36 Views

Best Selling Cars Around The Globe: How The Chinese Are Setting Themselves Up For Success (Part 2: Latin America)

by

Matt Gasnier

(IC: employee)

Published: June 4th, 2013

Share

{

"id": "9076993",

"alt": "",

"title": "",

"video_link": "https://www.youtube.com/embed/C02SVQpzpJw",

"youtube_video_id": "C02SVQpzpJw"

}

{

"width": 634,

"height": 357,

"showRelated": true

}

This is Part 2 of a 5 Part-series about how the Chinese car manufacturers are faring abroad. You can check out Part 1 about Africa here.If Chinese carmakers have started exporting to Africa in the early 00′s, they set foot in Latin America even earlier, with JAC starting to export trucks to Bolivia back in 1990. Similarly to the strategy they adopted in Africa, the Chinese have initially focused on the less developed car markets in the region. They are now in the process of stepping up their involvement by launching in the bigger, more mature markets like Argentina and Brazil.In fact, the foundations the Chinese have built in secondary Latin American car markets are potentially their strongest in the world so far…

FAW S80. FAW is the 10th most popular brand in Uruguay vs. #16 at home in China.The first logical anchor points in the region are Uruguay and Paraguay, both located between Argentina and Brazil and all part of the Mercosur, which makes it easier to export towards those two powerhouses as local assembly with 30% to 50% share of local components currently receive zero-tariff status inside the Mercosur. Both Chery and Lifan (40,000 units/year capacity) have assembly factories in Uruguay while Dongfeng has one in Paraguay. In Uruguay, 26 of the 60 brands on sale are Chinese, capturing 23.4% of the market so far in 2013 – their highest country penetration outside of China and actually on par with the penetration of Chinese passenger cars within China! There are 7 Chinese carmakers in the Uruguayan Top 20 and 2 among the Top 10: Chery is 6th with 6.8% share after peaking at #2 and 12.2% share in June 2011. FAW is 10th at 3.9%, followed by Geely at #12 and 2.7% and Great Wall at #14 and 2.2%. For comparison Toyota ranks #13 with 2.6% of the market…

The DongFeng Mini Pick-up is now produced in Paraguay. In Paraguay, the Chinese hold 9% of the passenger car market but 59% of the truck market! There were 10 Chinese among the Top 30 best-selling brands in 2012, led by Dongfeng which now produces pick-ups locally, up 57% to Great Wall at ChangAn at Haima at Foton at #23 and ChangHe at

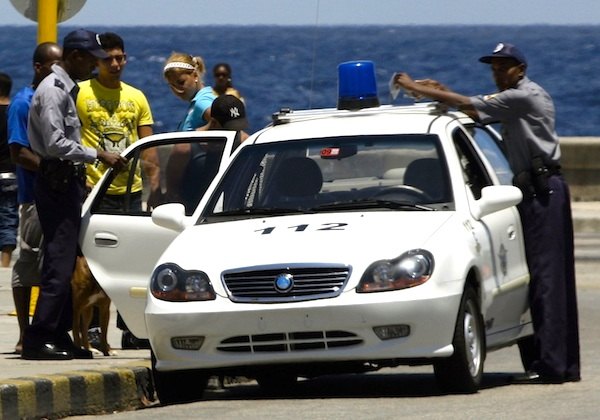

Geely CK Police car in Cuba Peru is another very important hub for Chinese manufacturers in Latin America: it is one of the fastest growing car markets in the world, with the last 3 years all being new records topped up by 178,000 registrations in 2012, and is “facing” China on the Pacific Ocean, making it an enticing port-of-entry into the continent. Roughly 15% of the Peruvian car market go to Chinese models, and latest data shows JAC at #9 in the overall brands ranking and Chery at #10 in the passenger cars one, with Great Wall at #12 and Geely at analysts even estimate that as much as 96 Chinese car brands (who knew there even were that many?!) are sold in Peru both formally in dealerships and informally by rogue vendors…

The DongFeng S30 was the best-selling model in Venezuela in December 2012…Venezuela is a slightly different situation because the exchanges with the rest of the region are more patchy, so the Chinese’s success so far has stemmed either from local production – Chery has started assembling cars there in 2011 but no figures are available – or direct agreements with the Chinese government, like the unprecedented 4,000-unit batch of DongFeng S30 imported in late 2012 which enabled the model to simply take the lead of the sales charts last December. The S30 has since celebrated its 5th consecutive month within the Top 5 best-sellers in Venezuela last month.

