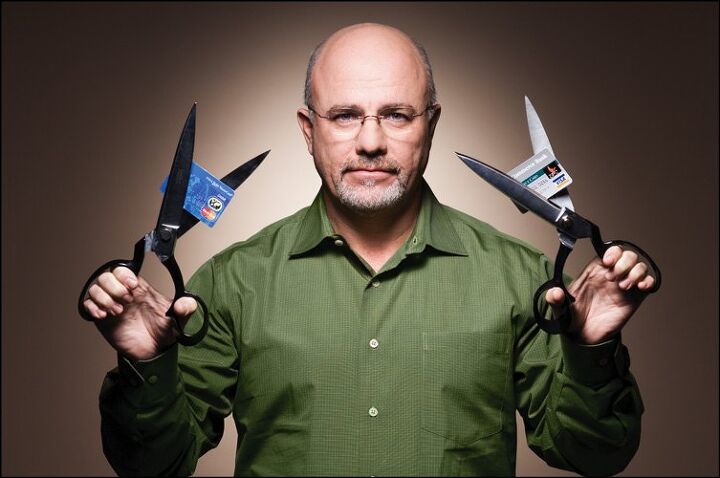

Hammer Time: Dave Ramsey, Bad Math & Statistical Quagmires

Dave Ramsey has done an awful lot of good in this world. Millions have been helped. Billions in debt has been eradicated forever. Plus now a lot of folks finally understand that consumer debt is little more than a barnacle of financial enslavement. When it comes to frugality and avoiding consumer spending traps, Dave Ramsey offers a lot of solid advice.

So having said that, will this article be another soulless puff piece about the virtues of Dave Ramseys methods? Hell no!. As much as I love the fact that he helps so many, I think his math is horrific and his conclusions are dead wrong. .

At least when it comes to cars.

Take a look at this ‘Drive Free, Retire Rich’ presentation and see what you think .

OK… well let’s assume for now you don’t want to. Or will do so after this article. The entire presentation is hinged on two beliefs.

A) Dave assumes we can get a 12% annual return on mutual funds. No taxation. No fees. Never. Plus if you can save that $475 a month payment… you may someday end up with $5.5 million.

This Warren Buffett article and this one by Bill Bernstein put these garbage stats to rest. The 12% annual return myth has been based on a lot of ‘nip and tuck’ investment studies that more or less espouse a belief that stocks can defy logic and grow at three to four times the annual GDP growth rate. They can’t over the long run.

I don’t care too much about the use of old financial myths. At least in 2011, most of us have already heard it all and seen the consequences of irrational exuberance.

What did get my eyebrows raised way beyond my imaginary hairline was this factoid.

B) On average, The top third of new car buyers finance a vehicle at $26,000 over 6 years and wind up paying $33,000. That means on average, one third of the vehicles you see on the street have an average monthly payment of $475 (assuming 9.6% interest).”

Really??? So 33+% of the vehicles on today’s roads are ‘recent‘ new cars that require, on average, $475 monthly payments? There is no way that can be right. Not even in Texas.

What I found out was a bit more sobering…

New car sales have cratered from their peak year of 17.4 Million in 2000 to 11.5 million in 2010. No surprise there.

In fact new car sales only made up 23% of all car sales in 2010 (36.7M Used vs. 11.5M New). Most folks in the auto industry believe that the ‘new normal’ will remain at a 12 to 13 million clip for a while.

But let’s be generous. Let’s assume an annual rate of new car sales of 14 million over these next six years. That would make 4.67 million cars annually that get the Dave Ramsey $475 barnacle.

14 million x ⅓ of buyers = 4.67 million

Multiply the 4.67 million by 6 years for the total population of new cars still under loan, and you get 28 million. A nice round number. Finished? Not quite.

Now we need to subtract out the annual repossession rate (2010 new car repo rate is 2.2% annually) and we end up with 24.5 million.

Are we finished now? Nope. This number doesn’t factor in those new vehicles that were either stolen or totaled. 2.5 million were totaled last year out of a registered vehicle population of 246 million.

