Analysis: Tesla Q1 2013 Results

Tesla Motors, Inc. released its first quarter financial results yesterday, which featured a number of milestones for the auto maker. Among them, Tesla’s revenue rose 83% from the last quarter to $562 million, a record high for the company.

Tesla also posted the first ever profitable quarter in its history, with a net income of $11 million, or $0.10 on a per share basis. This large growth in revenue was largely aided by the fact that Tesla was able to recognize revenue on 4,900 out of the 5,000 Model S vehicles it managed to produce in the quarter. It is worth noting that $68 million, or 12% of Tesla’s revenue was earned through the sale of Zero Emission Vehicle (ZEV) credits to other automakers. Tesla notes in its letter to shareholders that they expect the sale of ZEV credits to decline in the future, and expect the amount to reach $0 by Q4 2013. Tesla’s move away from the sale these credits and towards growing the sale of their automobiles demonstrates their confidence in projected global demand of 30,000+ units annually. An improvement in their gross margin, which has moved up from 8% to 17%, is also an extremely important factor in their profitability.

One would expect that Tesla has settled down and is beginning to ramp up their production of the Model S while continuing to lower its costs through managing its supply chain and reaching economies of scale. After all, management reaffirmed its guidance of a gross margin of 25% for Q4 2013. In the Outlook section of the letter, Tesla explains that it expects increases in operating, research and development (R&D), and selling general and administrative expenses (SG&A).

Some of these costs may naturally rise in proportion to sales volumes. However, as Tesla fights an uphill battle to expand their gross margin, it cannot lose sight of controlling its fixed costs. Total Operating Expenses currently amount to 18% of sales. Any increase to this amount threatens to eat up any profitability that Tesla might achieve through an increase in gross margin. From a profitability standpoint, the ideal situation would be one in which Tesla could achieve its margin of 25% on its vehicles, while simultaneously taking advantage of its increase in production to achieve economies of scale and decrease operating expenses.

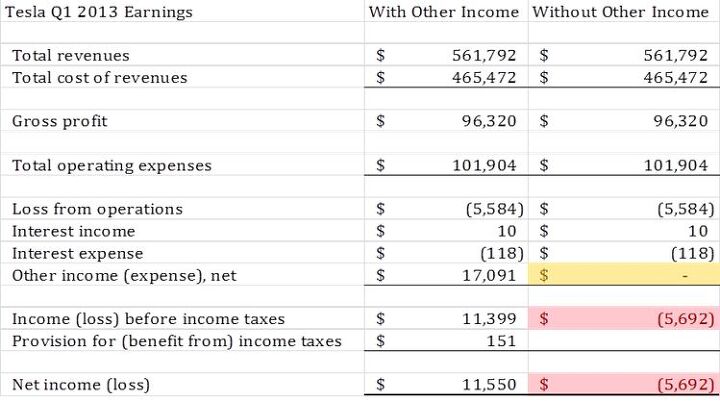

The most interesting line item on Tesla’s quarterly income statement is “Other Income.” Upon examining the statement solely on an operations level, one would notice that Tesla has posted a loss from operations of -$5.5 million. How could Tesla post a net income, yet be posting a deficit through its operations? One need only take a look at the line item “Other Income”, for a better picture. Other Income has a balance of $17 million, $11 million of which is from the elimination of a common stock warrant liability to the Department of Energy, and the remainder is from favorable foreign currency exchange impacts. Both of these items are irregular, specifically the liability elimination, in the fact that they will not likely happen year to year, and are not generated through the company’s regular operations. The liability elimination is also a non-cash item. To get a real sense of how Tesla performed, Other Income can be removed from the income statement (see Figure 1). The result is a net loss of $5.7 million for the quarter. It’s clear that there is still much work to be done before Tesla is truly profitable based on its operations. These types of irregular items cannot be relied upon to achieve profitability every quarter.

Figure 1(in millions)

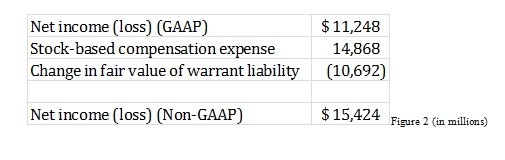

Perhaps a more relevant dataset is Tesla’s non-GAAP figures. The non-GAAP figures, which are intend to be used by management for internal purposes, can sometimes more accurately reflect a company’s performance on the interim, without being hindered by stringent accounting regulations. Figure 2 displays Tesla’s reconciliation of Net Income from GAAP to non-GAAP.

