Outstanding Subprime Loan Balances Hit 8-Year Highs

Buried in a feel good story about auto loans comes the news that subprime auto loans are at levels that we haven’t seen in nearly a decade.

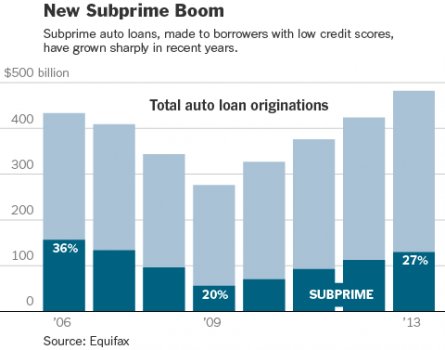

Citing data from Equifax, Automotive News reports

The credit bureau also noted originations and total outstanding balances for subprime auto loans — defined as loans to customers with credit scores of 640 or below — also hit recent highs.

Equifax said subprime originations were 2.6 million units year to date through April, representing 32 percent of all auto loan originations. The total outstanding balance of subprime auto loans was $46.2 billion — the highest in eight years, the credit bureau said.

Don’t expect that 32 percent figure to let up any time soon. The glut of credit available for auto financing – driven by securitized auto loans sold as investment grade instruments – is going to keep the auto financing business alive and kicking for the foreseeable future.

But don’t worry, guys. This time, it’s different.

More by Derek Kreindler

Comments

Join the conversation

RE: "Subprime in and of itself is not a bad thing. Banks make tons of money on subprime loans, with double digit interest rates and upfront bank fees." Seems you forgot to add in the huge costs of collection, repossession, and deficiency. Why leave that out? Do you think this people actually pay regularly without incident? RE: "When dealer finance guys fudge the applications to make it appear like the customer makes more than they do to get them approved - disregarding their ability to repay the loan to get the commission, that's when the problems start." So exactly when does that happen? Do you think sub prime lenders are ignorant. A lot of sub prime paper is held by the dealer. Do you think the dealer fudges himself? RE: "Consumers play a role in that scenario as well, signing up for a payment they must know they can't afford." You state this as if it is a pervasive fact. It isn't. RE: "A big problem in the crash was people being upside down in their auto loans in the same way they were upside down in the homes." Not even close. Most everyone is upside down in their auto loan from the beginning. Auto loans and the mortgage crisis have so little in common it isn't worth talking about. RE: "People had gotten into the habit of trading their cars frequently and refinancing the negative equity onto the new vehicle." Actually, people have been trading vehicles much less often than before. RE: "People did that a couple times and quickly became trapped in a very high payment and a vehicle worth much less than they owed." Well, the bank has to approve adding in the negative equity and that only happens for the best borrowers. LTV is a big deal to lenders even though it isn't the same formula as for a house. RE: "They became a prime voluntary repo candidates. I saw it all the time." Anyone is a default candidate if they can't or don't make their payments. Many people with negative equity go to a domestic dealership to get a rebate to help bring the LTV in line with a lenders requirements.

RE: "Your FICO score is a measure of how much money banks expect to profit from lending you money, not your creditworthiness." Where did that come from? RE: "People who are the most creditworthy do not have the highest FICO scores, because we don't need to borrow money often." People who pay cash probably don't have scores as high as people who buy on credit and pay off regularly and early. That is not to say they have low scores. A person with no history... well, has no history. What would a lender have to go on? The yield on loans to the highest credit tiers don't make much money for lenders, especially these days.

RE: "Deadbeats come in all flavors, wasn't that the point of things like FICO in the first place a better metric for identifying higher credits risks?" All deadbeats are not created equal. Bad things happen to good people. WHile credit scoring has been around for a while it really became refined when the CRA caused lenders to be able to prove why they denied or granted credit to someone.

Didn't there used to be an "edit" function?