Industry: Optimism Is Back, But Only A Little At A Time

Optimism sure ain’t what it used to be. Introducing its latest survey of auto industry executives [ PDF], Booz & Co. proclaims that “optimism is skyrocketing,” and that “a new wave of optimism is overtaking the U.S. auto industry.” They’re not wrong, but for those used to the pre-bailout days of unabashed optimism dressed up as analysis, the “new optimism” is remarkably guarded. And it’s all relative to the pessimism that was beginning to set in when the industry began to realize that the “old optimism” was wildly at odds with the slow-motion market recovery.

So, just how optimistic is the “new optimism”? Which companies have the most reason for optimism? What do industry executives worry about most? When do they expect a Chinese invasion? The answers to these questions and more after the jump.

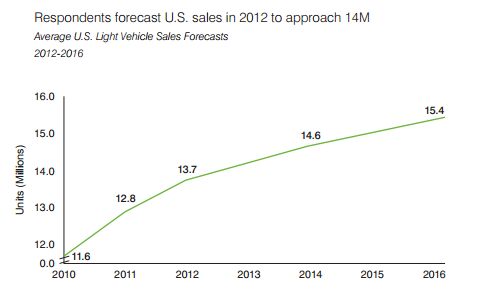

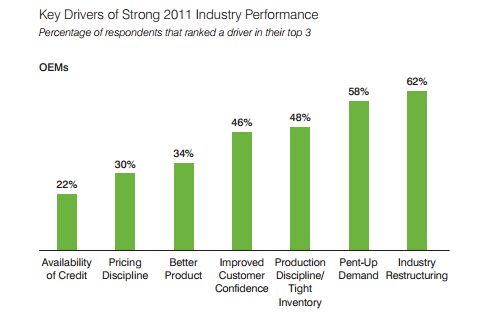

The “somewhat better” scenario that industry execs tell Booz is defining their business planning looks something like this graph. Overall, 86% of suppliers and OEMs expect auto sales growth to be consistent with GDP growth. This steady market growth outlook puts a premium on market share growth, and the execs polled certainly seem to have strong opinions on that front:

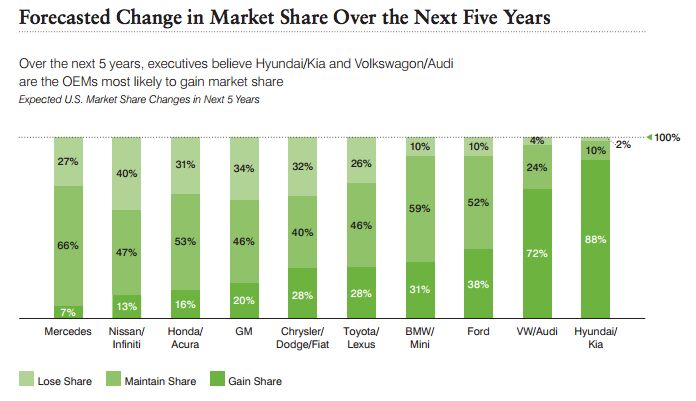

This chart is amazing to me. Clearly the US industry is terrified of two automakers: VW/Audi and Hyundai/Kia. More executives think VW will gain share than think Nissan, Honda, GM or Chrysler will gain or maintain their market share, and the optimism around Hyundai/Kia is straight-up out of control. It’s almost as if auto execs are haunted in their sleep every night by hipster hamsters and the disembodied voice of Jeff Bridges repeating the words “forty miles per gallon” over and over in a congenially bemused voice.

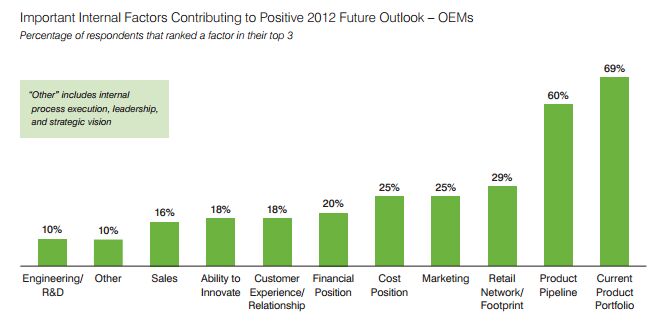

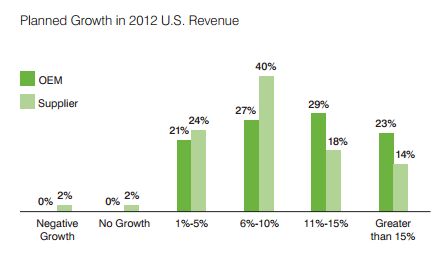

And where do executives think success comes from? Product, product, product. After all, market growth may be slow, but companies expect their revenue to rise. Cost, inventory and pricing discipline can deliver improved profit in a low sales growth environment, but only if the product sells itself.

