Supply Chain Bottleneck Due In Five Years According to Study

Bottlenecks are bad things to experience. Around 70,000 years ago, the Toba supervolcano eruption reduced humanity to anywhere from 1,000 to 10,000 breeding pairs — thus creating a genetic bottleneck — alongside a global cooling event concurrent with the Last Glacial Period.

For automakers in the United States and their North American supply chain, their Toba event is coming.

A study from Detroit consulting firm Harbour Results, Inc. warns that in five years’ time, the North American auto industry will experience a 40 percent bottleneck in their ability to screw together the cars and trucks we so love, due to falling short $6 billion in tooling capacity. As it stands, the industry will need $15.2 billion in tooling each year to avoid this fate; current industry capacity is $9.3 billion.

The issue isn’t helped by the fact that there are only 750 tool shops in North America, down a third from their peak in the late 1990s in part due to the global recession. On top of this, the average age of a toolmaker in each of the shops hovers around 52, with few new toolmakers coming up in the ranks to replace them; Harbour Results’ CEO Laurie Harbour states the training needed to bring aboard a toolmaker takes six years to complete.

On the other side, the automakers are planning to introduce 154 new models between now and 2018, a third alone coming down the ramps in 2014. With each new model requiring around 3,000 new tools to screw them all together, if not more due to increasing complexity, capacity can only continue to be strained.

Along with the other issues at hand, there’s also the fact that the automakers producing their goods in North America prefer to keep their business inside the NAFTA zone, ignoring Chinese toolmakers who could make the tooling needed quickly and cheaply. That said, Chinese and German toolmakers are planning to set up shop in the economic zone soon in an effort to encourage automakers to reach out for their tools once the latter opts to remove their blinders.

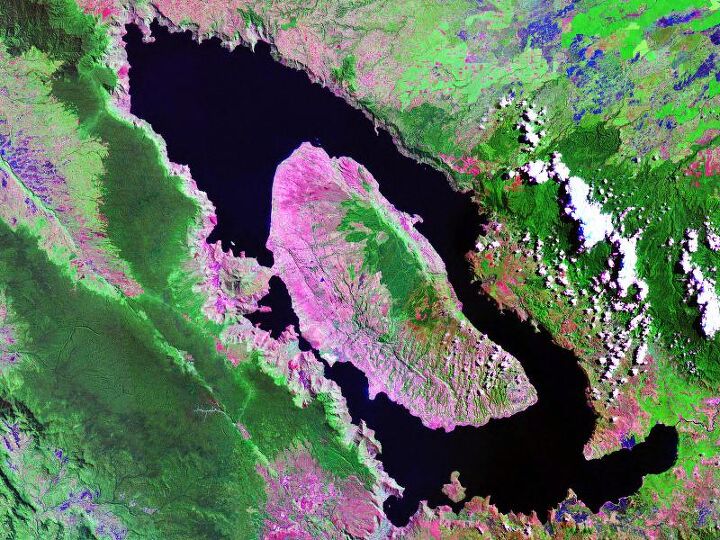

Another potential cause of the coming automotive production bottleneck? Disasters such as the Marl Chemical Park explosion in 2012, the Fukushima earthquake and tsunami in 2011, or a similar incident like the Lac-Mégantic derailment this year.

The only solution to all of these scenarios, in the words of Charlie Sheen, is for automakers to plan better by finding where the bottlenecks could occur, and promptly finding ways to avoid them, whether it’s through shifting key component manufacturing elsewhere or simplification of their latest and greatest.

More by TTAC Staff

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kwik_Shift_Pro4X Where's the mpg?

- Grg These days, it is not only EVs that could be more affordable. All cars are becoming less affordable.When you look at the complexity of ICE cars vs EVs, you cannot help. but wonder if affordability will flip to EVs?

- Varezhka Maybe the volume was not big enough to really matter anyways, but losing a “passenger car” for a mostly “light truck” line-up should help Subaru with their CAFE numbers too.

- Varezhka For this category my car of choice would be the CX-50. But between the two cars listed I’d select the RAV4 over CR-V. I’ve always preferred NA over small turbos and for hybrids THS’ longer history shows in its refinement.

- AZFelix I would suggest a variation on the 'fcuk, marry, kill' game using 'track, buy, lease' with three similar automotive selections.

Comments

Join the conversation

Now you know what's behind efforts like VW's MQB platform engineering. A vastly reduced overhead for all the models they want to produce because of standardization. If the UAW/CAW were smart, they would be holding apprenticeship classes on a regular basis to get new members into the fold instead of trying to force assembly plants to unionize.