Chrysler Posts $652m Net Loss For 2010

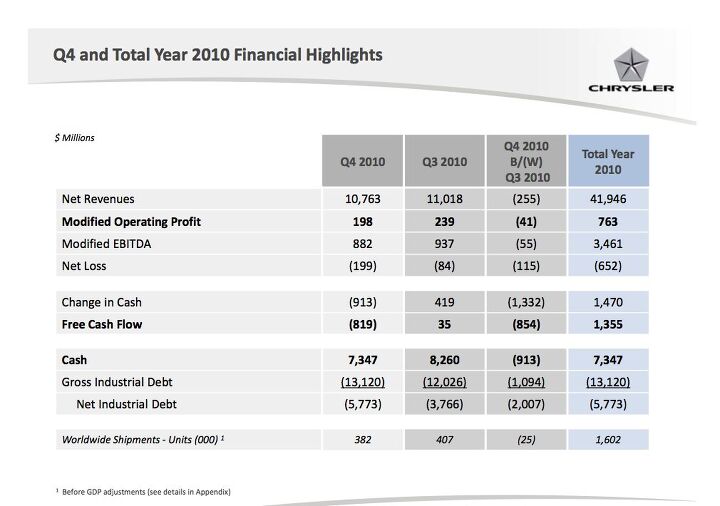

How did Chrysler do last year? It all depends on how you slice the numbers, isn’t it? As warned, Chrysler’s Q4 was a bit of a letdown, as net revenues dropped from $11.018b in Q3 to $10.763b, resulting in a $199m Q4 net loss. Interest expenses continue to be a major drag on Chrysler’s performance, costing $329m in Q3 and a whopping $1.228b over the course of the year. Cash dropped by nearly a billion dollars from Q3 to Q4, ending the year at $7.347b (not counting $2.3b in undrawn government facilities). Chrysler nearly hit the 1.6m worldwide sales number touted in its Five Year restructuring plan, as well as the 1.1m US-market target (although fleet mixes appear to have been higher than anticipated). Chrysler also hit its goal of $40b+ in net revenues and exceeded Operating Profit and EBITDA projections, but as the slide from Chrysler’s Q4 financial presentation [ PDF here] shows, Both debt (which will likely be restructured this year to reduce costs) and depreciation/amortization have killed Chrysler this year… which is why EBITDA and Modified Operating Profit take the top billing in Chrysler’s financial reporting.

Pricing has seen modest improvement this year, rising from $28,100 to $28,300, and average incentives dropped by $100. Inventory levels increased last year, from 58 days of supply last January to 63 days in January. And though volume dropped in the fourth quarter, pricing and mix generated by new 2011 products did help stem some of the bleeding, adding $39m to the Q4 modified operating profit walk. Meanwhile, industrial and selling (SG&A) costs have increased due to production changeovers and marketing needed to bring the new products to market.

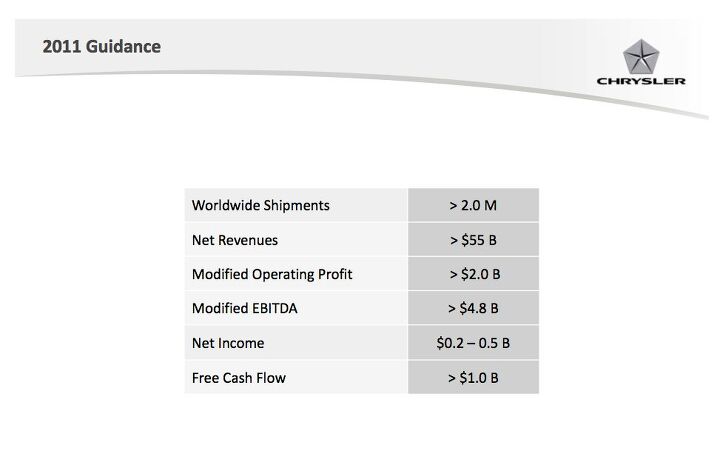

And though Chrysler essentially hit its targets for this year, next year is, as Sergio Marchionne puts it, “the year of execution.” And Chrysler’s Guidance for 2011 is necessarily ambitious:

Increasing global volume from 1.516m units to over 2m units is hard enough. Using its projected 2011 SAAR of 13.4m units, Chrysler’s market share will have to jump from 9.2 percent to around 12 percent in order to make its 1.6m US volume goal this year. Harder still: taking Modified Operating Profit from $736m to over $2b on 500k incremental units globally. CEO Sergio Marchionne insists that new and updated products will bring gains in both pricing and volume, but he will need to deliver on both to keep his Chrysler turnaround rolling through 2011. Government debt will need to be refinanced, and some form of net profit will have to be shown this year anyway, if Sergio wants his “Christmas present” of an IPO this year, so we will either see a independent, profitable Chrysler this time next year.. or not.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lorenzo The unspoken killer is that batteries can't be repaired after a fender-bender and the cars are totaled by insurance companies. Very quickly, insurance premiums will be bigger than the the monthly payment, killing all sales. People will be snapping up all the clunkers Tim Healey can find.

- Lorenzo Massachusetts - with the start/finish line at the tip of Cape Cod.

- RHD Welcome to TTAH/K, also known as TTAUC (The truth about used cars). There is a hell of a lot of interesting auto news that does not make it to this website.

- Jkross22 EV makers are hosed. How much bigger is the EV market right now than it already is? Tesla is holding all the cards... existing customer base, no dealers to contend with, largest EV fleet and the only one with a reliable (although more crowded) charging network when you're on the road. They're also the most agile with pricing. I have no idea what BMW, Audi, H/K and Merc are thinking and their sales reflect that. Tesla isn't for me, but I see the appeal. They are the EV for people who really just want a Tesla, which is most EV customers. Rivian and Polestar and Lucid are all in trouble. They'll likely have to be acquired to survive. They probably know it too.

- Lorenzo The Renaissance Center was spearheaded by Henry Ford II to revitalize the Detroit waterfront. The round towers were a huge mistake, with inefficient floorplans. The space is largely unusable, and rental agents were having trouble renting it out.GM didn't know that, or do research, when they bought it. They just wanted to steal thunder from Ford by making it their new headquarters. Since they now own it, GM will need to tear down the "silver silos" as un-rentable, and take a financial bath.Somewhere, the ghost of Alfred P. Sloan is weeping.

Comments

Join the conversation

Contrast this with Ford or GM and it's clear they are not out of the woods yet. Chrysler still has some niche vehicles and if they can stick a Hemi in it then the metal moves. When Fiat absorbs them fully and they start slapping the Chrysler badge on Fiats then we'll see the deal. GM got away with branding Daewoos here with a bowtie, they might too. I still think we deserve free cars from them for bailing out. I'll take my Challenger in Red please with the Hemi option.

Hmm...I wonder if this is a case of 'taking a bath' before 'suddenly' posting great results next year. Especially with all the debt restructuring business they're planning to do this year (why not last year then, ay?). I also wonder about the volume gains they're planning on. Almost all of that will have to come from the US market now that they're rebranding Dodge Journey's into FIAT Freemonts and Sebrings into Lancias here in Europe. Not that they'd had been selling a whole lot of them anyway (here in the Netherlands for instance, both Dodge and Chrysler sold about 300 cars each last year, which translates to 0,06% market share...In 2001, Chrysler sold 5122 cars which was 0,97% market share, while Dodge wasn't officially sold).