If we assume a highly optimistic 1% annual attrition rate, we wind up with only 23.6 million of these cars on the road.

So it looks like only about 9.6% of the cars on the road have these loans. Except registered vehicles are not always daily drivers. Some are tractor trailers. Others are antiques. Many more are government vehicles or commercial vehicles.

Even if 50 million of the 246 million are not daily drivers, the percentage of new vehicles with payment vs. all personal cars on the road would only come out to only 12.2%.

33.3% vs. 12.2%? That’s a lot lower than Dave Ramsey’s factoid.

Is that 12.2% correct? Probably not. I’ve crossed a threshold where statisticians and economists are far better qualified to find the ultimate true answer… if the data is out there. But the belief that one out of every three cars out there is a recent debtful new car still seems way off the mark.

It could be 1 out of 7. Maybe only 1 out of 8. But 1 in 3? In today’s economy? Sheeezzz!!!!

I found a few other whoppers in the presentation. Including…

- Today’s new car loses 25% of it’s value the instant you drive it off the lot.

- After four years, your new car loses 70% of it’s value.

- That $26,000 creme puff bought 4 years ago is worth only about $6,000.

- After 6 years, the ‘normal’ new car buyer gets car fever and buys another one on the note

- A 6 year, 10 month old car is worth only $1500.

- But don’t worry! If you save just 20k and put it in a super-duper ‘stock market mutual fund’, earning 12%, you can buy a $14k to $18k new car every five years for the rest of your life!

You know what? Even If all these ‘leaps of numerical indulgence’ were correct, I still would buy used. Just imagine how much joy you can get out of a 2004 Mazda MX-5 that is only $1500! I’ll gladly take three of those Miatas, another Honda Insight, and maybe a Camry for when my mom is in town.

More by Steven Lang

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy TG likes price reductions.

- ToolGuy I could go for a Mustang with a Subaru powertrain. (Maybe some additional ground clearance.)

- ToolGuy Does Tim Healey care about TTAC? 😉

- ToolGuy I am slashing my food budget by 1%.

- ToolGuy TG grows skeptical about his government protecting him from bad decisions.

Comments

Join the conversation

My opinion on Dave Ramsey is he sometimes overshoots his arguments, and probably uses cherry-picked stats of best and worst case scenarios (ie market returns during boom times or especially bad car loan structures that people with bad credit are forced to use, etc) Still, I think his message is one more Americans should heed. It's astonishing to me our "debt culture" and how it enslaves people to a life of poverty. A little over shooting would probably put most people closer to where they should be.

I have been listening to Dave Ramsey in TN on/off since before he hit it big (The Money Show anyone) and have purchased several of his books though only in used books stores! I tend to agree some with malloric above about Dave Ramsey: "He’s the other side of the credit-fueled conspicuous consumption coin along with the other late-night, get-rich-scheme pushers of his ilk." And that is kind of proved by Dave's books on what he says is even a simple subject: "spend less than you make." Why do new books when he could just update an old one to a current edition? Dollars is the answer on that. One problem I have with him is that he is all about personal responsibility versus holding corporations feet to the fire. He has never ever come out against any predatory lending practices in TN or even to support TN gov't agency's or gov't department's investigations against predatory lending practices and or businesses. He is like an anti-drug crusader who is against drugs but won't report the quick-mart down the street selling legal but harmful synthetic drugs as "bath salts". Also Dave never ever tells people that a new car could be a good investment if it is bought with the understanding to keep it 10 years or more. Owning and (correctly) maintaining a car from mile zero is a better investment than any used car will ever be since you always risk someone else's expensive problem(s) in a used car. Sure not everyone can afford a new car and should stay in a $4,000 used car if they cannot afford a new car versus trying to get a new car on credit alone and spiraling into debt. He should really counsel getting a specific type of used car- not just ugly but one owner for a long period, well maintained, low use, made in large production volumes = better parts availability , and with a good online support group so typical problems for that model car can be quickly queried and determined and/ or fixed or at least know what to tell a mechanic is wrong.