Figure 2 (in millions)

The non-GAAP measure of Net Income is slightly higher than the GAAP reporting, at approximately $15 million. Non-GAAP starts with the GAAP reported income of $11 million. Notice how almost $11 million is subtracted from net income in “Change in fair value of warrant liability.” This represents the Department of Energy liability elimination mentioned earlier. What Tesla is doing here is effectively removing this amount from its GAAP net income, not unlike the similar calculation done above. Tesla has management has realized that this liability is a large contributor to its profits, and has removed it to create a figure more representative of its operational profitability.

The next item is stock-based compensation expense. This amount was originally included in “Total cost of revenues.” For those of you who are unfamiliar with this concept, an article by Ian Gow, an assistant professor of accounting information and management at Northwestern’s Kellog School of Management, explains it as stock options that are granted to employees. Gow explains that recently accounting standards have required companies to disclose stock-based compensation expenses, as Tesla has done by including it in cost of revenue. The article continues to elaborate that stock-based compensation expense is an area for managers to manipulate accounting data in order for them to reach their targets or benchmarks. The accounting for this type of expense becomes increasingly tricky when considering that it is a non-cash expense. While it is harder for management to toy around with this expense due to revisions to GAAP, Tesla has elected to add this expense back to their net income in its non-GAAP reporting. This is not an attempt to discredit the integrity of Tesla’s management, rather to illustrate the importance that non-GAAP figure must be taken with a grain of salt.

Regardless, Tesla has made huge strides in its earnings. Just last quarter (Q4 2012) Tesla posted a net loss of almost $90 million. Accountants and analysts can debate the significance of line items for eternity, the larger point being that of an upward trend for Tesla. In Q2 it will be interesting to see is Tesla can build on its profitability, or fall back into the red without the help of irregular account balances.

All figures taken from Tesla’s SEC Filing

Graeme Kreindler is an HBA Candidate at the Richard Ivey School of Business at The University of Western Ontario.

More by Graeme Kreindler

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 1995 SC Wife has a new Ridgeline and it came with 2 years so I don't have to think about it for a while.My FIAT needed a battery (the 12V...not the drive battery), a replacement steering column cover and I had to buy a Tesla Charging adapter to use the destination charger at one of the places I frequent. Also had to replace the charge cable because I am an idiot and ran the stock one over and destroyed the connector. Around 600 bucks all in there but 250 is because of the cable.The Thunderbird has needed much the past year. ABS Pump - 300. Master Cylinder 100. Tool to bleed ABS 350 (Welcome to pre OBD2 electronics), Amp for Stereo -250, Motor mounts 150, Injectors 300, Airbag Module - 15 at the u pull it, Belts and hoses, 100 - Plugs and wires 100, Trans fluid, filter and replacement pan, 150, ignition lock cylinder and rekey - 125, Cassette Player mechanism - 15 bucks at the U Pull it, and a ton of time to do things like replace the grease in the power seat motots (it was hard and the seats wouldn't move when cold), Rear pinion seal - 15 buckjs, Fix a million broken tabs in the dash surround, recap the ride control module and all. My wife would say more, but my Math has me around 2 grand. Still needs an exhaust manifold gasket and the drivers side window acts up from time to time. I do it all but if I were paying someone that would be rough. It's 30 this year though so I roll with it. You'll have times like these running old junk.

- 3-On-The-Tree Besides for the sake of emissions I don’t understand why the OEM’s went with small displacement twin turbo engines in heavy trucks. Like you guys stated above there really isn’t a MPG advantage. Plus that engine is under stress pulling that truck around then you hit it with turbos, more rpm’s , air, fuel, heat. My F-150 Ecoboost 3.5 went through one turbo replacement and the other was leaking. l’ll stick with my 2021 V8 Tundra.

- Syke What I'll never understand about economics reporting: $1.1 billion net income is a mark of failure? Anyone with half a brain recognizes that Tesla is slowly settling in to becoming just another EV manufacturer, now that the legacy manufacturers have gained a sense of reality and quit tripping over their own feet in converting their product lines. Who is stupid enough to believe that Tesla is going to remain 90% of the EV market for the next ten years?Or is it just cheap headlines to highlight another Tesla "problem"?

- Rna65689660 I had an AMG G-Wagon roar past me at night doing 90 - 100. What a glorious sound. This won’t get the same vibe.

- Marc Muskrat only said what he needed to say to make the stock pop. These aren't the droids you're looking for. Move along.

Comments

Join the conversation

One of Tesla's real opportunities is in Europe. The difference between gas prices and electricity prices is far greater there, and the reduction in operating costs means that the car is about half the price that it is in the US. Supposedly in Norway, where the strength of the currency makes any imported goods seem ridiculously inexpensive, Model S production is already sold out through the end of the year. Why is the Norwegian currency doing so well? Oil of course!

All I know is that I saw 2 of them last week. Driving around the South Shore. One was on Rt 24 heading south at 65 MPH.