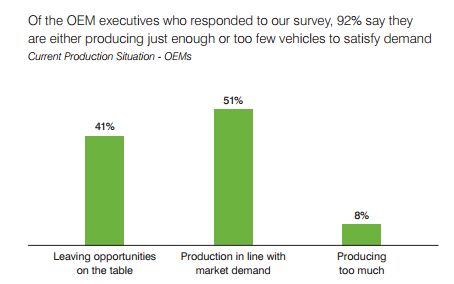

Meanwhile, 55% of the OEM executives polled say their companies are “capacity constrained” and 36% say they are comfortable with current capacity. As sales rise slowly, higher capacity utilization will help drive the revenue improvements the industry sees. Once again, as long as the product is good and discipline can be maintained.

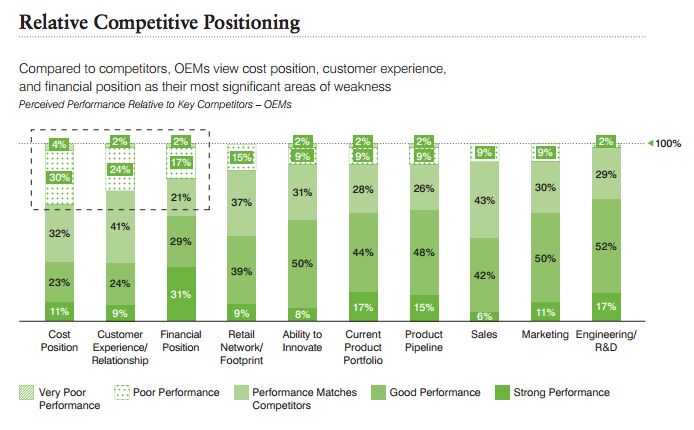

And though 69% identified current product portfolio as a top-three driver of growth in 2012, only 17% expect their current portfolio to turn in a “strong performance” vis-a-vis the competition, with 44% expecting a “good performance.” Cost position and financial position are two factors that could always be better from an executive’s position, but the fact that 26% of execs say customer experience and relationship performance could be “poor” or “very poor” is worrying.

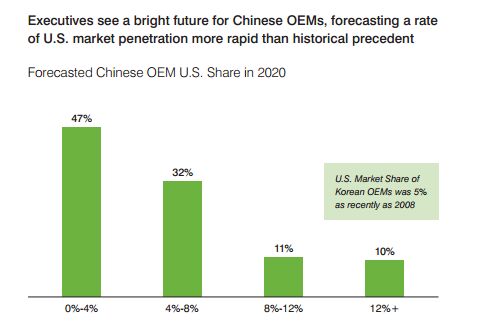

Meanwhile, all the talk of price and capacity discipline and improving profit rather than buying market share will only last as long as there’s no major effort to break into the US market. But by 2020, 32% of auto execs expect Chinese manufacturers to have broken into between four and eight percent of the market. By attacking the low end of the market and aggressively trying to buy a foothold in the US market, Chinese firms hold the potential to wreck the disciplined, realistic “new optimism” by putting severe pressure on pricing discipline.

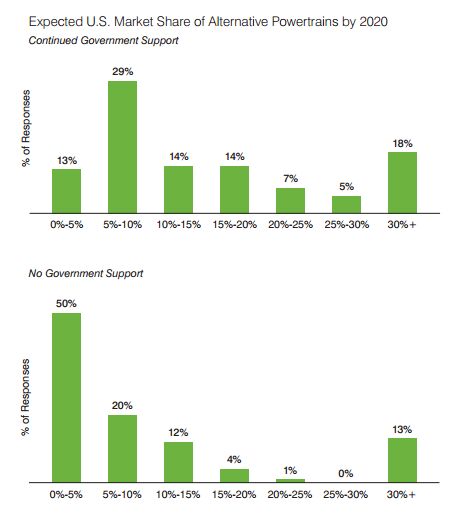

For now, though, the automakers in the US market seems to be settling into a quiet phase of profit-taking rather than adventurous market share grabs. Clearly there’s a sense of having learned tough lessons from the auto bailout, and from the ongoing capacity issues in Europe. But rather than focusing on bailout-era lessons as they did last year, Booz’s 2012-specific questions now center on dealing with “black swan” events like last year’s tsunami and Thai floods. All of which adds to the overall perception that automakers are playing defense, concentrating on profits and hedging against uncertainty.

