Best Selling Cars Around The Globe: What Future For French Manufacturers?

Lately there has been a lot of talk, speculation, and actual structural changes within both French car manufacturers, Renault and PSA Peugeot-Citroen, with notably Carlos Tavares switching from one manufacturer to the other over the past year. Being French, this is close to my heart and I thought it would be timely to take stock and evaluate what lies in the future for these two French manufacturers.

Recently, both manufacturers have suffered from the European car market’s weakness, but thanks to the arrival of the Renault Captur and Peugeot 2008, things seem to be turning around. A combination of alliances, low-cost models, and targeted efforts in strategic markets are all strategies being pursued by both OEMs.

1. European sales

With two established brands, Peugeot and Citroen, PSA is above the Renault Group in Europe. The Peugeot brand alone even passed Renault in January. Over the Full Year 2013, PSA held 11% of the European market thanks to 1.34 million sales, 741,939 for Peugeot and 603,080 for Citroen. Renault for its part held 8.85% of the market thanks to 1.09 million units sold: 803,166 for Renault and 290,078 for Dacia, which is by far the fastest growing major brand on the continent last year at +22%. And here is where the long-term trends show we may be on the verge of a change in leadership somewhere in the next few years…

PSA went from 15% share in 2003 to 13% in 2007 to 11% this year. Renault went from 10.6% in 2003 to 8.6% in 2007 to 8.85% in 2013, managing to stabilise its share recently thanks to the growing success of Dacia (0% in 2003 to 2.3% in 2013). The launch of the Peugeot 2008, new generation 308 and Renault Captur in 2013, all candidates for a European Top 10 ranking in 2014, will potentially reinforce both brands, but Dacia’s progression seems unstoppable, especially on the back of a very successful launch in the UK last year.

2. Success outside of Europe

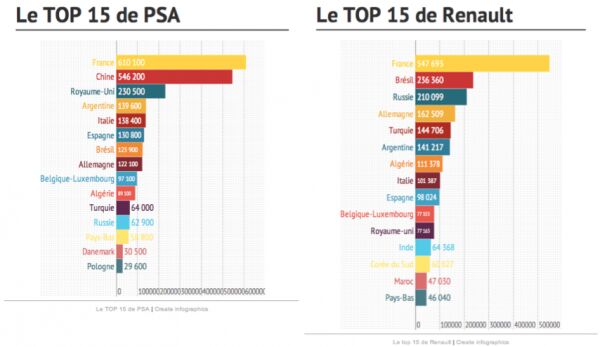

France is still both manufacturers’ biggest market. But for the first time in its history, over 50% of Renault’s sales now occur outside of Europe, to be compared with 42% for PSA. China, the biggest car market in the world, will pass France to become PSA’s #1 market in 2014 after its sales in the country gained 26% in 2013 to 546,200 units. Renault will only start manufacturing cars in China – a key to strong sales there – later this year, after its joint-venture with local carmaker Dongfeng got approved last December. We won’t see a significant impact on Renault’s sales in China before 2015-2016, thanks to the timing of the approval. But if PSA has a clear advantage in China, Renault dominates its French rival in all other major developing markets.

In Brazil, PSA’s two brands sell 40% less than Renault with one brand and fewer models in its lineup. Renault makes a profit there, Peugeot doesn’t. In Russia, Renault sells 3 times as many vehicles as PSA, comprised almost exclusively(85%) of the Duster, Logan and Sandero sold under the Renault brand, meaning it is very profitable there, while Peugeot loses money. Renault’s takeover of Avtovaz/Lada, finalised this year, which means it will control almost 25% of the Russian market in 2014, with over 650,000 units. Finally in India, Renault has made enormous progress over the past year, solely due to the success of the Duster there, while PSA has cancelled its Indian foray because of a lack of cash.

3. International alliances

Following a failed takover of AMC in the eighties, and Volvo in the nineties, Renault forged a strong alliance with Nissan in 1999, of which it currently owns 43.4%. With Carlos Ghosn at the helm of both brands, the Renault-Nissan alliance has been a rare example of a truly successful international cooperation in the car manufacturing industry. Owning 100 percent of Romanian carmaker Dacia and 80 percent of Korean brand Samsung’s auto venture, Renault is now taking over Avtovaz/Lada, ensuring it a very strong presence in Russia.

Lately, Renault-Nissan started a new cooperation arrangement with Mitsubishi which means a Renault model – the replacement for the Latitude, produced in South Korea – will hit US shores for the first time since 1987, albeit sold as a Mitsubishi. Finally Renault’s Chinese joint-venture with Dongfeng was approved last December. This is where it gets tricky, as Dongfeng currently has manufacturing joint-ventures in China with both PSA (since 1992), Nissan (since 2003) and Renault (since 2013).

