Toyota's Forecast: The Tsunami Won't Kill Us, But The Yen Might

Today, Toyota finally delivered its delayed outlook for this fiscal year. It usually is delivered at the annual results conference, but the tsunami had muddled the waters, so to speak. Now, Toyota has a bit more visibility. Today, Toyota did forecast a 35 percent fall in profit for the fiscal year ending March 31, 2012. Toyota expects to end the fiscal with a net income of 280 billion yen ($3.5 billion).

According to Reuters, that’s “well short of the consensus for a 434 billion yen profit in a poll of 23 forecasts by Thomson Reuters I/B/E/S.” I am proud of the optimism of the forecasters. Personally, after looking at the disaster in Japan, I hadn’t expected any profits.

Message to all competing companies: Expect the Japanese to come out with guns blazing once the supply lines are back in shape.

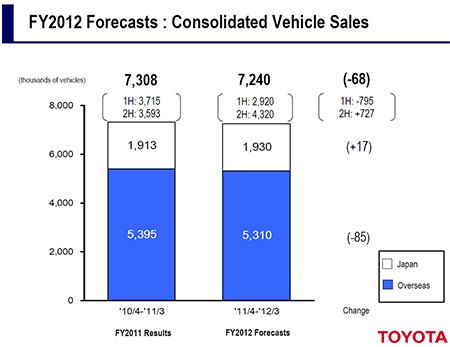

Where Toyota sees a loss is in vehicle sales. Toyota closed out the last fiscal with 7.308 million units sold. Toyota lowered its projection for Fiscal 2012 to 7.24 million vehicles. That’s 68,000 units less.

On a calendar year basis, this will look nastier. April through September 2011, Toyota sees 795,000 units less than last year, to be followed by 727,000 units more than in the preceding year for the October 2011 through March 2012 period.

What this means is that Toyota will end the calendar year 2011 in all likelihood in third place behind GM and Volkswagen. The party line at Toyota is “We don’t want to have the most sales, we want to have the most satisfied customers.” But dropping from top to 3 will hurt the pride, even if the face is brave.

The big caveat: The projections are based on an exchange rate of 82 yen to the dollar.

Toyota CFO Satoshi Ozawa, who presented the forecast today in Tokyo, warned again that the strong yen is the biggest obstacle facing Toyota. In the May conference, Ozawa had said that the break even point for profitable production in Japan is 85 yen to the dollar. Today, the dollar already buys 5 yen less. “We are in a situation where it is becoming impossible for Japan’s manufacturing industry to do business,” Ozawa said today.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy First picture: I realize that opinions vary on the height of modern trucks, but that entry door on the building is 80 inches tall and hits just below the headlights. Does anyone really believe this is reasonable?Second picture: I do not believe that is a good parking spot to be able to access the bed storage. More specifically, how do you plan to unload topsoil with the truck parked like that? Maybe you kids are taller than me.

- ToolGuy The other day I attempted to check the engine oil in one of my old embarrassing vehicles and I guess the red shop towel I used wasn't genuine Snap-on (lots of counterfeits floating around) plus my driveway isn't completely level and long story short, the engine seized 3 minutes later.No more used cars for me, and nothing but dealer service from here on in (the journalists were right).

- Doughboy Wow, Merc knocks it out of the park with their naming convention… again. /s

- Doughboy I’ve seen car bras before, but never car beards. ZZ Top would be proud.

- Bkojote Allright, actual person who knows trucks here, the article gets it a bit wrong.First off, the Maverick is not at all comparable to a Tacoma just because they're both Hybrids. Or lemme be blunt, the butch-est non-hybrid Maverick Tremor is suitable for 2/10 difficulty trails, a Trailhunter is for about 5/10 or maybe 6/10, just about the upper end of any stock vehicle you're buying from the factory. Aside from a Sasquatch Bronco or Rubicon Jeep Wrangler you're looking at something you're towing back if you want more capability (or perhaps something you /wish/ you were towing back.)Now, where the real world difference should play out is on the trail, where a lot of low speed crawling usually saps efficiency, especially when loaded to the gills. Real world MPG from a 4Runner is about 12-13mpg, So if this loaded-with-overlander-catalog Trailhunter is still pulling in the 20's - or even 18-19, that's a massive improvement.

Comments

Join the conversation

If Toyota were more successful in Europe (rather than the dismal