2 Views

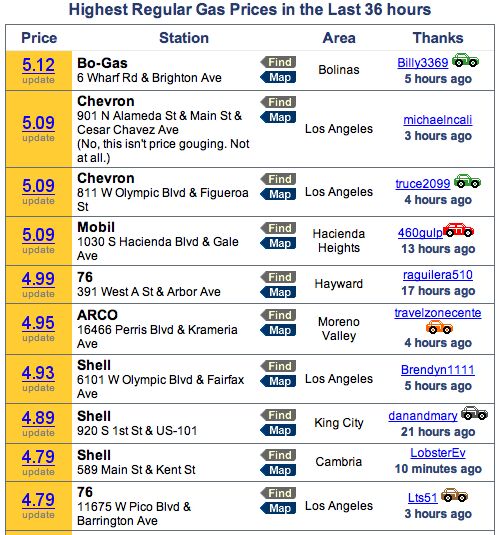

Gas Prices Crest Above $5/Gallon In California

by

Derek Kreindler

(IC: employee)

Published: February 23rd, 2012

Share

Derek Kreindler

More by Derek Kreindler

Published February 23rd, 2012 3:10 PM

Comments

Join the conversation

Gas is $3.65/gallon here in SE Pennsylvania. The rising gas prices have caused me to start adopting some hypermiling practices and I have been pleased with the results. Just last fill up I got 32 MPG in 100% city driving in a car that has an EPA city MPG of 25. I want to see if I can make it to 35 MPG.

lately, the valero station in my san diego neighborhood - usually one of the cheaper resources around here - has been raising prices twice-a-day!

postscript: national public radio broadcast yesterday stated that a couple of stations in the orlando florida area are currently selling gas for more than six dollars/gallon.

£1.33 a litre in sunny Glasgow today. Litre. Pounds. Ugh. It's sad to be a Yurpean who uses a car for work. My sympathies are, frankly, limited.