Cain's Segments: October 2013 Truck Sales

With an 18,000-unit sales improvement in October, America’s pickup truck market again grew at a slightly quicker pace than the overall industry.

The 11% year-over-year improvement came despite the loss of numerous nameplates and the drastic slowdown of Chevrolet Avalanche volume. Excluding small and midsize trucks, the appetite for pickup trucks was 12% stronger than it was one year ago.

Pickup truck sales are up 14% this year. Full-size truck sales are up 19%.

The Tacoma and its not-so-merry gang of smaller trucks were responsible for just 11% of all truck sales over the last ten months, down sharply from 15% through the first ten months of 2012.

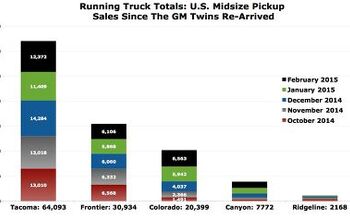

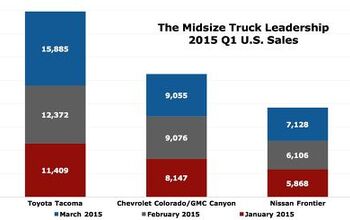

There’s no doubt that the Tacoma has benefited from the disappearance of the Dakota, Ranger, and Equator and the pause in North American sales of GM’s two small pickups. Tacoma growth slowed in October – though sales were still stronger than in the same period a year ago – but volume is up 17% this year, a faster rate of growth than we’re seeing across the pickup truck category. Nevertheless, the fifth-ranked Tacoma isn’t reporting quite the same measure of year-over-year improvement that is being attributed to the four better-selling trucks.

65% of the small/midsize trucks sold in the United States this year have been Tacomas, up from 48% during the first ten months of 2012. Even nearing the end of its life, Ford’s Ranger generated 8% of small/midsize truck sales at this time last year, a figure which has fallen to nothing in 2013.

Yet without the Ranger, Ford is selling a substantially higher number of pickup trucks in America this year: 83,859 more over the last ten months, a 15.5% year-over-year increase. 35% of the trucks sold in the United States this year have been Fords; 39% of the full-size trucks.

Ford has reported six consecutive months with more than 60,000 F-Series sales, a feat Ford only accomplished once in 2012 and once in 2011. F-Series sales have grown in each of the last 27 months. After generating 28% of Ford brand volume in 2009, 30% in 2010, 28% in 2011, and 30% in 2012, Ford currently relies on the F-Series for 31% of the brand’s sales.

Much of the pickup truck world’s recent news has rightly involved the new General Motors twins. Whether it’s a lack of 5.3L V8 engines or high transaction prices or prices that are too high, the automotive world pays attention when General Motors introduces new trucks. Between the Silverado and Sierra, GM owned 36% of the full-size truck market in October, on par with what GM achieved one year ago.

As the new trucks become more widely available, we’ll be looking for more than just sales growth. If GM can’t attract greater market share when the Silverado and Sierra are brand new, what will happen when Ford, the maker of America’s best-selling vehicle, debuts its next F-150 for 2015? And don’t ignore the fact that Ram market share in the full-size segment rose to 18% in October 2013, up from 17% in October 2012.

TruckOctober2013October2012October %Change10 mos.201310 mos.2012YTD%ChangeFord F-Series63,803 56,497 + 12.9% 623,309 520,230 + 19.8% Chevrolet Silverado 42,660 38,739 + 10.1% 403,435 336,939 + 19.7% Ram Pickup29,846 25,222 + 18.3% 292,633 238,815 + 22.5% GMC Sierra16,503 14,568 + 13.3% 152,173 126,749 + 20.1% Toyota Tacoma12,351 12,191 + 1.3% 134,123 115,063 + 16.6% Toyota Tundra9913 8086 + 22.6% 91,734 83,058 + 10.4% Nissan Frontier5242 3051 + 71.8% 51,423 47,865 + 7.4% Honda Ridgeline1239 996 + 24.4% 14,807 11,225 + 31.9% Nissan Titan984 1582 – 37.8% 13,227 17,988 – 26.5% Chevrolet Avalanche526 2331 – 77.4% 16,144 19,480 – 17.1% Cadillac Escalade EXT137 174 – 21.3% 1811 1522 + 19.0% Chevrolet Colorado 29 1612 – 98.2% 3404 34,220 – 90.1% GMC Canyon5 472 – 98.9% 923 8090 – 88.6% Suzuki Equator— 135 – 100% 448 1561 – 71.3% Ford Ranger— 74 – 100% — 19,220 – 100% Dodge Dakota— 2 – 100% —490 – 100% — ———— — — Total 183,238165,732+ 10.6%1,799,594 1,582,515 + 13.7% Full-Size TruckOctober2013October2012October%Change10 mos.201310 mos.2012YTD %ChangeFord F-Series63,803 56,497 + 12.9% 623,309 520,230 + 19.8% Chevrolet Silverado 42,660 38,739 + 10.1% 403,435 336,939 + 19.7% Dodge Ram29,846 25,222 + 18.3% 292,633 238,815 + 22.5% GMC Sierra16,503 14,568 + 13.3% 152,173 126,749 + 20.1% Toyota Tundra9913 8086 + 22.6% 91,734 83,058 + 10.4% Honda Ridgeline1239 996 + 24.4% 14,807 11,225 + 31.9% Nissan Titan984 1582 – 37.8% 13,227 17,988 – 26.5% Chevrolet Avalanche526 2331 – 77.4% 16,144 19,480 – 17.1% Cadillac Escalade EXT137 174 – 21.3% 1811 1522 + 19.0% — ———— — — Total 165,611148,195+ 11.8%1,609,2731,356,006+ 18.7% Small/MidsizeTruckOctober2013October2012October % Change10 mos.201310 mos.2012YTD % ChangeToyota Tacoma12,351 12,191 + 1.3% 134,123 115,063 + 16.6% Nissan Frontier5242 3051 + 71.8% 51,423 47,865 + 7.4% Honda Ridgeline1239 996 + 24.4% 14,807 11,225 + 31.9% Chevrolet Colorado 29 1612 – 98.2% 3404 34,220 – 90.1% GMC Canyon5 472 – 98.9% 923 8090 – 88.6% Suzuki Equator— 135 – 100% 448 1561 – 71.3% Ford Ranger— 74 – 100% — 19,220 – 100% Dodge Dakota— 2 – 100% —490 – 100% — ———— — — Total 18,86618,533+ 1.8%205,128237,734– 13.7%More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy TG likes price reductions.

- ToolGuy I could go for a Mustang with a Subaru powertrain. (Maybe some additional ground clearance.)

- ToolGuy Does Tim Healey care about TTAC? 😉

- ToolGuy I am slashing my food budget by 1%.

- ToolGuy TG grows skeptical about his government protecting him from bad decisions.

Comments

Join the conversation

You could have entitled this "The Incredible Shrinking Compact-Midsize Truck Market." While sales of full size trucks are approaching pre-recession levels, the combined compact-midsize segments have taken a nosedive. In 2005, the full-size trucks outsold the smaller ones by a ratio of just under 4 to 1; so far this year, that gap has increased to almost 8 to 1. There's just enough interest for now to keep Toyota and Nissan in business, but there isn't much room for the rest. The trend is obviously moving in one direction, and that trend doesn't favor smaller trucks.

When will all these new truck sales take the price of used trucks down? Used truck prices are too high.