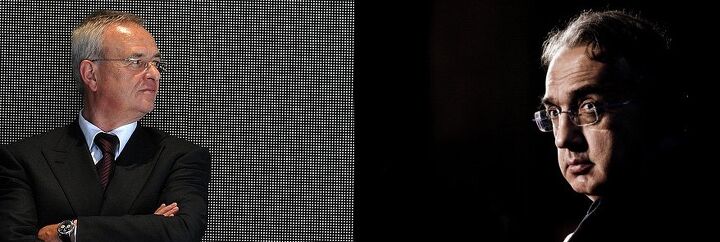

Winterkorn: Marchionne Talks Nonsense

Volkswagen chief Martin Winterkorn heaped salt into the open wounds of Europe’s embattled automakers. In light of the drooping demand, Europe could perfectly manage with 10 fewer plants, Winterkorn said in an interview with Germany’s Handelsblatt. However, don’t you’re your breath on Volkswagen shutting down any of its EU assembly lines. Volkswagen stand behind its European sites “without ifs and buts.” What about Sergio Marchionne’s accusations that Volkswagen is waging a brutal price war in Europe? Winterkorn: “Nonsense.”

“Success goes to whoever builds the right cars at the right time at the right place,” said Winterkorn.

With a “we have enough work on our hands at the moment,” Winterkorn dismissed rumors of Volkswagen buying Proton in Malaysia, or others.Volkswagen has enough brands for the moment. Winterkorn echoed prior remarks by his labor chief Bernd Osterloh and said that Volkswagen’s twelve brands must be consolidated first before any new ones are contemplated or acquired.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

I suspect a lot of "European" companies will start to merge to increase volumes. Renault/ Nissan and Fiat/ Chrysler anyone?

Sounds like a simple case of a successful company dominating in the marketplace. Those who can figure out the market get bigger market share. And a "brutal price war?" That sounds great for the consumer. It's just a capitalist free market system at work. Oh wait, this is Europe we're talking about...

RNC, you summed it up well. The rise and fall of Opel in particular is a sad story. Opel goes back to 1862.

It's real simple for the European car makers: Sell in the US or die. VW has been selling mass market cars for decades. I'm old enough to remember when the BMW dealer in Indy was in a glorified pole barn, now they sponsor cars in the Indy 500. Mercedes was in that position too; 40 years ago, great but seldom seen European cars. Peugeot and Renault threw in the towel and left the US market. Chrysler got pimped to Fiat and Fiat still doesn't have a huge dealer network. JLR, Bentley, and RR have been doing business here for decades. I'm sure I haven't listed some small European brands that were sold here and then left.