European Slaughterhouse: EU Car Sales Down For The 18th Straight Month, U.S. Makers Badly Mauled

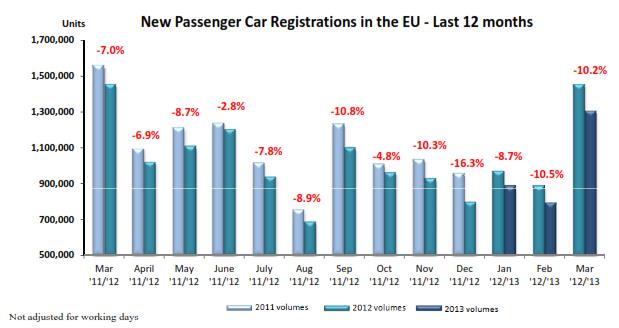

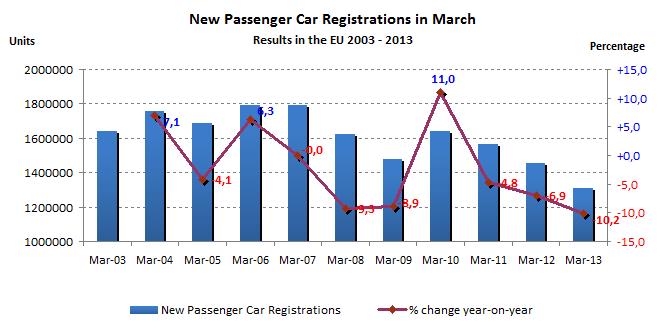

If anyone is hoping for a bottom in the European car market, then it’s nowhere to be seen. In the contrary, the decline appears to be accelerating. European passenger car registrations were down 10.2 percent in March, data published by the European manufacturers association ACEA show. That would be a decline for the 18th consecutive month.

Germany, which used to be an island of stability, was down a whopping 17.1 percent in March. Italy was down 4.9 percent, Spain lost 3.9 percent in sales, France decreased 16.2 percent. Only the UK, up 5.9 percent, saw increased sales.

For the first three months of the year, the European passenger car market declined by 9.8 percent, compared to the same period a year earlier.