According to Booz & Co.: Two hundred and eight automotive executives from more than 75 automotive vehicle manufacturers and suppliers participated in the online survey. Thirty-two percent of the respondents were employees of OEMs, and 68 percent work for auto parts suppliers. Three-quarters of the executives were from U.S.-based firms. More than 50 percent of respondents were VP level or above.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jeff JMII--If I did not get my Maverick my next choice was a Santa Cruz. They are different but then they are both compact pickups the only real compact pickups on the market. I am glad to hear that the Santa Cruz will have knobs and buttons on it for 2025 it would be good if they offered a hybrid as well. When I looked at both trucks it was less about brand loyalty and more about price, size, and features. I have owned 2 gm made trucks in the past and liked both but gm does not make a true compact truck and neither does Ram, Toyota, or Nissan. The Maverick was the only Ford product that I wanted. If I wanted a larger truck I would have kept either my 99 S-10 extended cab with a 2.2 I-4 5 speed or my 08 Isuzu I-370 4 x 4 with the 3.7 I-5, tow package, heated leather seats, and other niceties and it road like a luxury vehicle. I believe the demand is there for other manufacturers to make compact pickups. The proposed hybrid Toyota Stout would be a great truck. Subaru has experience making small trucks and they could make a very competitive compact truck and Subaru has a great all wheel drive system. Chevy has a great compact pickup offered in South America called the Montana which gm could be made in North America and offered in the US and Canada. Ram has a great little compact truck offered in South America as well.

- Groza George I don’t care about GM’s anything. They have not had anything of interest or of reasonable quality in a generation and now solely stay on business to provide UAW retirement while they slowly move production to Mexico.

- Arthur Dailey We have a lease coming due in October and no intention of buying the vehicle when the lease is up.Trying to decide on a replacement vehicle our preferences are the Maverick, Subaru Forester and Mazda CX-5 or CX-30.Unfortunately both the Maverick and Subaru are thin on the ground. Would prefer a Maverick with the hybrid, but the wife has 2 'must haves' those being heated seats and blind spot monitoring. That requires a factory order on the Maverick bringing Canadian price in the mid $40k range, and a delivery time of TBD. For the Subaru it looks like we would have to go up 2 trim levels to get those and that also puts it into the mid $40k range.Therefore are contemplating take another 2 or 3 year lease. Hoping that vehicle supply and prices stabilize and purchasing a hybrid or electric when that lease expires. By then we will both be retired, so that vehicle could be a 'forever car'. And an increased 'carbon tax' just kicked in this week in most of Canada. Prices are currently $1.72 per litre. Which according to my rough calculations is approximately $5.00 per gallon in US currency.Any recommendations would be welcomed.

- Eric Wait! They're moving? Mexico??!!

- GrumpyOldMan All modern road vehicles have tachometers in RPM X 1000. I've often wondered if that is a nanny-state regulation to prevent drivers from confusing it with the speedometer. If so, the Ford retro gauges would appear to be illegal.

Comments

Join the conversation

"For now, though, the automakers in the US market seems to be settling into a quiet phase of profit-taking rather than adventurous market share grabs." I would say that depends upon the automaker. VAG and Hyundai are both playing for share -- they are adding models and variety to their US lineups and they can use foreign operations to pay for it. If anything, Hyundai's problem appears to be one of having too little capacity. Likewise, Chrysler is also pushing for share. (They have no choice, as they risk not having sufficient to go the distance.) Nissan seems to be content with competing on price, leaving the top of the segments to the stronger competitors. Ford, TMC and Honda do seem to be more focused on margins. That's been a recipe for TMC's and Honda's success in the US, and Ford wants to play the same game. GM may be somewhere in the middle.

I think Hyundai is both pushing for share and focused on margins. During the the past 2 years or so they've added significant market share and and are among the lowest in incentives paid per unit. They've actually taken a page out of the Honda playbook—aggressively focusing on leasing.