A lot of brands and alliances are involved, but Carlos Ghosn has kept a clear focus on high potential markets. Renault has long been criticised for ‘giving up’ the US and not being present in China. However, once again according to Carlos Ghosn, this is compensated by Nissan’s strength in both markets: Nissan sells almost twice as many cars in the US as it does in Japan and has become the best-selling Japanese carmaker in China only 10 years after launching there.

PSA has traditionally preferred one-off technical cooperation without alliances (with Fiat, Renault, Toyota, BMW, Ford…). Philippe Varin, who is about to be replaced at the head of the Group by Carlos Tavares, tried to negotiate ‘true’ alliances which have failed so far: first with Mitsubishi, then more spectacularly with General Motors which took a 7% stake in 2012 and forced Peugeot to stop assembling cars in Iran, costing it precious revenue over the past couple of years. We will have to wait until 2016 to see real economies of scale for the Peugeot-General Motors alliance, when the two partners are scheduled to produce 700,000 annual vehicles together, saving $1.2 billion a year split between Opel and PSA from 2018 onwards.

Finally a few weeks ago, 12 years after launching a manufacturing joint-venture with Chinese automaker Dongfeng to produce cars locally, PSA unveiled a $4 billion capital increase in which Dongfeng and the French state will each get a 14% stake. The founding Peugeot family’s holding will fall to 14% from its current 25% stake and 38% of voting rights, short of the 33% required to veto decisions. This reinforced alliance has left some experts skeptical, as vastly divergent interests between PSA, Dongfeng and the French state could create more instability for the carmaker.

However this is a very welcome cash injection for PSA that will enable it to pursue aggressive development plans in Asia where the brand has launched in no less than 13 countries over the past 18 months, as I described in my recent article about Peugeot’s Mongolian operations. PSA also has a joint-venture with Changan since 2012 to produce upscale DS models locally, which we will analyse in more detail in the “Luxury segment” section of this feature article.

4. Low cost cars

This is potentially where the two French manufacturers’ strategies differ the most at the moment. A precursor in this domain, Renault launched the low cost Dacia Logan in 2004, originally for emerging markets only but eventually for Western Europe as well. Fast-forward 10 years and Renault has produced over 5 million units of its low cost range, including one million in 2013 alone, in every corner of the globe. Standardisation and simplification are pushed to the extreme, with significantly lower manufacturing costs resulting in a very impressive 10% profit margin for the Duster for example, even though it is sold at a dirt cheap price. Renault has also used its low-cost knowledge to relaunch Datsun as Nissan’s entry range.

More by Matt Gasnier

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Bkojote @Lou_BC I don't know how broad of a difference in capability there is between 2 door and 4 door broncos or even Wranglers as I can't speak to that from experience. Generally the consensus is while a Tacoma/4Runner is ~10% less capable on 'difficult' trails they're significantly more pleasant to drive on the way to the trails and actually pleasant the other 90% of the time. I'm guessing the Trailhunter narrows that gap even more and is probably almost as capable as a 4 Door Bronco Sasquatch but significantly more pleasant/fuel efficient on the road. To wit, just about everyone in our group with a 4Runner bought a second set of wheels/tires for when it sees road duty. Everyone in our group with a Bronco bought a second vehicle...

- Aja8888 No.

- 2manyvettes Since all of my cars have V8 gas engines (with one exception, a V6) guess what my opinion is about a cheap EV. And there is even a Tesla supercharger all of a mile from my house.

- Cla65691460 April 24 (Reuters) - A made-in-China electric vehicle will hit U.S. dealers this summer offering power and efficiency similar to the Tesla Model Y, the world's best-selling EV, but for about $8,000 less.

- FreedMike It certainly wouldn't hurt. But let's think about the demographic here. We're talking people with less money to spend, so it follows that many of them won't have a dedicated place to charge up. Lots of them may be urban dwellers. That means they'll be depending on the current charging infrastructure, which is improving, but isn't "there" yet. So...what would help EV adoption for less-well-heeled buyers, in my opinion, is improved charging options. We also have to think about the 900-pound gorilla in the room, namely: how do automakers make this category more profitable? The answer is clear: you go after margin, which means more expensive vehicles. That goes a long way to explaining why no one's making cheap EVS for our market. So...maybe cheaper EVs aren't all that necessary in the short term.

Comments

Join the conversation

The short answer, Peugeot is as stupid as stupid can be. If it doesn't get its act together, like yesterday, it's just a matter of time before it's gone. Now Renault is smart. It has a global presence and a portfolio of brands that strike a pretty good figure across the potential buying scope. From Dacia to Nissan, everything is looking up. They are fine, the 4th largest maker in the world and could get up there and challenge the big global 3 with a couple of hits. Renault: Keep at it. Peugeot: Re-think the idiocy.

Had a Peugeot dealer here on Cape Cod, into the mid 90's. Worked for a customer, who always bought Peugeot wagons,…..never, ever remember many Renaults…. except around Boston….French cars are certainly an acquired taste, but they add a variety [ automotive wise]…that I fear is slowly disappearing….