Cain's Segments, November 2013: Compact Vs. Mid-Size Cars

Four months ago, when we last looked into the U.S. compact car sales battle, the Toyota Corolla (including the Matrix hatchback offshoot with which Toyota combines Corolla sales figures) was the class leader. Yet the expiring Corolla’s lead over the Honda Civic was slim, and it didn’t seem promising.

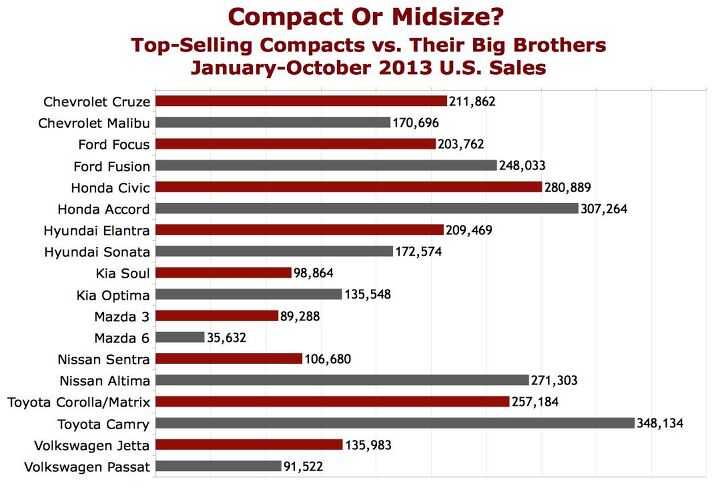

Indeed, through ten months, the best-selling compact car in America is the Honda Civic, not the Toyota Corolla. By the end of October, the Civic was America’s third-best-selling car, up from sixth at the halfway point.

Toyota’s Corolla is now 23,705 sales back of the increasingly popular Honda.

The Civic’s 10% year-over-year improvement through the end of October comes on the heels of a year in which Civic sales rose to their highest level since 2008. Honda may not be commanding absurd transaction prices, and they may be competing with the same kinds of incentives used by other automakers, but that doesn’t change the outright number of Civics that are currently being sold.

The Civic outsold Honda’s top seller, the Accord, in the months of July, August, and October. Accord sales were down 0.5% over the last four months as Civic volume jumped 25% to 122,185 units, 1781 more than what Honda managed with the Accord.

By those measurements, the Honda Civic seems to be the dominant small car in the United States. Through six months, 13.5% of the sales generated by the cars we showed in the compact table were Civic-derived, a figure which has risen to 14.6% through ten months.

But you can do math just as well as Dave in accounting. If fewer than 15% of of compact car buyers are choosing the Civic then most compact car buyers, more than 85% of them, are choosing something other than the Civic.

There certainly is a dominant group of small cars. The Civic, Corolla, Chevrolet Cruze, Hyundai Elantra, Ford Focus, Volkswagen Jetta, and Nissan Sentra – the seven compacts which have attracted at least 100,000 buyers so far this year – produce 73% of the compact category’s U.S. sales.

Although October was a particularly poor month for compact car sales in America, the category has certainly punched beyond its weight category over the course of 2013. Automotive News says car sales are up just 5% this year even as the overall auto industry has grown 8.2%. Yet compact sales are up 6.6%.

The segment has been pushed forward most especially by the Dodge Dart, which has contributed 46,630 more sales than Dodge compacts did last year, and by the Hyundai Elantra’s 25% year-over-year improvement, equal to 42,382 extra sales. Declines among compacts were most notable at Kia, Mazda, and Volkswagen.

If we define the compact segment’s borders in a stricter fashion, compact growth still appeared slow in October, yet healthy through ten months. Exclude the Suzuki SX4, two Scions, Nissan’s Cube, and the Kia Soul and compact sales rose 0.8% in October; 8.1% year-to-date. Exclude those cars plus the defunct Dodge Caliber and compact sales were up 0.9% in October; 8.2% year-to-date. Exclude the aforementioned cars and the premium-leaning Acura ILX and Buick Verano and compact car sales rose 0.7% to 143,475 units in October; 7.9% to 1,732,330 year-to-date.

AutoOctober2013October2012%Change10mos.201310mos.2012%ChangeAcura ILX2005 1529+ 31.1%17,2757658+ 126%Buick Verano3306 3502– 5.6%39,87432,648+ 22.1%Chevrolet Cruze16,087 19,121-15.9%211,862199,721+ 6.1%Dodge Caliber— 92– 100%4510,113– 99.6%Dodge Dart5617 5455+ 3.0%71,45314,710+ 386%Ford Focus15,108 18,320– 17.5%203,762205,006– 0.6%Honda Civic27,328 20,687+ 32.1%280,889254,716+ 10.3%Hyundai Elantra14,876 14,512+ 2.5%209,469167,087+ 25.4%Kia Forte4706 5911– 20.4%57,42167,139– 14.5%Kia Soul8240 7988+ 3.2%98,864101,344– 2.4%Mazda 37674 9518– 19.4%89,288103,223– 13.5%Mitsubishi Lancer1161 1256– 7.6%16,58114,024+ 18.2%Nissan Cube297 475– 37.5%47196287– 24.9%Nissan Sentra8399 5624+ 49.3%106,68091,464+ 16.6%Scion xB1246 1463– 14.8%15,23817,055– 10.7%Scion xD716 855– 16.3%76769280– 17.3%Subaru Impreza4923 4738+ 3.9%64,92268,389– 5.1%Suzuki SX4— 1072– 100%285910,633– 73.1%Toyota Corolla/Matrix23,637 20,949+ 12.8%257,184243,652+ 5.6%Volkswagen Golf2249 2914– 22.8%26,83635,322– 24.0%Volkswagen Jetta11,710 13,476– 13.1%135,983140,504– 3.2%———————Total159,285159,457– 0.1%1,918,8801,799,975+ 6.6%More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Calrson Fan Jeff - Agree with what you said. I think currently an EV pick-up could work in a commercial/fleet application. As someone on this site stated, w/current tech. battery vehicles just do not scale well. EBFlex - No one wanted to hate the Cyber Truck more than me but I can't ignore all the new technology and innovative thinking that went into it. There is a lot I like about it. GM, Ford & Ram should incorporate some it's design cues into their ICE trucks.

- Michael S6 Very confusing if the move is permanent or temporary.

- Jrhurren Worked in Detroit 18 years, live 20 minutes away. Ren Cen is a gem, but a very terrible design inside. I’m surprised GM stuck it out as long as they did there.

- Carson D I thought that this was going to be a comparison of BFGoodrich's different truck tires.

- Tassos Jong-iL North Korea is saving pokemon cards and amibos to buy GM in 10 years, we hope.

Comments

Join the conversation

Tim, Nice segment snapshot....would also be interesting to take those same compacts and pair them with their subcompact little brothers.

Seems like market share hasn't changed much over the last 25 yearg (Tho quality / engineering has).