end of the first quarter last year, Volkswagen sales were up 4% compared with the first quarter of 2012, the year in which annual VW sales in America ended up rising to their highest level since 1973; more than doubling the brand’s 2009 output. By this stage last year, we knew something was amiss. Through the first three-quarters of 2013, America’s new vehicle market had grown 8% and Volkswagen sales were down nearly 3%.

“Amiss” turned into “ugly” by year’s end. Sales fell 7% from 2012’s near four-decade high.

Nine months later, the introduction of Volkswagen’s global favourite, the seventh-generation Golf, has not been nearly enough to overcome the losses at the rest of the brand.

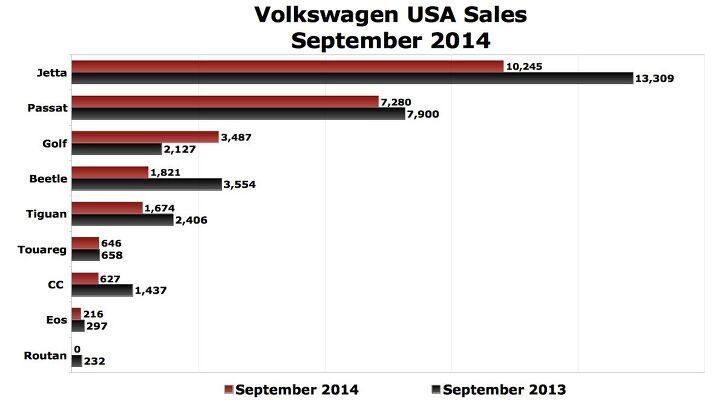

September sales of the Beetle plunged 49%. (Included in that total is the Beetle Convertible, sales of which nose-dived 52% last month.) The CC was down 56%. Sales of the cancelled Eos were down 27%. Passat? down 8%. Tiguan? Down 30%. Touareg? Down 2%. The defunct Routan resulted in 232 fewer sales.

Total Jetta sales fell 23%, as sedan volume dropped by 22% and the SportWagen slid 32%, losses equal to 2474 and 590 units, respectively. The Jetta range was America’s 21st-best-selling vehicle line in September 2013; 37th one year later. From 24th on year-to-date terms in 2013, the Jetta dropped to 29th over the last nine months.

Total Golf sales rose by just 1360 units as Volkswagen’s other models combined for 7284 fewer sales, a 24% loss. GTI volume shot up 48% to 1600 units, 46% of the Golf’s total. (It’s the better seller over the last nine months, with 57% of all Golf sales.) Non-GTI Golfs were up 93% to 1887 in September.

Thus, Volkswagen’s steady decline in the United States stands at 18 months and counting. The whole Subaru vs. Volkswagen thing is increasingly invalid. Meanwhile, across the northerly border, Volkswagen sales jumped 12% last month to the brand’s highest September total ever. The Volkswagen brand’s Canadian market share held steady at 3.8%. It was Volkswagen Canada’s sixth consecutive month of growth; the 42nd in the last 45; and sales are up 7% this year in a market that’s up less than 6%.

Back in the USA and elsewhere in the Volkswagen Group, Audi sales were up 14% in September and Porsche sales jumped 17%. Audi generated 23% of the brand’s volume with the A3 and Q3. More than half of Porsche’s sales are derived from the Cayenne and Macan.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jkross22 When I think about products that I buy that are of the highest quality or are of great value, I have no idea if they are made as a whole or in parts by unionized employees. As a customer, that's really all I care about. When I think about services I receive from unionized and non-unionized employees, it varies from C- to F levels of service. Will unionizing make the cars better or worse?

- Namesakeone I think it's the age old conundrum: Every company (or industry) wants every other one to pay its workers well; well-paid workers make great customers. But nobody wants to pay their own workers well; that would eat into profits. So instead of what Henry Ford (the first) did over a century ago, we will have a lot of companies copying Nike in the 1980s: third-world employees (with a few highly-paid celebrity athlete endorsers) selling overpriced products to upper-middle-class Americans (with a few urban street youths willing to literally kill for that product), until there are no more upper-middle-class Americans left.

- ToolGuy I was challenged by Tim's incisive opinion, but thankfully Jeff's multiple vanilla truisms have set me straight. Or something. 😉

- ChristianWimmer The body kit modifications ruined it for me.

- ToolGuy "I have my stance -- I won't prejudice the commentariat by sharing it."• Like Tim, I have my opinion and it is perfect and above reproach (as long as I keep it to myself). I would hate to share it with the world and risk having someone critique it. LOL.

Comments

Join the conversation

The main factor I've noticed in Volkswagen's sales drop is that their core Jetta and Passat models look the same as the ones that were selling well two years ago. Volkswagen needs to make some exterior cosmetic changes to show buyers that the models have been "refreshed". Could be as simple as new wheels and a new grill to go with the change from the 2.5 L 5 to the 1.8 L turbo 4. As others have commented, Volkswagen is missing out in the rapid growth of the CUV market.

I bought a new Rabbit/Golf for my daughter in 08 for 17K. It now has 101,000 miles and has never been back to the dealer. I bought a new Sportwagon tdi in 12 for myself for 26K. It has 36,000 miles and has been back to the dealer only for the free service every 10K. I realize its popular here at TTAC to bash VW at every opportunity but I have nothing to complain about