Dropping Euro Makes Japanese Carmakers Want To Throw Up

Everybody is talking about how much the Euro is losing against the dollar. At closer look, it is not alarming. Even during normal times I have seen lower Euro rates than the current $1.27. But wait until you look at the Euro from a Japanese perspective. (Like the one I have at the moment, sitting in a pittoresk cabin half way up Mount Fuji that could use better heat.) The anemic euro might discourage people like me from coming to Japan. What it really does is discourage Japanese automakers from exporting to Europe. A lot has been said about the strength of the Yen against the dollar. It’s nothing compared to the Euro. Against the Euro, the yen turned into Godzilla. This has Japanese automakers extremely worried. They don’t really know what to do about it.

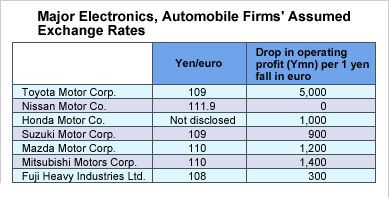

The Nikkei [sub] made a table of manufacturers’ assumed exchange rates, i.e. the exchange rate that is in the budget, and of the drop in operating profit for each yen below that rate. The table is in yen. The dollar fetches around 77 yen ( it has fetched less) at the moment. If there is 1,000 in the right column, then think there are $13 million.

On Monday, the Euro momentarily dropped to 97 yen in Tokyo, its lowest level in about 11 years. Let’s run the numbers for Toyota. Assume the Euro stays there, that would cost Toyota $779 million in operating profit – in Europe alone. Ouch!

The pain is even greater for small Mazda. Says The Nikkei:

“Among automakers, Mazda Motor Corp. is most seriously affected by the euro’s deprecation because it has no plants in Europe. It exported some 200,000 Mazda 3s and Mazda 2s to Europe, including Russia, in 2010. But because exports are unprofitable at the euro’s current exchange rate, Mazda will try to make due for now with cost cuts.”

Mazda is aiming for a 25 percent cut in procurement and production costs, but that may not be enough. Even for automakers with local production in Europe, the euro is falling faster than they can adjust production.

The low Euro of course is a boon for European automakers, especially for the export-heavy Germans. I would love to see a table that discloses how much more money they make for every cent the Euro sinks, but I have never seen such a table.

If you look closely, and with an open mind, you see something else that is highly alarming: The dollar/euro rate is masking the fact that both are dropping rapidly. Euro and dollar fall, the euro just falls a little faster than the greenback It is like two people who just fell out of another airplane. One watching the other guy, the drop might look benign. Viewed from the bottom (and this is where Japan should be,) it looks like a ….. get out of the way!!!!

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Ltcmgm78 Imagine the feeling of fulfillment he must have when he looks upon all the improvements to the Corvette over time!

- ToolGuy "The car is the eye in my head and I have never spared money on it, no less, it is not new and is over 30 years old."• Translation please?(Theories: written by AI; written by an engineer lol)

- Ltcmgm78 It depends on whether or not the union is a help or a hindrance to the manufacturer and workers. A union isn't needed if the manufacturer takes care of its workers.

- Honda1 Unions were needed back in the early days, not needed know. There are plenty of rules and regulations and government agencies that keep companies in line. It's just a money grad and nothing more. Fain is a punk!

- 1995 SC If the necessary number of employees vote to unionize then yes, they should be unionized. That's how it works.

Comments

Join the conversation

When I was in Germany, the 46,000 euro rental car we had was about $75k american. Since it was roughly a 328i equivalent, I drove carefully, wondering how BMW deals with this problem. Clearly they are not alone.

alluster... You have written a well thought out, very informative, and great comment. Thanks.