New Passenger Registrations EU & EFTA By ManufacturerMarchJanuary – March %ShareUnitsUnits% Chg %ShareUnitsUnits% Chg’13’12’13’1213/12’13’12’13’1213/12ALL BRANDS**1,346,8891,500,880-10.33,096,2663,428,926-9.7VW Group23.723.5319,662352,533-9.324.323.7751,340813,394-7.6VOLKSWAGEN11.612.3156,487184,080-15.012.212.6377,549431,262-12.5AUDI5.75.676,40183,630-8.65.55.2169,871179,885-5.6SEAT2.32.131,15630,856+1.02.32.069,95969,541+0.6SKODA3.73.650,46553,641-5.94.03.8122,435132,008-7.3Others (1)0.40.05,153326+1480.70.40.011,526698+1551.3PSA Group10.311.0138,173164,998-16.311.211.9345,258407,606-15.3PEUGEOT5.75.976,69788,906-13.76.16.3189,082217,457-13.0CITROEN4.65.161,47676,092-19.25.05.5156,176190,149-17.9RENAULT Grp7.67.5101,962112,903-9.78.38.2258,311281,800-8.3RENAULT5.86.278,08593,033-16.16.26.6193,413225,170-14.1DACIA1.81.323,87719,870+20.22.11.764,89856,630+14.6GM Group8.48.6112,918129,402-12.77.88.1241,944277,129-12.7OPEL/VAUXHALL7.47.499,595110,833-10.16.76.6208,994226,991-7.9CHEVROLET1.01.213,30618,530-28.21.11.532,86449,989-34.3GM (US)0.00.01739-56.40.00.086149-42.3FORD8.28.7110,243131,128-15.97.38.2224,883281,594-20.1FIAT Group6.05.480,70381,658-1.26.46.3197,806217,712-9.1FIAT4.73.963,14958,607+7.75.04.5153,807154,287-0.3LANCIA/CHRY0.60.67,6529,302-17.70.60.819,33627,255-29.1ALFA ROMEO0.50.77,18010,185-29.50.60.817,54527,220-35.5JEEP0.20.22,1762,907-25.10.20.26,0927,501-18.8Others (2)0.00.0546657-16.90.00.01,0261,449-29.2BMW Group6.66.288,93493,320-4.76.35.7194,920196,738-0.9BMW5.24.970,59273,890-4.55.14.6158,462157,587+0.6MINI1.41.318,34219,430-5.61.21.136,45839,151-6.9DAIMLER5.44.973,18773,899-1.05.44.9168,331168,003+0.2MERCEDES4.94.466,35265,814+0.84.94.3150,739148,940+1.2SMART0.50.56,8358,085-15.50.60.617,59219,063-7.7TOYOTA Grp4.54.860,02271,976-16.64.44.8135,097163,474-17.4TOYOTA4.34.657,38268,295-16.04.24.5129,662154,838-16.3LEXUS0.20.22,6403,681-28.30.20.35,4358,636-37.1NISSAN4.34.357,37063,935-10.33.93.9121,330132,198-8.2HYUNDAI3.43.345,19350,230-10.03.53.4109,693115,057-4.7KIA2.72.336,59235,262+3.82.72.382,75179,974+3.5VOLVO CAR1.71.722,77026,148-12.91.81.954,36863,849-14.8HONDA1.81.323,62519,892+18.81.41.143,69336,759+18.9JLR1.81.423,99821,321+12.61.41.143,40138,285+13.4LAND ROVER1.41.118,80317,096+10.01.10.934,80331,384+10.9JAGUAR0.40.35,1954,225+23.00.30.28,5986,901+24.6MAZDA1.31.418,08221,187-14.71.31.139,80439,125+1.7SUZUKI1.31.317,32020,060-13.71.21.338,63644,185-12.6MITSUBISHI0.60.78,5729,843-12.90.60.718,91124,056-21.4OTHER**0.61.47,56321,185-64.30.81.425,78847,988-46.3The list of manufacturers resembles a MASH unit after a major battle: Blood and severed limbs everywhere. Volkswagen ended its walk on water and is down 9.3 percent in March. GM is down12.7 percent, Ford 15.9 percent. PSA lost 16.3 percent in sales and is down 15.3 percent for the first quarter.

Renault is down only 9.7 percent, saved by its low cost Dacia brand which is up a remarkable 20.2 percent. We have been telling you to keep an eye on the low cost segment, to which Europeans increasingly flock in those trying times.

Looking at the first quarter of the GM Group, prospects of producing itself out of the crisis look like a pipe dream. Interestingly, GM’s big hope, Chevrolet, is down 34.3 percent in the first quarter while Opel lost only 7.9 percent in the first three months. Imports from the U.S. are as good as non-existent. Only 86 GM units have been imported from the U.S. and sold in the EU, strangely without anyone complaining about a closed European market.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Analoggrotto Ford wishes it could be Hyundai Kia Genesis.

- John I used to have a 2016 Chevy Spark EV (leased, 85 miles range when new) as our family's 3rd car. Loved it. When the lease ended the only cheap EV was the bolt but I couldn't stomach the tuperware interior so I bought a used Cayman instead and have been waiting now for another a cheap EV for almost 5 years. My bigger problem would be that I dislike giving Elon Musk even more $$, but the tesla supercharger network makes long trips (within CA at least) an option.

- SCE to AUX "...it’s unclear how Ford plans to reach profitability with cheaper vehicles, as it’s slowed investments in new factories and other related areas"Exactly. They need to show us their Gigafactories that will support the high-demand affordable EV volume.

- 1995 SC I have a "Hooptie" EV. Affordable would be a step up.

- Buickman if they name it "Recall" there will already be Brand Awareness!

Comments

Join the conversation

GM and Ford are in a real holes. What can they do to reverse this? So Ford had the "best" selling car Globally. First or more probably 2nd best selling car Globally, has not done much for the bottom line in Europe.

Really not bad for Fiat