The Return Of Subprime: GM Getting High On Junk Again

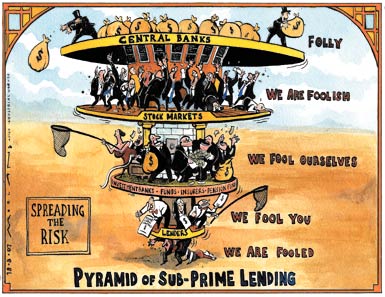

The collapse of the house of cards built with subprime mortgages was a central reason for the 2008 crash. GM’s GMAC was brought down by subprime loans. The economy has not quite recovered, and the deck of cards is again being used as building material. Back in the high-risk game: General Motors.

“As financial institutions recover from the losses on loans made to troubled borrowers, some of the largest lenders to the less than creditworthy, including Capital One and GM.

Consumer advocates and lawyers worry that the financial institutions are again preying on the most vulnerable and least financially sophisticated borrowers, who are often willing to take out credit at any cost.

‘These people are addicted to credit, and banks are pushing it,’ said Charles Juntikka, a bankruptcy lawyer in Manhattan.”

Other people worry that GM fell off the wagon, and is getting a fix on the same old junk. Continues the Times:

“Moody’s was already sounding the alarm last year that some very risky borrowers were getting auto loans. The market, Moody’s wrote in a report in March 2011, could be growing “too much too fast.”

Steve Bowman, the chief credit and risk officer for GM Financial, expects subprime auto loans continue to grow. GM Financial openly flaunts its return to the subprime poker table. On its website, GM Financial says:

“When it comes to subprime auto financing, GM Financial is the perfect fit … Today, over 40 percent of Americans are in need of subprime financing options. And, according to A.T. Kearney’s 15th Annual Automotive Study, the economic downturn of 2008-2009 resulted in an additional 15 million Americans being classified as subprime.”

There is nothing wrong with having a well-managed captive finance arm. Ford Credit is one example. A captive finance arm can provide profits and increase customer loyalty. It is not without risks however. In the wrong or desperate hands, it can get more dangerous than crack. Customers can default. Overly optimistic residuals can break the bank. A parent that is desperate for gaining market share can prod its financing arm into making riskier and riskier bets until the house of cards comes crashing down – again.

Forbes says that subprime lending is “not such a bad thing,” and that “the most important thing for lenders is to keep the lessons learned from 2008 crisis fresh in their memory.” It seems like the only lesson GM Financial has learned is that the 2008 crisis was just the right thing to produce 15 million additional subprime marks.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Carson D I thought that this was going to be a comparison of BFGoodrich's different truck tires.

- Tassos Jong-iL North Korea is saving pokemon cards and amibos to buy GM in 10 years, we hope.

- Formula m Same as Ford, withholding billions in development because they want to rearrange the furniture.

- EV-Guy I would care more about the Detroit downtown core. Who else would possibly be able to occupy this space? GM bought this complex - correct? If they can't fill it, how do they find tenants that can? Is the plan to just tear it down and sell to developers?

- EBFlex Demand is so high for EVs they are having to lay people off. Layoffs are the ultimate sign of an rapidly expanding market.

Comments

Join the conversation

yep..their at it again! My recent credit score is WAY TOO HIGH!!!!!! I should be proud but Ive become rather cynical since I pulled the score(its been 2 years)and damn near fell out of my chair!!! Me thinks the banks are being pressured to get the economy jump started and that's not a good thing!

Subprime mortgage loan defaults were the basis for the credit default swap problems that created the financial crisis of 2008. There is no cause for concern about subprime car loans. Vehicles can easily be repossessed and most subprime car loans are actually being repaid. The situation with vehicles is quite different from that of the housing bubble. While subprime (and any other) mortgage defaults have caused a glut of houses that can't be sold for what is owed, that situation does not exist with vehicles. A vehicle loan default simply results in repossession and resale into a market with very strong used values. GM recognized the competitive disadvantage of not having a captive credit arm, as most makers sell to subprime customers. GM acquired GM Financial specifically to address this disadvantage.