Volkswagen Is Getting Worried

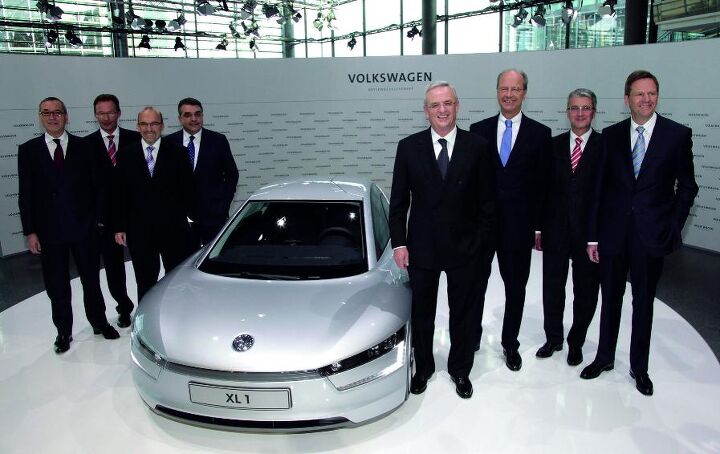

In an interview with Germany’s Handelsblatt, Volkswagen’s CEO Martin Winterkorn said:

„No question, 2012 will be come much tougher, particularly in Europe, and there especially in highly indebted countries like Italy or Spain.The market will shrink in 2012, and we will suffer from that. We expect the European market to get smaller next year. Also the developments in other areas of the world need to be monitored closely.”

On December 15, Winterkorn will prepare the Volkswagen management for the tough times. At a conference in Dresden, there will be “intensive discussions.” This according to an invitation Automobilwoche [sub] could get its hands on.

In Volkswagen-typical hyperbola, the „Strategie 2018“ has been renamed to „Mach 18“. It’s up to you whether you think this means 18 times the speed of light, or (read in German) „do it in 2018.“

Afterburners may be needed, because for the first time, Winterkorn is worried that he might fail:

Winterkorn warns:

“We will reach our Mach 18 targets only with a broad consensus in society.“

If, by 2018, Volkswagen won’t be he largest, most profitable, most admired automaker with the highest customer satisfaction – then it’s the society’s fault. No consensus. Forget about it. New strategy.

Volkswagen is facing more problems than just a soft Europe. There is the never-ending drama with Suzuki. In China, Volkswagen is growing so fast that it has trouble getting qualified personnel. Some factories even have problem getting enough electrical power. And that in a time when China wants to electrify its cars.

According to Automobilwoche, „Winterkorn is worried that the high speed of expansion could create similar problems for Volkswagen as it did fort he Japanese rival Toyota.“

All of this will be discussed on December 15th. It should become an interesting conference.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts The crossover is now just "the car," part 261.

- SCE to AUX I'm shocked, but the numbers tell the story.

- SCE to AUX "If those numbers don’t bother you"Not to mention the depreciation. But it's a sweet ride.

- Shipwright Great news for those down south. But will it remove internal heat to the outside / reduce solar heat during cold winter months making it harder to keep the interior warm.

- Analoggrotto Hyundai is the greatest automotive innovator of the modern era, you can take my word for it.

Comments

Join the conversation

Herr Winterkorn what was it Hitler said about Von Ribbentrop? "With Von Ribbentrop it is so easy because he always blows ." "The others, they come to me and say we must be CAREFUL, exercise CAUTION etc." "With Von Ribbentrop its much better because all I need do is to gently apply the brakes.."

The Euro hasn't fallen probably because a lot of European banks are selling foreign assets and bringing back funds to replace money being withdrawn due to increasing worries about bank solvency. That means the money has go so somewhere, but where? Is it to German bonds, or is there an equal amount of money going to the safer (!) US as is being repatriated? Anyways, I recommend for those who aren't quite sure what's going on or how serious the economic situation is (could be a lot worse than 2008) that they read this and its related articles. economist.com/node/21540255 This special report is also good for more background/explanation. economist.com/node/21536872 It all depends on whether the European Central Bank or Germany will put aside their principles and back the other European countries financially.