Detroit Leads Incentives, But Toyota Forecasts Volume-Buying Binge

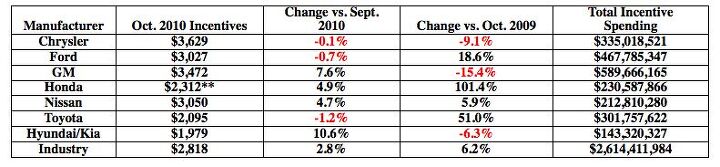

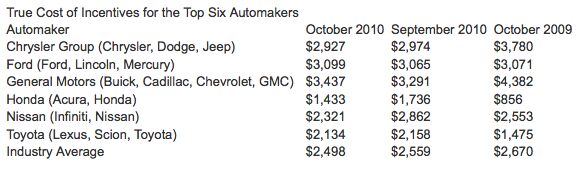

Who spent the most money on volume-building but profit-sapping incentives over the last month? Well, it depends on who you ask. Edmunds.com’s True Cost Of Incentives index puts GM at the top of the heap, with an October estimate of $3,437 spent per sale. Truecar.com has a similar number for GM, at $3,472, but says that Chrysler was the king of incentivized sales last month, spending $3,629 per car sold. Interestingly, both firms put Ford at just over $3,000 spent per vehicle, but Edmunds says Chrysler is actually under that mark, spending $2,927 per vehicle. In another discrepancy between the two reports, TrueCar puts Nissan at $3,050 while Edmunds puts the Nissan number at $2,321. In any case, Toyota may just be the Japanese automaker that breaks Detroit’s dominance of average incentive numbers. Toyota’s Bob Carter has revealed that big incentives are coming as Toyota struggles to get its volume up by year’s end, telling Automotive News [sub]

You will see an enhancement to marketing and incentives but [they] will remain consistent in the APR and lease arenas,” he said. “They will be the best deals of the year — leasing and APR deals are moving the market.Hit the jump for average incentive spending reports from Truecar.com and Edmunds.comEdmunds.com’s True Cost Of Incentives report

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Varezhka Maybe the volume was not big enough to really matter anyways, but losing a “passenger car” for a mostly “light truck” line-up should help Subaru with their CAFE numbers too.

- Varezhka For this category my car of choice would be the CX-50. But between the two cars listed I’d select the RAV4 over CR-V. I’ve always preferred NA over small turbos and for hybrids THS’ longer history shows in its refinement.

- AZFelix I would suggest a variation on the 'fcuk, marry, kill' game using 'track, buy, lease' with three similar automotive selections.

- Formula m For the gas versions I like the Honda CRV. Haven’t driven the hybrids yet.

- SCE to AUX All that lift makes for an easy rollover of your $70k truck.

Comments

Join the conversation

I am terribly confused how Chrysler can have a $700 dollar swing between the 2. Same for Nissan. You also forgot to mention the differences between the Honda numbers. I am also confused by the ** on the prnewswire story. It says "**Highest incentive spend per unit in 2010". How are they the highest spend per unit in 2010 but don't have the highest number?

Lets not forget a big important issue. What car maker's dealers are having to take the most off the asking price to move iron? Toyota, according to TTAC in a story a week or two ago. The average Toyota dealer was amazingly having to take 8.1% off the sticker price to move the product. Sure, the mothership in Japan may not be giving the biggest industry incentives but the dealers are cutting until it hurts just to stay afloat; and they aren't pleased about it either. It is also worth noting, even more amazingly, that it was Ford that was commanding the, "hey, that's the sticker price, and if you don't like it you can leave because someone else will come in and buy it," premium, with dealers on average taking the lowest percentage off the sticker price to move iron.