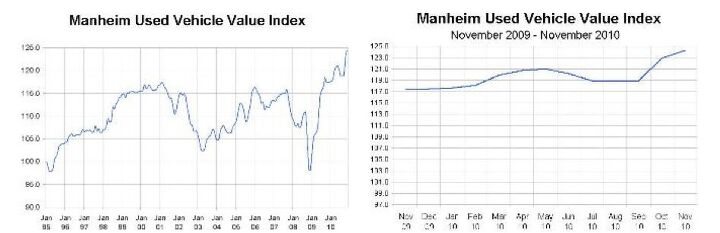

Has There Been A Better Time To Sell A Low-Mileage Used Car?

Manheim Consulting’s Used Vehicle Value Index shows that used cars have more than recovered from their all-time low of just two years ago, and have hit their strongest levels since 1995. This isn’t wildly surprising, given that weak new car sales over the last two years have boosted demand for less expensive used options. What’s intriguing about the strong growth is that a recovering new-car market doesn’t seem to have dented pre-owned values much in the short term. Manheim’s report notes:

Because the new and used vehicle markets are both monthly payment driven, the important ratio is not transaction prices, but loan-to-value ratios, credit-adjusted APRs, loan maturities, and the resulting monthly payment. Given that new vehicle incentive activity has remained restrained and the model-year changeover was smooth, the monthly payment ratio between the two markets is not as far out-of-line as it has been at some points in the past.

Additionally, although there is waterfall effect that means new vehicle pricing eventually impacts all segments of the used vehicle market, the most effective transmission is through late-model used vehicles, especially those that represent a real substitute to a new vehicle purchase. With the reduction in off-rental units, late-model trade-ins, and early cycle repossessions, nearly-new used vehicles are in short supply. The average mileage on vehicles sold at auction has risen in every market segment over the past two years. And, with significant redesigns and new options, manufacturers have been able to make many models less susceptible to substitution pressure from the nearly-new market.

The significance of this trend: after two years of credit crunch-weakened sales, fleet buyers binged like crazy during 2010, largely fueling the new-car sales turnaround, especially in the early part of the year. Leasing is back in a big way as well: having fallen to just 9 percent of new car transactions two years ago, they’re back up to 25 percent. As these purchases (not to mention subprime repossessions) work their way back onto the used market, the supply of lower-mileage used cars could well increase, depressing the value of the entire used-car market.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jrhurren Worked in Detroit 18 years, live 20 minutes away. Ren Cen is a gem, but a very terrible design inside. I’m surprised GM stuck it out as long as they did there.

- Carson D I thought that this was going to be a comparison of BFGoodrich's different truck tires.

- Tassos Jong-iL North Korea is saving pokemon cards and amibos to buy GM in 10 years, we hope.

- Formula m Same as Ford, withholding billions in development because they want to rearrange the furniture.

- EV-Guy I would care more about the Detroit downtown core. Who else would possibly be able to occupy this space? GM bought this complex - correct? If they can't fill it, how do they find tenants that can? Is the plan to just tear it down and sell to developers?

Comments

Join the conversation

Funny; I just received a friendly note from my Kia dealer that the used car I bought from them in April would make an ideal trade today. I've only made 7 payments. Obviously they have something newer to sell me.

I noticed my Mitsubishi had depreciated much slower than I had expected. I should just unload it and go find something older for the wife, like an 850 wagon. They're starting to have high enough mileages that "normals" are afraid of them and prices get adjusted accordingly.