Canada Sales Recap: May 2014

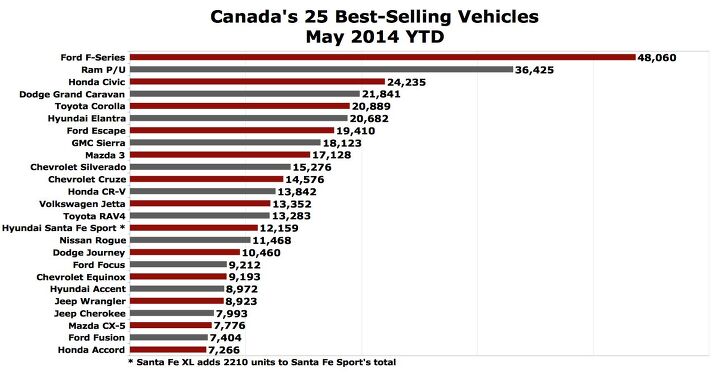

In May 2014, Canadian auto sales shot up to record monthly levels by soaring beyond 195,000 units, one-eighth the size of the U.S. industry last month.

These record sales levels occur as buyers transition from in large numbers from cars to crossovers, particularly smaller crossovers from volume brands.

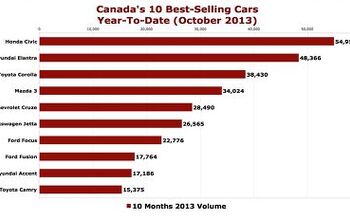

It’s become a long-running theme. Car sales were down 2.4% in May 2014 according to the Automotive News Data Center. Cars formed just 43.5% of the overall market, down from 43.6% in April and down from 47.1% in May of last year, a massive market share decline.

The bigger the car, the more serious the hit. Large Impala-class cars slid 24% in May to just 2803 units, equal to just 3.3% of the passenger car market. More seriously, midsize cars – led by the Ford Fusion – were off May 2013’s pace by 23%, a loss of 3518 units in just one month.

The Subaru Legacy and Volkswagen Passat stand out as the only midsize cars to achieve year-over-year improvements during the first five months of 2014, but their gains are moderate, and neither of those two cars are even close to being top sellers in the category.

Even Canada’s most popular vehicle category, the compact class, is not immune to the move away from passenger cars. The Honda Civic and Toyota Corolla, the segment’s two top sellers at the moment, have recorded impressive year-over-year improvements by stealing sales from rival cars, not by bringing in new buyers. Compact sales were down 3% in May (4% YTD) as the Dart, Focus, Elantra, Forte, Lancer, and Sentra collectively slid 21%.

Many of the smallest cars are selling better this year than in 2013. Year-to-date, the Ford Fiesta, Honda Fit, Hyundai Accent, Nissan Versa, and Toyota’s Prius C and Yaris are ahead of last year’s pace. Mitsubishi and Nissan have added 2740 sales this year that couldn’t exist at this time last year via the Mirage and Micra. In fact, the Micra has not surprisingly proven capable of attracting Canadians, helped by its ultra-low sub-$10,000 base price. 877 were sold in May, ranking the Micra 28th among all cars. All six of the cars which ranked directly ahead the Micra reported year-over-year declines.

In order to reach record-high sales levels, Canada’s auto market is clearly making up for the lost car sales elsewhere. Although pickup truck volume is down very slightly year-to-date, May pickup sales jumped 6%, a gain of 1879 units. Pickups accounted for 17.1% of the Canadian auto industry’s May sales; 12.7% in the United States.

Minivan volume shot up 7% in May. Include the Mazda 5, Kia Rondo, and Chevrolet Orlando in the mix, and minivan sales were up 10%. Minivans generated 5.6% of the industry’s May sales. 52% of Chrysler Canada’s sales in May were generated by the Ram P/U (Canada’s second-best-selling vehicle line), Dodge Grand Caravan (54% minivan market share), and Chrysler Town & Country.

The perception that Canadians prefer small cars is not without merit. Yet 48.5% of the new vehicles sold in Canada in May 2014 were pickups, SUVs, and crossovers, compared with 44.3% south of the border.

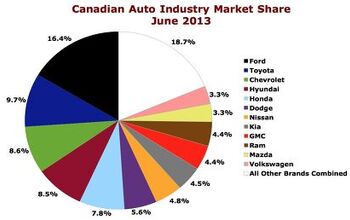

Ford Motor Company was again the top seller of new vehicles in Canada in May, although Chrysler Canada leads the way year-to-date. Despite falling F-Series sales and plunging car volume, Ford’s Blue Oval brand continues to outsell all other auto brands in Canada. BMW was Canada’s top so-called premium brand in May; Mercedes-Benz leads year-to-date.

The Honda and Nissan brands owned 12% of the Canadian market in May 2013 but improved that total to 13.4% one year later. No brand has added more sales to their 2013 five-month over the first five months of 2014 than Nissan, although Jeep’s 7998-unit YTD improvement comes close.

Strong as Jeep is, and as much as Nissan is powered by its top-selling Rogue, there is perhaps no greater figurehead for the utility vehicle boom than Porsche. By adding its second-best-selling Macan in May, Porsche Canada gleaned 60% of its sales from the high-riding side of the showroom even as Porsche car sales jumped 7%. Not only did Porsche add the Macan, but Cayenne sales increased, as well.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Analoggrotto What the heck are those people doing in front of that house? Just staring at this stupid pos truck?

- Jeff Good review but the XLT although not a luxury interior is still a nice place to be. The seats are comfortable and there is plenty of headroom. The main downside is the limited availability resulting in dealer markups above MSRP. I have a 2022 hybrid Maverick XLT for over 2 years and it has more than met my expectations. I believe for many who do not need a truck most of the time but want one the Maverick will meet their needs.

- Kwik_Shift_Pro4X I use a now discontinued Kuhmo AT tire that is surprisingly good in the snow, even in 2WD. However since most of my driving is on road, I'm going to look for a more highway friendly tire for smoother quiet. I'm sure it can still handle the forest roads leading to my fishing spots.

- MaintenanceCosts So this is really just a restyled VW Fox. Craptacular tin can but fun to drive in a "makes ordinary traffic seem like a NASCAR race" kind of way.

- THX1136 While reading the article a thought crossed my mind. Does Mexico have a fairly good charging infrastructure in place? Knowing that it is a bit poorer economy than the US relatively speaking, that thought along with who's buying came to mind.

Comments

Join the conversation

I'd be really curious to know how many of those pickups are leases driven by tax wrtite-offs.

LOC's buoyed by real estate bubble.