The New York Times Shines A Light On Subprime

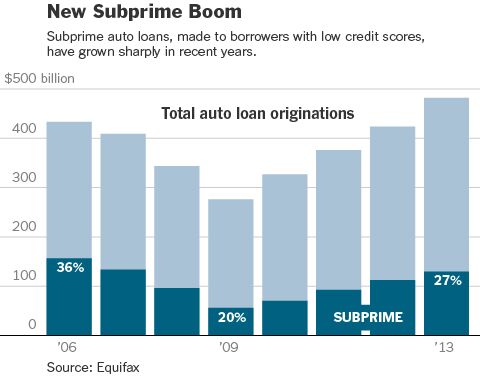

The issue of subprime car loans, specifically loans with exorbitant interest rates for used cars, has filtered into the New York Times, with the paper’s Dealbook section running an investigation into the practice.

The NYT article serves as a primer on the subprime auto loan crisis, though it focuses on used cars, and the unscrupulous practices of dealers who charge interest rates as high as 25 percent for used cars, which are frequently repossessed and then re-sold, enabling dealers to make vast profits many times over on the same car.

The Times also found evidence of hardball sales tactics and fraudulent loan documents, with some salesmen facing criminal charges related to their heavy-handed sales tactics and fraudulent loan applications. T he article also focuses on the securitization of these loans, and Wall Street’s hunger for them thanks to the higher yields that they pay

Investors, seeking a higher return when interest rates are low, recently flocked to buy a bond issue from Prestige Financial Services of Utah. Orders to invest in the $390 million debt deal were four times greater than the amount of available securities.

What is backing many of these securities? Auto loans made to people who have been in bankruptcy.

An affiliate of the Larry H. Miller Group of Companies, Prestige specializes in making the loans to people in bankruptcy, packaging them into securities and then selling them to investors.

The average interest rate on loans bundled into Prestige’s latest offering, for example, is 18.6 percent, up slightly from a similar offering rolled out a year earlier. Since 2009, total auto loan securitizations have surged 150 percent, to $17.6 billion last year, though some estimates have put the total volume even higher. To meet that rising demand, Wall Street snatches up more and more loans to package into the complex investments.

Much like mortgages, subprime auto loans go through Wall Street’s securitization machine: Once lenders make the loans, they pool thousands of them into bonds that are sold in slices to investors like mutual funds, pensions and hedge funds. The slices that include loans to the riskiest borrowers offer the highest returns.

Rating agencies, which assess the quality of the bonds, are helping fuel the boom. They are giving many of these securities top ratings, which clears the way for major investors, from pension funds to employee retirement accounts, to buy the bonds.

None of this is news for anybody that has been following the topic on TTAC, nor does the NYT article cover the risks related to subprime lending in the new car market. But the Times does advance the argument that the lending practices of certain banks could pose a systemic risk if the subprime auto loan market faces a major downturn.

While losses from soured car loans would be far less than those on subprime mortgages, the red ink could still deal a blow to the banks not long after they recovered from the housing bust. Losses from auto loans might also cause the banks to further retrench from making other loans vital to the economic recovery, like those to small business and would-be homeowners.

If those losses materialize, they could pummel a wide range of investors, from pension funds to insurance companies to mutual funds held by Americans preparing for retirement. For the huge baby-boomer generation, including many whose savings were sapped by the 2008 crisis and the ensuing recession, any losses from the auto loan securities could deal them another setback.

After outlining the deteriorating underwriting standards and outright fraud used to get unworthy buyers into overpriced cars with usurious loan terms, NYT article closes by noting that in Q1 2014, repossessions were up 78 percent year over year. While the NYT points the finger at ratings agencies for being complicit in fueling the subprime bubble, at least one agency has taken notice.

As it stands now, the average vehicle loan term is 66 months, according to credit rating agency Experian, with loan terms of 73 to 84 months make up nearly a quarter of loans originated in Q1 of this year. The average amount financed for a new vehicle loan and the average loan payment also hit new highs in that same period. All of this suggests that Americans are financing vehicles with ever higher transaction pricing and stretching out the payments to unprecedented lengths, all in the name of a lower, more manageable monthly payment with little regard to how affordable the actual vehicle is. But as well all know, it’s different this time.

More by Derek Kreindler

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy TG likes price reductions.

- ToolGuy I could go for a Mustang with a Subaru powertrain. (Maybe some additional ground clearance.)

- ToolGuy Does Tim Healey care about TTAC? 😉

- ToolGuy I am slashing my food budget by 1%.

- ToolGuy TG grows skeptical about his government protecting him from bad decisions.

Comments

Join the conversation

My credit isn't *bad*...it's just mostly non-existent. But apparently VW offers 1.9% financing to people about to graduate, or people who've graduated within the previous 24 months, so long as they have a stable income (I do). So now---despite my previous and eternal ban on Volkswagens---I'm looking at pulling the trigger on a new Jetta SportWagen TDI w/sunroof and nav this Friday. I do love the way the TDI cars drive, and they keep their resale value quite well. Then I can do a 36-month loan, 48 months at the most, and spend the rest of the time basking in vehicular equity. I *would* wait for the next SportWagen/Variant, but I don't have that kind of time...

I have no issue with subprime auto lending, I do take issue with blatantly illegal sales tactics. But that's another issue altogether. The thing that many people are missing, however, is that cheap money ultimately pushes up the prices on cars for *everyone*. Ultimately, you and I all pay the price for super-cheap money in the form of higher transaction prices. Everyone "needs" a car, just like everyone "needs" a house and "needs" a college education. When the market gets sneaky and finds ways to make these goods affordable (unlimited student loans, 3/1, 5/1, interest only ARMs, 84mos. auto financing, leasing) to the masses, prices go up. I think that housing and college tuition are the biggest offenders by far, but we're seeing it in auto transaction prices. Mind you, I'm not making any moral or financial judgments on these products because for many people they are legitimate means to purchase and are being done so in a reasonable, measured fashion. But as with anything, done to excess or recklessly it's dangerous. Subprime autos won't take down the economy like housing did. I do think, however, that student loans have become a major drag on consumer spending in the 18-35 demo and that people are on the whole far less cash-flush than they were a decade ago. As a result I don't think we've seen the end of these financing models, if anything this is the early phase of creative finance for a generation of debt-rich, cash people citizens.