Hail Mary: Cadillac Bets Big On China

When GM announced last week t hat it wants to increase Cadillac’s share of the global luxury market from 8.5 percent now to 9 percent by 2016, we opined that from “looking at the plan, GM appears to be betting big on the success of its new Chinese assembly plant.” It turns out that Cadillac is betting big on China. Cadillac “aims to quadruple its share of China’s luxury auto market to 10 percent by 2020,” Reuters reports today.

By 2020, GM is “targeting about 250,000 luxury car sales in China,” says Reuters. It will be rough.

China is an astoundingly sophisticated and well-informed market when it comes to cars. When I came to China first some 10 years ago, I was amazed to see internal Volkswagen platform codes being routinely bandied about in the media. I helped a bit with the 2006 launch of the Magotan in China, to learn to my bafflement that media and the masses called it the “Passat B6” as opposed to the Passat B5 that was built by Shanghai Volkswagen.

China bypassed the buff books completely, the Internet car sites are huge and influential, and they read all the foreign sites.

Chinese car buyers, especially those interested in the higher segments, are well informed, and recently well traveled. They know that in terms of premium marques, it’s the Germans that rule the world. GM’s Susan Docherty was right when she said: “If a luxury brand is successful in Europe, whether that brand is Chanel or Prada, or Mercedes or BMW, people in parts of Asia look to see what Europeans validate as true luxury.” This thinking will strongly limit Cadillac’s chances in China, unless there is a serious change of mind.

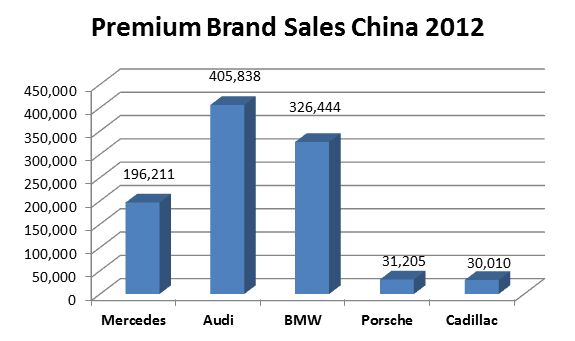

In China, Cadillac is a relative nobody. “German luxury nameplates accounted for 80 percent of premium car sales in China last year,” says Bloomberg, “with the remaining shared by other European, U.S. and Japanese brands.” Audi is the absolute ruler of the premium segment in China, with BMW, up 40 percent in 2012, catching up quickly. Mercedes sales were more or less stagnant – proof that even a Benz has to work hard in China.

Absolutely stagnant was Cadillac . For 2012, GM reported sales of 30,010 Cadillacs in China, two (2) more than in the year before, and we won’t be surprised if the numbers received one of those well-known Chinese massages to finish at a not totally unhappy ending.

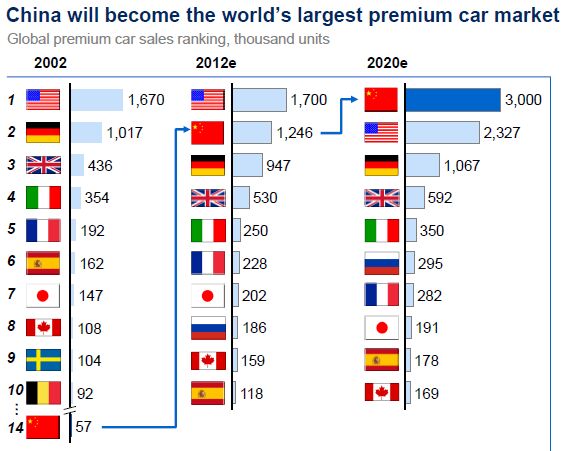

McKinsey’s predictions for the premium car market

The design of the Caddys did not help much to wean Chinese away from their love affair with German premium brands. Caddy’s “edgy new designs, with sharp creases and flat planes inspired by U.S. stealth fighter jets, have failed to impress China’s wealthy car buyers who have voted with their wallets in favor of smoother-looking European rides,” says Reuters. Made in China designs have been toned down and rounded off a bit.

Cadillac’s all-out attack on China, and the optimistic market share targets have the smell of desperation. Premium class buyers are conservative and have a high degree of brand loyalty, which – just ask Audi – can take many decades to dislodge. GM is probably listening to consultants who promise that the young affluent of China have a more open mind. They sure do: They buy BMWs while the older buy long wheelbase Audis.

Brand-wise, Cadillac is a disaster abroad and has seen better times at home. Nevertheless, China is a (in my view, very slim) chance that simply must be taken for Cadillac. Currently the world’s second largest market for luxury cars, China is projected to overtake the U.S. by 2020. If you can’t make in there, you won’t make it anywhere.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 28-Cars-Later I see velour and pleather seats are back in style.

- 28-Cars-Later Please come buy one of the two things we sell which don't suck.

- 28-Cars-Later Ahahahahaha.

- Carrera I live in Florida and owned summer tires once before on a Corolla. Yes I know, it's a Corolla but it drove much better ( to me) with those on. I would have bought them again but replacement time came during the beginning of the " transitory inflation" and by then, I found all seasons that were much cheaper. Currently I own a slightly more performance oriented Acura TLX -AWD and when the OEM all season Michelin wear out, I will replace them with summer Michelins. Often times, a car comes alive with summer tires but I understand why people don't buy them above South Carolina. I lived in Canada for 5 years and just thinking about swapping twice per year made me anxious.

- Steve Biro I don’t bother with dedicated summer or winter tires. I have no place to store them. But the newest all-weather tires (with the three-peak mountain symbol) are remarkably good year-round. The best of them offer 90 percent of the performance of winter tires and still fall mid-pack among summer ultra-high performance tires. That’s more than enough for my location in New Jersey.

Comments

Join the conversation

Bertel keeps noting that the premium car brands have the best loyalty. i'd like to see some back-up numbers. I thought Ford and Kia had the best loyalty and even the premium BMW/Audi are only in the 30% range. that's a lot of wiggle room...

GM would be wise to stop selling Caddy's in China. tell them they can't have them and watch the demand spike. promote Cadillac elsewhere but not in the Middle Kingdom. if we manufacture them there, make it only for export, it will drive them silly. doing so will make the car desirable beyond any push marketing. meanwhile, focus all energies on the Buick brand where there's a foothold and immediate opportunity for growth.