Cain's Segments June 2014: Commercial Vans

The only van not capable of improving its May 2013 U.S. sales figures in May 2014 possessed an in-showroom rival last month which didn’t exist a year ago. Ram Cargo Van sales fell 21%, or 209 units, in May 2014. But with the ProMaster making headway, total Ram commercial van sales jumped 84%.

FCA is not yet a major player in America’s commercial van category, but the ProMaster has, together with the Mercedes-Benz Sprinter and Nissan NV200, stirred up the traditional full-size van market.

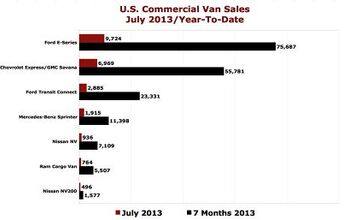

Ignore the smaller Ford Transit Connect, Nissan NV200, and Ram C/V for a moment to focus on the full-size vans. 14.4% of the full-size commercial-oriented vans sold in the United States in May 2014 weren’t GM or Ford products, up from 10.9% in pre-ProMaster May 2013, and 3.5% in pre-NV May 2009.

This isn’t to suggest that Ford and General Motors are soon to lose control of the American commercial van industry. Indeed, in the coming months, Ford will combine two formulas: the new Transit will still wear a Blue Oval, the logo so many buyers associate with commercial van desirability, and it will also utilize all the European flexibility and diesel availability FedEx enjoys with its Sprinters.

Back in the here and now, Ford set a Transit Connect sales record in May with the model’s second consecutive year-over-year sales increase after a 29% first quarter drop. (Ford’s monthly sales releases don’t separate sales of the Transit Connect van from the minivan-fighting Wagon.) The Transit Connect sold more than twice as often as the Nissan NV200 and Ram C/V combined. Chevrolet’s NV200-based City Express should help form a viable Transit Connect opposition later this year.

Meanwhile, GM’s market share in the overall commercial van market slid only slightly from 30.6% during the first five months of 2013 to 30.5% year-to-date; rising to 35.6% in May 2014 compared with 33.5% in May 2013 and 27.5% in April 2014. Through the first five months of 2014, the Chevrolet Express and GMC Savana generated 43,314 U.S. sales.

Nissan commercial van sales more than doubled to 2678 units in May – the NV200 was only a two-month-old product at this time a year ago. Sprinter volume reached the second-highest level in the model’s U.S. history in 2013 and sales are up more than 23% in 2014. Year-over-year, Sprinter sales have improved in each of the last nine months, following four calendar years of improvement.

The overall category enjoyed a massive month in May 2014 as sales increased by 8524 units, a 28% boost. Sales are up 14% to 142,116 units so far this year, equal to 2.1% of the industry’s total output, up from 1.9% a year ago. It’s not a bad business in which to operate. The Volkswagen brand, for example, has sold 150,317 vehicles in 2014; Mazda has sold 130,223. Total pickup truck volume has risen 4% to more than 900,000 units through five months.

AutoMay2014May2013%Change5 mos.20145 mos.2013%ChangeChevrolet Express98228353+17.6%31,37831,734-1.1%Ford E-Series14,26912,571+13.5%55,11552,783+4.4%Ford Transit Connect42223709+13.8%15,22616,914-10.0%GMC Savana41241906+116%11,9366320+88.9%Mercedes-Benz Sprinter22641828+23.9%92827517+23.5%Nissan NV1475971+51.9%62315148+21.0%Nissan NV2001203341+253%4564588+676%Ram Cargo Van768977-21.4%38083452+10.3%Ram ProMaster1033——4576———— —————Total 39,18030,656 +27.8% 142,116 124,456 +14.2%More by Derek Kreindler

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- W Conrad I'd gladly get an EV, but I can't even afford anything close to a new car right now. No doubt if EV's get more affordable more people will be buying them. It is a shame so many are stuck in their old ways with ICE vehicles. I realize EV's still have some use cases that don't work, but for many people they would work just fine with a slightly altered mindset.

- Master Baiter There are plenty of affordable EVs--in China where they make all the batteries. Tesla is the only auto maker with a reasonably coherent strategy involving manufacturing their own cells in the United States. Tesla's problem now is I think they've run out of customers willing to put up with their goofy ergonomics to have a nice drive train.

- Cprescott Doesn't any better in red than it did in white. Looks like an even uglier Honduh Civic 2 door with a hideous front end (and that is saying something about a Honduh).

- Kwik_Shift_Pro4X Nice look, but too short.

- EBFlex Considering Ford assured us the fake lightning was profitable at under $40k, I’d imagine these new EVs will start at $20k.

Comments

Join the conversation

Is it possible to get a passenger wagon version of the ProMaster (not a fan of the name, FWIW) yet?

I think you have an editing error in the 2nd paragraph, where the Nissan reference should be to the NV2500/3500, not the NV200.