What's Wrong With This Picture: Tsunami In A Teapot Edition

Three companies, each alike in dignity. Or not. Don’t look at the numbers just yet. Instead, consider the following. One of these companies is Japan’s largest automaker and relies heavily on that country for its production and its profit. Another one, although Japanese, produces the bulk of its vehicles overseas. The third company is American and relies very little on Japan for production.

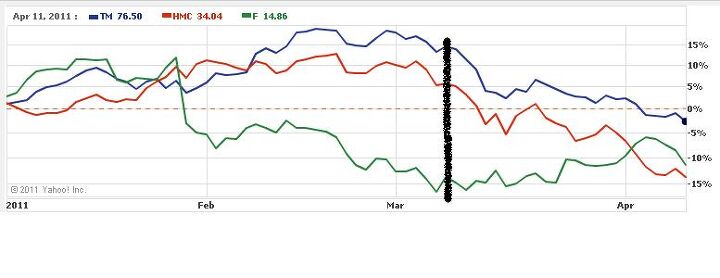

Baseline their stock at Jan 1, 2011. When an earthquake, a tsunami, and an authentic nuclear disaster strike, which of the three end up with the same stock price as the baseline afterwards, and which take a big dive?

You cheated, didn’t you? You looked at the graph and realized that, against all logic and reason, it’s Toyota which has effectively taken no hit to its stock price since January 1. Honda, which is far less reliant on Japan for production of both automobiles and unique parts, is almost fifteen percent down from that base point. Meanwhile, Ford, which competes more effectively against the Japanese in their core areas (small cars, Camcords) than either GM or Chrysler, is also down.

What possible mindset could Wall Street have to believe that Honda has had more bad news this year than Toyota, or that Ford’s had more bad news than either? I’m hoping that some of TTAC’s financial wizards can provide an answer, because the only one I can come up with is that Wall Street believes in some sort of racist theory which describes Japanese people as inscrutable, invicible worker bees who don’t suffer or make mistakes like the rest of us. This would explain why Toyota’s inability to build cars, find parts, or power its plants is seen as a minor bobble while Ford’s so far successful “war on debt” is apparently a big issue. Thoughts?

More by Jack Baruth

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy TG likes price reductions.

- ToolGuy I could go for a Mustang with a Subaru powertrain. (Maybe some additional ground clearance.)

- ToolGuy Does Tim Healey care about TTAC? 😉

- ToolGuy I am slashing my food budget by 1%.

- ToolGuy TG grows skeptical about his government protecting him from bad decisions.

Comments

Join the conversation

Uhhh.. here's what I see (After all this is Rorschach test right? You see what you want to see). Toyota has a higher stock than Honda or Ford. Ford has a lower price than Toyota or Honda. Then the tsunami comes. Afterwords Toyota's price goes DOWN, but is still higher than the rest. Honda's price goes DOWN and Ford (the non tsunami company) goes UP, so that it's higher than Honda but still lower than Toyota. The big mystery here is why Honda's price dropped more as a percentage than Toyota's drop.

It has to do with institution investors' expectation of return on the equities. TMC has forward looking P/E 20.88; HMC is 4.80 & whereas F is 8.82. There is a reason why certain common stocks will trade at low P/E whereas growth stocks (better managed corp) tends to have higher multiples. The analyst usually look at the whole sector and they don't compare apple to orange.