Chevrolet N300 If we go up one notch to Chile – yet another record-breaking market at 340,000 sales in 2012, we notice that the best-selling model in the country, the Chevrolet Sail, is actually imported from China. Chinese brands have a 7% market share, with no less than 18 of them represented in the brands ranking. They are led by Great Wall at Chery at JAC at Geely at BYD at #27 and Hafei at In Colombia, there is one (hidden) Chinese model in the Top 40 in 2012: the Chevrolet N300 which is actually a rebadged Wuling Rongguang, up 171% to Bolivia and Ecuador, although no sales data is available, are two other developing Latin American markets likely to have seen a recent flood of Chinese cars.The Caribbean region is yet another under-developed zone most carmakers traditionally sidestep, except the Chinese. Geely regularly ships cars to Cuba, the last batch from October 2011 was composed of 1,300 Geely CK (now a common sight in La Habana as a police car) and 250 Emgrand EC7. In the Dominican Republic, a few Chinese models have already managed to break into the Full Year Top 20 like the BYD F3 (#9 in 2010), the DongFeng Cargo Van ( #14 in 2011) and the Jinbei Haise (#18 in 2011).

Brazilian JAC J3This all means that Chinese carmakers have now established a solid footing in almost all Latin American markets, working extremely hard hard to secure the foundations for long-term success in the region. They are now using these stepping stones to access Argentina (800,000+ annual units) and Brazil (record 3.6 million units in 2012), where the volumes really are. In Argentina, Chery imports from Uruguay and as a result has seen a few models make their way up the ladder: both the Chery QQ ( and Tiggo ( reached their highest ranking so far in the country in March 2013. In Brazil, JAC broke with the Chinese tradition and chose to enter the market all guns blazing on 18 March 2011, which they called J-Day. They simultaneously inaugurated 50 dealerships across the country and hired a famous TV presenter, Fausto Silva, as their ambassador in a multi-million dollar TV campaign (watch above).

The JAC J2 is now the best-selling Chinese model in Brazil ( #64 in April 2013)However JAC’s strong start in the country has since fizzled out. The JAC J3 hatchback ( and J3 Turin sedan ( both hit their highest ranking only 3 months after launch in June 2011 while in the meantime the Chery QQ peaked at #36 in September 2011, but 2012 was harsh: J3 at -37%, J3 Turin at -40% and QQ at -25%, on the back of increased levies on imports. Now both manufacturers realise their success in Brazil lies in local assembly: Chery is reportedly building a 150,000 annual unit-production facility in the São Paulo state while JAC is set to open a 100,000 annual vehicle-plant in the state of Bahia in 2014.A very strong base in Latin America’s developing markets should ensure Chinese manufacturers surf on these markets’ predicted explosive growth in the next coming decades. The next challenge is to manage to crack more mature markets like Brazil and Argentina and this will require a much more significant level of investments in the form of large scale manufacturing operations. But the rewards could be priceless: thanks to its brand-new factory producing models tailored to Brazilian tastes, Hyundai has tripled its market share in the space of a few months… No doubt the Chinese are watching with tremendous interest.Stay tuned for Part 3 of this series tomorrow about Eastern Europe

Matt Gasnier

More by Matt Gasnier

Published June 4th, 2013 10:41 AM

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Analoggrotto Does anyone seriously listen to this?

- Thomas Same here....but keep in mind that EVs are already much more efficient than ICE vehicles. They need to catch up in all the other areas you mentioned.

- Analoggrotto It's great to see TTAC kicking up the best for their #1 corporate sponsor. Keep up the good work guys.

- John66ny Title about self driving cars, linked podcast about headlight restoration. Some relationship?

- Jeff JMII--If I did not get my Maverick my next choice was a Santa Cruz. They are different but then they are both compact pickups the only real compact pickups on the market. I am glad to hear that the Santa Cruz will have knobs and buttons on it for 2025 it would be good if they offered a hybrid as well. When I looked at both trucks it was less about brand loyalty and more about price, size, and features. I have owned 2 gm made trucks in the past and liked both but gm does not make a true compact truck and neither does Ram, Toyota, or Nissan. The Maverick was the only Ford product that I wanted. If I wanted a larger truck I would have kept either my 99 S-10 extended cab with a 2.2 I-4 5 speed or my 08 Isuzu I-370 4 x 4 with the 3.7 I-5, tow package, heated leather seats, and other niceties and it road like a luxury vehicle. I believe the demand is there for other manufacturers to make compact pickups. The proposed hybrid Toyota Stout would be a great truck. Subaru has experience making small trucks and they could make a very competitive compact truck and Subaru has a great all wheel drive system. Chevy has a great compact pickup offered in South America called the Montana which gm could make in North America and offered in the US and Canada. Ram has a great little compact truck offered in South America as well. Compact trucks are a great vehicle for those who want an open bed for hauling but what a smaller more affordable efficient practical vehicle.

Comments

Join the conversation

Everything shown here looks like blatant copies of Japanese and Korean models.

"In Argentina, Chery has started assembling a limited amount of cars locally and as a result has seen a few models make their way up the ladder: both the Chery QQ (#47) and Tiggo (#53) reached their highest ranking so far in the country in March 2013." Chery doesn't assemble cars in Argentina. They assemble them in Uruguay or import them straight from China. They can do this because they pay import taxes and made a joint venture with an Argentinian politician, so they get special treatment. They promised to open a factory in Argentina, but they decided to set up one in Brazil instead. The only Chinese company that has or will have a factory in Argentina is Great Wall, and it's for trucks, not cars.