Chinese Brands Continue To Profit From Japanese Woes, Germans Not So Much

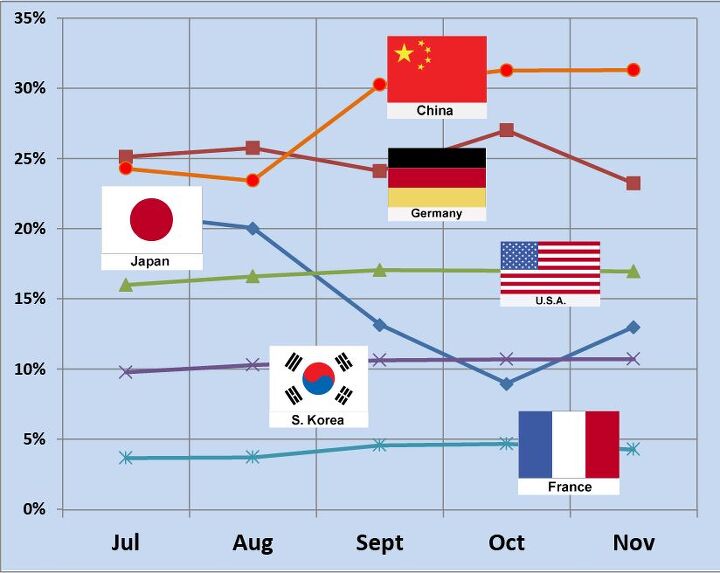

Market share by country, passenger vehicles, w/o SUV

The island row does not make headlines anymore in China where people focus on the once in a decade transition of power. Japanese carmakers however still feel the pain. Two countries appear to be the winners: China and Germany.

Sales of Japanese-branded have rebounded slightly from their October low in November, as their share of the passenger-car market (not counting SUVs) rose from 7.61% in October to 11.65% in November. Sales are far away from their former market-leading glory.

Three trends become evident:

- Chinese brands are up solidly.

- German-branded cars are can easily take the place of Japanese in the Chinese customer’s mind, but can just as quickly lose the gains.

- American, Korean, and French brands profit only slightly from the market dislocations.

And here the data for passenger vehicles including SUVs:

Market Share Passenger Vehicles w/ SUVsJulAugSeptOctNovJapan19.8%18.6%12.2%7.6%11.65%Germany20.4%20.8%19.3%21.6%18.46%U.S.A.11.8%12.3%12.8%12.5%13.06%S-Korea8.7%9.1%9.7%9.7%9.78%France2.6%2.7%3.3%3.3%3.04%China36.7%36.4%42.7%45.1%43.70%Source: CAAMAll data supplied by the China Association of Automobile Manufacturers (CAAM). Data reflect deliveries from automakers to dealers, not sales from dealers to end users.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

Is July's data representative of the market positioning before the China-Japan dispute? I ask because of the statement "Sales are far away from their former market-leading glory." When Japanese market share was third behind German and Chinese.