GM China Copies Old Detroit Tactic: Sacrifice Profits For Volume

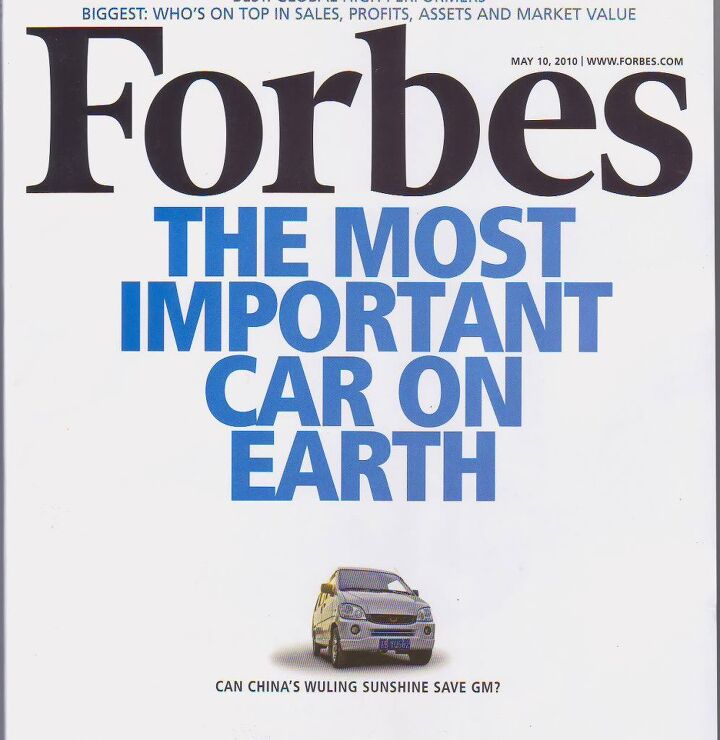

GM China always had a comfortable lead over Volkswagen in China – at least on paper. More than half of GM China’s volume comes from small delivery vans, made by a three-way joint venture with SAIC and Wuling, in which GM held 34 percent. This share had been recently raised to 44 percent. The joint venture agreement allows GM to claim 100 percent of the small cars as theirs. “Whatever turns them on” (or Chinese word to that effect) say the other JV partners who happily count the cars again in their annual reports. There is one big problem with that. The “breadvan segment” (so called because the cars looks like loafs on wheels) has been shrinking and is ruining GM’s otherwise good Chinese numbers. Now, GM can’t take it anymore, and is using a familiar tactic: “GM is sacrificing profit margins to maintain market share in China, cutting prices of low-cost minivans by as much as 15 percent to offset slowing sales in the world’s largest vehicle market,” Bloomberg reports.

“GM does not rely on the minibus for profit,” said Jenny Gu of J.D. Power China. “They only contribute volume.” At 15 percent off, the already razor-thin margin could evaporate. Now remember when we were young and swore we would stop when we need glasses? Same here.

“We made some short-term focused promotions to help the overall market situation,” Matthew Tsien, VP at SAIC-GM-Wuling, told Bloomberg. “We don’t expect it to be a long-term issue.” Same here.

June ’11June ’10ChangeYTDChangeShanghai GM101,52471,78241.4%600,00225.00%Chevrolet51,31238,30434.0%297,84114.50%Buick54,14036,48648.4%324,91928.20%Cadillac2,7221,81250.2%14,07888.30%Wuling88,02799,115-11.2%641,324-5.40%FAW-GM4,3275,220-17.1%30,332-38.80%All GM JV193,878176,4869.9%1,273,5025.30%The best-selling Wuling Sunshine minivan has been reduced to 28,000 yuan ($4,384) from 33,000 yuan earlier this year, according to GM.

Before the price reduction, SAIC-GM-Wuling made about 2,000 yuan ($313) on average for every minivan, says J.D. Power. GM’s 44 percent stake would translate to $138 per car.

In the meantime, Volkswagen is breathing down GM’s neck. GM sold 1.27 million vehicles in China in the first six months, 641,000 of those Wulings (see table.) Volkswagen sold 1.1 million cars in the same time in China, none of them cheap minivans.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Brian Uchida Laguna Seca, corkscrew, (drying track off in rental car prior to Superbike test session), at speed - turn 9 big Willow Springs racing a motorcycle,- at greater speed (but riding shotgun) - The Carrousel at Sears Point in a 1981 PA9 Osella 2 litre FIA racer with Eddie Lawson at the wheel! (apologies for not being brief!)

- Mister It wasn't helped any by the horrible fuel economy for what it was... something like 22mpg city, iirc.

- Lorenzo I shop for all-season tires that have good wet and dry pavement grip and use them year-round. Nothing works on black ice, and I stopped driving in snow long ago - I'll wait until the streets and highways are plowed, when all-seasons are good enough. After all, I don't live in Canada or deep in the snow zone.

- FormerFF I’m in Atlanta. The summers go on in April and come off in October. I have a Cayman that stays on summer tires year round and gets driven on winter days when the temperature gets above 45 F and it’s dry, which is usually at least once a week.

- Kwik_Shift_Pro4X I've never driven anything that would justify having summer tires.

Comments

Join the conversation

What's the revenue difference between selling a car there and NA? I put my $ on their market! Sell, sell, sell!

It's like I've said before: All the people who needed to learn from the bankruptcy learned nothing because of the government bailout. GM had good volume before they bankrupted too. Why not just have the best car for the job?