Will Creditors' Lawsuit Undo GM Bailout? Bankruptcy Judge 'Shocked' By Undisclosed GM Canada Deal

A couple of weeks ago the Wall Street Journal published an article about a “little-noticed” lawsuit in U.S. Bankruptcy Court filed by a trust representing “old” GM’s unsecured creditors. Those creditors are challenging a 2009 deal between GM Canada and a group of hedge funds that helped keep GM’s Canadian subsidiary out of its own bankrupcy. It’s a bit surprising to me that the WSJ article itself got very little notice in the automotive world because, if successful, the lawsuit could undo at least part of GM’s restructuring or result in a $1.3 billion price tag for the automaker. In regulatory filings GM has said its possible exposure will be less than that, $918 million, though in theory the bankruptcy court could reopen the entire bankruptcy, which would be much more disruptive to GM than just paying out a billion dollars.

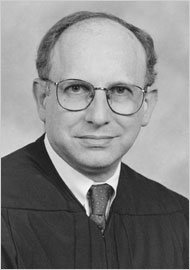

Earlier this year, Judge Garber said,

“When I heard about that, it wasn’t just a surprise, it was a shock. When I approved the sale agreement and entered the sale approval order I mistakenly thought that I was merely saving GM, the supply chain, and about a million jobs. It never once occurred to me, and nobody bothered to disclose, that amongst all of the assigned contracts was this lock-up agreement, if indeed it was assigned at all.”

The case centers on $1.3 billion in GM Canada debt to a group of hedge funds that was waived in 2009 after GM Canada agreed to make a lump sum cash payment of $367 million (USD) to those hedge funds. To make that cash payment, GM Canada in turn borrowed $450 million from old GM. New GM says that it can prove that loan was made before it filed for bankruptcy before Judge Gerber. The trust representing the creditors says that the deal was backdated to hide it from the judge. Those creditors are unhappy because while 35 cents on the dollar doesn’t sound like a great deal, that’s better than what they got.

Ronnie Schreiber edits Cars In Depth, a realistic perspective on cars & car culture and the original 3D car site. If you found this post worthwhile, you can dig deeper at Cars In Depth. If the 3D thing freaks you out, don’t worry, all the photo and video players in use at the site have mono options. Thanks for reading – RJS

Ronnie Schreiber edits Cars In Depth, the original 3D car site.

More by Ronnie Schreiber

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- SCE to AUX All that lift makes for an easy rollover of your $70k truck.

- SCE to AUX My son cross-shopped the RAV4 and Model Y, then bought the Y. To their surprise, they hated the RAV4.

- SCE to AUX I'm already driving the cheap EV (19 Ioniq EV).$30k MSRP in late 2018, $23k after subsidy at lease (no tax hassle)$549/year insurance$40 in electricity to drive 1000 miles/month66k miles, no range lossAffordable 16" tiresVirtually no maintenance expensesHyundai (for example) has dramatically cut prices on their EVs, so you can get a 361-mile Ioniq 6 in the high 30s right now.But ask me if I'd go to the Subaru brand if one was affordable, and the answer is no.

- David Murilee Martin, These Toyota Vans were absolute garbage. As the labor even basic service cost 400% as much as servicing a VW Vanagon or American minivan. A skilled Toyota tech would take about 2.5 hours just to change the air cleaner. Also they also broke often, as they overheated and warped the engine and boiled the automatic transmission...

- Marcr My wife and I mostly work from home (or use public transit), the kid is grown, and we no longer do road trips of more than 150 miles or so. Our one car mostly gets used for local errands and the occasional airport pickup. The first non-Tesla, non-Mini, non-Fiat, non-Kia/Hyundai, non-GM (I do have my biases) small fun-to-drive hatchback EV with 200+ mile range, instrument display behind the wheel where it belongs and actual knobs for oft-used functions for under $35K will get our money. What we really want is a proper 21st century equivalent of the original Honda Civic. The Volvo EX30 is close and may end up being the compromise choice.

Comments

Join the conversation

I know Gerber. He is a pompous @$$ and a jerk.

Hey Ronnie, that judge's last name is Gerber, not Garber.