Chart Of The Day: At Least Toyota Has Toyotas

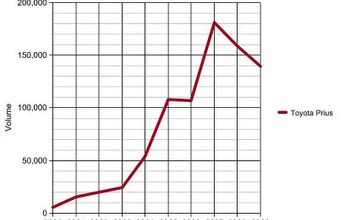

Having reached a four-year peak in 2012, the year in which the FR-S first arrived, sales at Toyota USA’s Scion division slid 7.1% in 2013.

Through the first seven months of 2014, every Scion model except the tC is selling less often than they did one year ago. The iQ’s 47% drop equals 1244 fewer sales through seven months. The FR-S’s 24% decrease translates to 2802 fewer sales.

Scion sold 173,000 new vehicles in 2006, the brand’s best year on recor d. With likely no more than 65,000 sales in 2014, Scion will have declined 62% from that point. (It was, not surprisingly, worse between 2009 and 2011.)

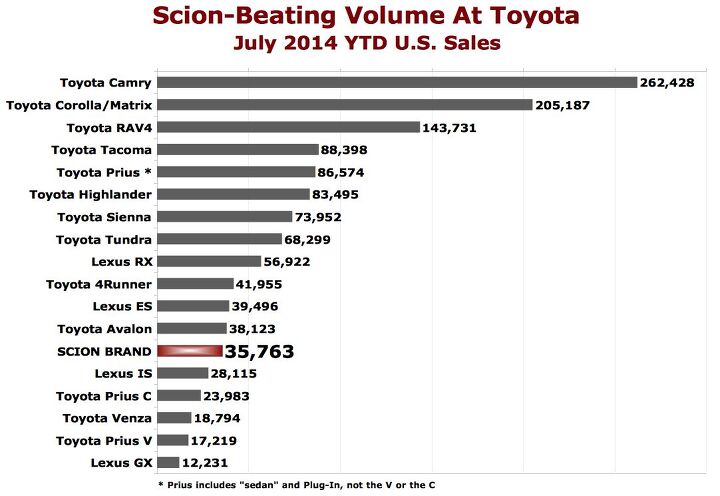

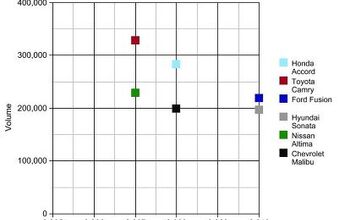

Scion’s Toyota parent company, however, sells a rather large number of vehicles in America. With just 2.6% of U.S. Toyota volume coming from Scion – 12% from Lexus – it’s not as though this has to be a long-term headache. Twelve different nameplates, on their own, outsell the Scion brand as a whole.

More by Timothy Cain

Comments

Join the conversation

RE: "No new auto manufactures have made it in decades. I'm not betting on Tesla. But I like its style." Well put! My thinking exactly, although I think the name will last while the business model will morph!

RE: "Saddam sold oil. Iran wants to. The US doesn't care who sells it. Same with oil companies." Of course Saddam sold oil. So does Iran. Iran does more than want to sell oil. Is there a point here?

RE: "I am ready to pay $300 and use my laptop only to buy a car rather than dealing with thugs in sleazy dealership and fight them to the death for hours and still loose to professionals who do it that in daily basis as part of their job. Two hours of my life cost more than $300." So who sells you the car? Where do you pick it up? Where do you do the paperwork? Who does the warranty work on it? What happens, if at some point, dealerships decide they no longer want to cooperate with Costco, USAA, TrueCar? Their business only has value as long as there is gross profit in it. Dealers are experiencing a situation where most of their deals are so called "special deals" or "plus business." What happens when they've had enough? We saw dealers rise up against TrueCar a few years ago. Seems it cost TC about $76. million and delayed their IPO. Dealers figured out they have power if they band together. There are some dealer vendors walking a fine line at the moment. TrueCar is one of them.

RE: "I'm not in the market for a car like the Avalon but I am in it's demographic and, trust me, when people of my generation were in their 20s they weren't buying new cars, either. Thus has it always been." Yes!! Its about time that is recognized. There are some who want to turn auto retail upside down to satisfy a group who will eventually be a BIG factor in the auto market. By the time they reach that point, their preferences and habits will have changed. They will have, by necessity, learned how the business world works. In the meantime, the demographic of most value to both auto OEMs and dealers remains the Boomers, followed by Gen X. The the actual value of new vehicles purchased by Gen Y and Millennials pales in comparison. Those vehicles tend to be low margin to both auto OEMs and dealers.