Cain's Segments, July 2014: Trucks

89% of the pickup trucks sold in the United States in the first half of 2014 were full-size trucks, a segment of the auto market that has risen 4.3% so far this year.

Lost market share among the top pickup sellers in America, Ford and General Motors, has been swallowed up in large part by FCA’s Ram brand and the Toyota Tundra. Already this year, Ram has sold 33,541 more pickups than during the first six months of 2013.

Ford’s F-Series, on the other hand, is down by 1661 units. GM’s twins have combined to rise 1.1%, but their share of the full-size category, not even including the now extinct Chevrolet Avalanche and Cadillac Escalade EXT, has fallen by more than a percentage point.

June 2014 was in large part a stronger example of this trend. F-Series sales dropped 11% to 60,560 units, the first time since February that Ford sold fewer than 63,000 F-Series trucks. We expect lower F-Series sales these days, as a number of customers will wait for a new 2015 F-150 and forego the discounted outgoing model. Ford dealers didn’t just miss out on a large number of F-Series sales in June, however, as utility vehicle volume was down 8%.

Meanwhile, Ram’s 20.4% market share in June was par for the course. Ram owned 20.3% in May, 21.4% in April, 22.9% in March, 20.2% in February, and 20.8% in January, a great deal better than the 18.3% Ram managed during the first half of 2013.

Unlike the Ford Motor Company, most of Ram’s relations performed above last year’s pace in June 2014, as well. Fiat sales jumped 11%, Jeep shot up 28% (thanks to Cherokee), and Dodge moved up 1%. Chrysler Group car sales continue to underperform, yet with 68% of the automaker’s sales coming from Ram pickups, Jeep, and minivans, the overall figures tend to impress.

We’re no longer seeing the kinds of decreasing market share figures from GM’s twins that we were earlier in the year – their February share slid by more than four percentage points – but the half-year numbers hark back to those especially disappointing days. Despite their freshness, GM’s full-size truck market share fell to 34.5% over the last six months from 35.6% during the equivalent period one year earlier. June volume was also down 1.5%. (Taking the fewer available selling days into account, the Silverado and Sierra were up 7.7%.)

At Toyota, the Tundra and better-selling Tacoma were responsible for 11.4% of all Toyota U.S. sales so far this year, including Lexus and Scion. Although the Tacoma consistently leads all small/midsize trucks, the Tundra’s steady improvements came to an abrupt halt in june after eight consecutive year-over-year monthly sales increases.

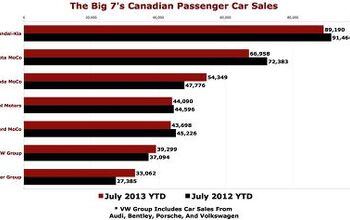

Clearly pickup trucks aren’t the essential motivating forces at Toyota that they are at Ford, GM, and Chrysler. The Ram P/U range is the Chrysler Group’s top seller in the U.S., accounting for 20% of first-half sales. Including the Avalanche, Escalade EXT, Colorado, and Canyon, pickup trucks have pulled in 22.9% of GM’s U.S. volume in 2014. (Full-size, body-on-frame SUVs generated one in ten GM sales in June.) At Ford MoCo, the F-Series, with no help from a Ranger, attracts 28.8% of the automaker’s sales.

Nissan? Sales are booming, but of the 704,477 new vehicles sold by Nissan and Infiniti over the last six months, only 5.1% have been Frontiers; only 0.9% have been Titans.

TruckJune2014June2013%Change6 mos.20146 mos.2013%ChangeFord F-Series60,56068,009-11.0%365,825367,486-0.5%Chevrolet Silverado43,51943,259+0.6%240,679242,586-0.8%Ram P/U33,14929,644+11.8%203,860170,319+19.7%GMC Sierra15,40616,568-7.0%93,19187,633+6.3%Toyota Tundra89779759-8.0%57,98751,565+12.5%Nissan Titan9761300-24.9%64168852-27.5%—— —————Total162,587168,539-3.5%967,958928,4414.3%TruckJune2014ShareJune2013Share6 mos. 2014 Share6 mos. 2013ShareFord F-Series37.2%40.4%37.8%39.6%Chevrolet Silverado/GMC Sierra36.2%35.5%34.5%35.6%Ram P/U20.4%17.6%21.1%18.3%Toyota Tundra5.5%5.8%6.0%5.6%Nissan Titan0.6%0.8%0.7%1.0%—————Full-Size Share Of Total Pickup Truck Market89.4%87.9%89.0%87.1%Full-Size Pickup Share Of Total Industry11.4%12.0%11.8%11.9%More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Zerofoo 5-valve 1.8T - and OK engine if you aren't in a hurry. These turbocharged engines had lots of lag - and the automatic transmission didn't help.Count on putting a timing belt on this immediately. The timing belt service interval, officially, was 100,000 miles and many didn't make it to that.

- Daniel J 19 inch wheels on an Elantra? Jeebus. I have 19s on my Mazda 6 and honestly wish they were 18s. I mean, I just picked up 4 tires at over 1000 bucks. The point of an Elantra is for it to be cheap. Put some 17s on it.

- ToolGuy 9 miles a day for 20 years. You didn't drive it, why should I? 😉

- Brian Uchida Laguna Seca, corkscrew, (drying track off in rental car prior to Superbike test session), at speed - turn 9 big Willow Springs racing a motorcycle,- at greater speed (but riding shotgun) - The Carrousel at Sears Point in a 1981 PA9 Osella 2 litre FIA racer with Eddie Lawson at the wheel! (apologies for not being brief!)

- Mister It wasn't helped any by the horrible fuel economy for what it was... something like 22mpg city, iirc.

Comments

Join the conversation

Market share is interesting, but margins are what matter. Any insights, Mr. Cain?

@Lou_BC - If small pickups won't work for you and you're a huge fan of, how can you expect the general pop to put up with all their shortcomings and disappointments. But when you refuse to expand on all the problems you have with them and lack of so called "capabilities", how do you expect OEMs to listen and fix them???